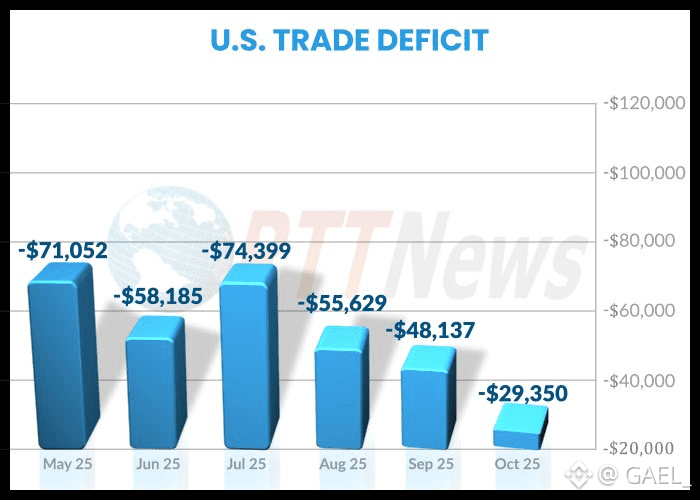

The United States recorded a trade deficit of $29.4 billion in October 2025, the narrowest since June 2009, surpassing expectations. This 39% reduction was driven by a 3.2% drop in imports and record export levels, signaling stronger-than-anticipated external demand. Markets reacted positively, with the S&P 500 testing the psychologically significant 7,000 level and the US Dollar Index (DXY) stabilizing near 98.50.

Exports reached a historic $302 billion, led by a $6.8 billion surge in non-monetary gold shipments to overseas vaults. Pharmaceutical imports fell sharply by $14.3 billion as companies unwound excess stockpiles built up ahead of prior tariff deadlines. The ongoing implementation of tariffs under the International Emergency Economic Powers Act (IEEPA) continues to influence trade flows, reshaping import and export patterns across multiple sectors.

The equity market reflected this improved trade backdrop. The S&P 500 maintains a bullish structure with immediate support at 6,850-6,900, while small-cap equities, as measured by the Russell 2000, jumped 4.6% in early January. Institutional trading activity spiked with an $8.9 billion volume surge following the data release, nearly half occurring in dark pools. Investors are observing a rotation from mega-cap AI growth stocks into more traditional value sectors, including Financials, Industrials, and Energy.

The US Dollar Index has stabilized at 98.50 following a 9.3% decline in 2025. Resistance is observed in the 98.80-99.20 range, which traders are closely monitoring. Technical signals suggest that the S&P 500 could move toward 7,100 if it holds above support, while a failure by DXY to break its resistance could see a retest of the 96.00 multi-month base. These movements underline the close interaction between trade flows, currency strength, and equity performance.

Atlanta Fed GDPNow estimates were revised upward to 5.4%, reflecting the boost from record export activity. The combination of narrower trade deficits and rising GDP expectations highlights the potential for continued economic momentum. Yet, analysts caution that the year-to-date trade gap remains 7.7% higher than in 2024, underscoring persistent reliance on imports despite monthly improvements.

Investors should remain vigilant. A pending Supreme Court decision on the legality of IEEPA tariffs, expected in mid-January, could trigger renewed volatility. Sudden policy shifts or geopolitical tensions may reverse the current trend in trade balances and affect market positioning. While the October figures offer optimism, long-term structural dynamics and regulatory uncertainties require ongoing attention for risk management and portfolio planning.

#USmarket #TradeDeficit #FedRateCut #USTradeDeficitShrink #CryptoNews