For a long time, blockchains were built around one simple assumption: if everything is public, trust will come automatically.

And honestly, in the early crypto days, that idea worked. Open ledgers helped experimentation. Anyone could verify anything. It felt clean.

But that model starts to fall apart the moment you try to use blockchain for real finance.

In real markets, visibility is selective. Shareholder records are protected. Trading positions are confidential. Settlement details are shared only with parties that are legally allowed to see them. This is not a flaw in finance — it’s how accountability actually works.

Regulation exists for a reason. Not to slow systems down, but to make sure responsibility doesn’t disappear while sensitive information stays protected.

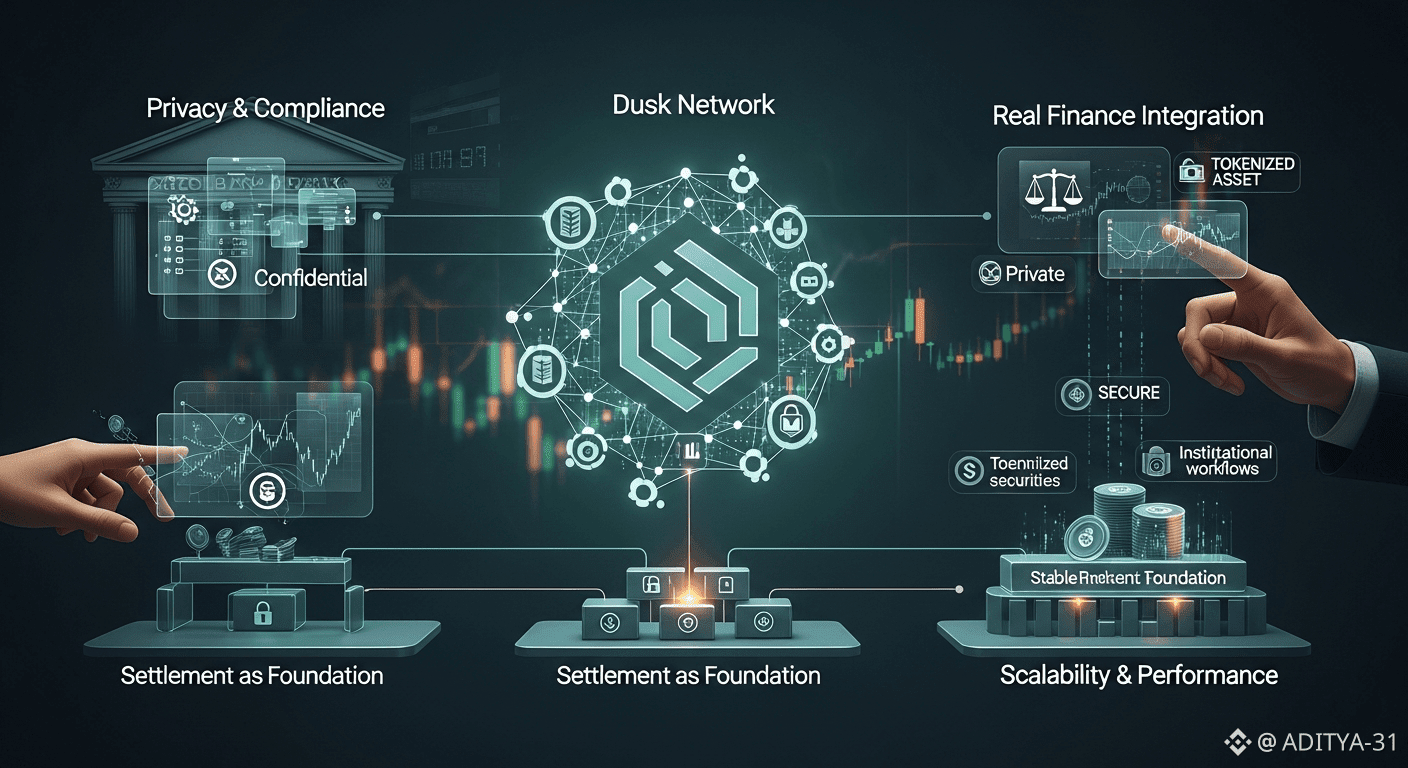

This is the environment Dusk Network was built for.

Dusk isn’t trying to be a blockchain that does everything. It’s not chasing retail hype, memecoins, or experimental DeFi trends. Its focus is much narrower, and because of that, much harder: allowing regulated financial activity to move onchain without breaking privacy or legal structure.

Once you look at public blockchains through a financial lens, a problem becomes obvious. Transparency doesn’t always create trust. In regulated finance, it often destroys it. If everything is public, positions leak. Strategies become visible. Privacy laws get violated before the system even scales.

That’s why institutions usually avoid public chains. Or worse, they use them only partially. Logic runs onchain, but settlement and sensitive data are quietly pushed into private systems. On paper, it looks decentralized. In reality, it’s fragmented.

Dusk starts from the opposite assumption. If finance is regulated by nature, then the blockchain must respect that reality at the protocol level — not work around it.

Privacy on Dusk is not about hiding activity. It’s about structuring visibility correctly. Transactions and balances can remain confidential, while still being provable. Sensitive data doesn’t need to be visible to everyone, but correctness can still be verified by regulators, auditors, or authorized counterparties when required.

That distinction matters more than it sounds. Compliance isn’t about exposing everything. It’s about being able to prove rules were followed without leaking information that never needed to be public in the first place. Dusk embeds this logic directly into how transactions and settlement work, instead of adding it later as a patch.

Another difference shows up in how Dusk treats settlement. Many blockchains optimize for speed first and hope settlement sorts itself out later. Financial systems work the other way around. Settlement is the foundation. Finality matters. Correctness matters. Mistakes are not acceptable.

Dusk is built around that reality. Settlement is treated as a core responsibility, not a side effect. That makes the network suitable for tokenized securities, regulated assets, and institutional workflows where precision matters more than headline TPS numbers.

At the same time, Dusk doesn’t isolate developers. Builders can still work with familiar tools and environments. The difference is that privacy and compliance are enforced underneath, at protocol level. Applications focus on logic. Infrastructure handles the rules. That separation mirrors how real financial systems already operate.

The $DUSK token fits naturally into this structure. It secures the network through staking, pays for transactions, and supports governance. Its relevance grows with real usage — regulated issuance, compliant settlement, institutional participation — not with short-term narratives.

Dusk isn’t competing with open blockchains. Those systems serve an important role. Dusk is focused on what comes next.

As tokenization, digital securities, and compliant settlement move closer to reality, infrastructure that understands privacy, legality, and responsibility will matter more than speed charts or viral attention.

Open blockchains helped crypto begin.

Privacy-aware, compliant infrastructure is what will help real financial markets move onchain.

Dusk isn’t trying to change how finance works.

It’s trying to make finance work onchain — without pretending the rules don’t exist.