Most traders first encounter the term “inclusive finance” as a slogan. It sounds like a conference tagline, not a chart to trade on. Yet every so often, a project forces you to take the phrase seriously because its strategy tackles a real problem affecting real people and real capital: access.

Access is the quiet divider in global markets. A retail investor in Dhaka, Lagos, or Manila can buy crypto in minutes, yet participation in institution-grade markets—treasuries, regulated securities, structured products, and professionally issued real-world assets—remains out of reach. Barriers may be cost, legal complexity, or simply that these assets were never designed to exist outside traditional financial accounts.

@Dusk is built around one guiding idea: bring institutional-grade assets to anyone’s wallet without bypassing regulation, compliance, or privacy. In short, don’t fight the rules. Build rails that work with them.

This mission separates Dusk from the usual “bank the unbanked” narrative. Many blockchains promise open finance, emphasizing speed, low fees, and composability. That works for permissionless DeFi, but it fails when applied to regulated assets. Regulated markets demand disclosures, identity verification, audit trails, sanctions screening, investor protections, and reporting. Without meeting these requirements, assets cannot move on-chain at scale.

@Dusk addresses that challenge while preserving a principle often overlooked in traditional finance: privacy.

Financial privacy is not a luxury. It is standard practice. Salaries, investments, and spending patterns are private in the real world. Most blockchains, however, broadcast all activity permanently. Even legitimate transactions tied to an identity can create exposure and risk for both individuals and institutions.

Dusk’s solution is to treat privacy and compliance as complementary, not conflicting. The network supports privacy-preserving smart contracts that satisfy regulatory requirements. Privacy does not mean lack of oversight. Instead, it ensures that information is shielded while verification remains possible whenever needed. This balance is the foundation of inclusive finance in a regulated world.

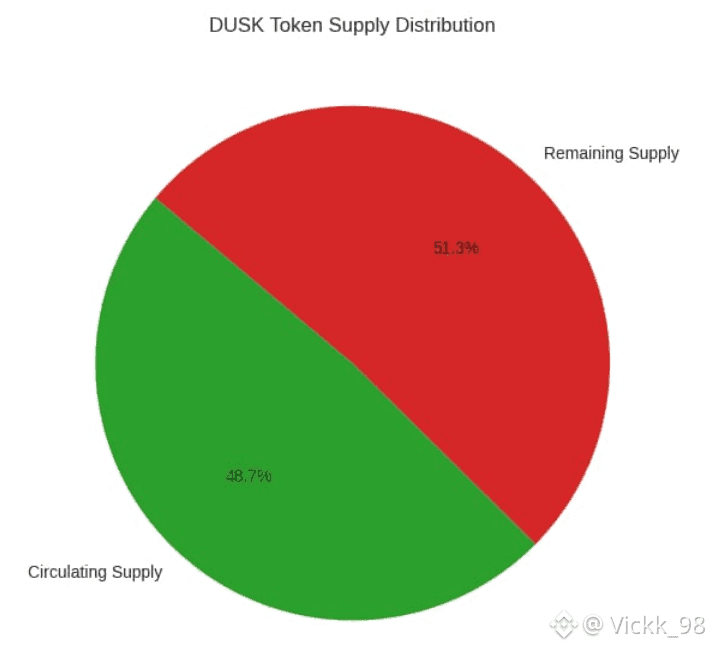

For investors, credibility is grounded in numbers as well as philosophy. As of today, DUSK trades around $0.072 with a 24-hour volume of $41.9 million and a market cap near $35.1 million. With roughly 487 million tokens circulating out of a 1 billion maximum supply, DUSK is liquid enough for serious trading while still small enough that strategic developments and narrative shifts have material impact.

So what does “turning the mission into reality” look like?

It looks like aligning with the measured pace of European market structures rather than pretending they do not exist. Dusk has highlighted partnerships focused on regulated tokenized securities, including collaboration with 21X, the first company to receive a DLT-TSS license under European regulation for a fully tokenized securities market. This is not a marketing gimmick. It signals a concrete path: regulated issuance, regulated settlement, regulated exchange workflows. In practical terms, this is the bridge between “assets for institutions only” and “assets anyone can hold under compliant rules.”

Picture this: a small business owner who has learned to save and invest responsibly. She may have access to basic banking and local stocks, but institution-grade opportunities remain out of reach—not due to ability, but because markets were built for a different world. If tokenized regulated assets become standard, her wallet could eventually hold instruments previously “off-limits,” with compliance enforced at the protocol level instead of through expensive intermediaries. That is inclusion in practice: market access with guardrails, not charity.

Building this infrastructure takes time. Regulated finance moves slowly. Every layer—from privacy technology and auditability to settlement guarantees and developer tooling—must meet institutional standards. That is why Dusk emphasizes its “privacy plus compliance” design philosophy and why its development path is methodical, focused on a mainnet-ready system for real-world assets.

From an investor’s perspective, the takeaway is clear: Dusk is not competing with fast, retail-first chains. It is positioning for relevance in a future where tokenized real-world assets and compliant on-chain markets are standard. If that future arrives, inclusive infrastructure is essential. If it does not, Dusk still illustrates a fundamental truth: global finance does not scale on speed alone. It scales on trust, legality, privacy, and settlement certainty—the foundational elements that enable big money to participate safely and confidently.