Most traders don’t lose money because they picked the wrong chain. They lose money because they misunderstand what kind of chain they are dealing with.

If you’ve been in crypto long enough, you’ve seen the story play out: a token pumps on hype, everyone assumes adoption is imminent, and months later nothing meaningful has changed—except the chart. Dusk Network is different. It’s not vying to be the loudest Layer 1. It’s addressing a problem that only becomes clear when you watch how real finance works: in regulated markets, privacy is non-negotiable, and so is compliance.

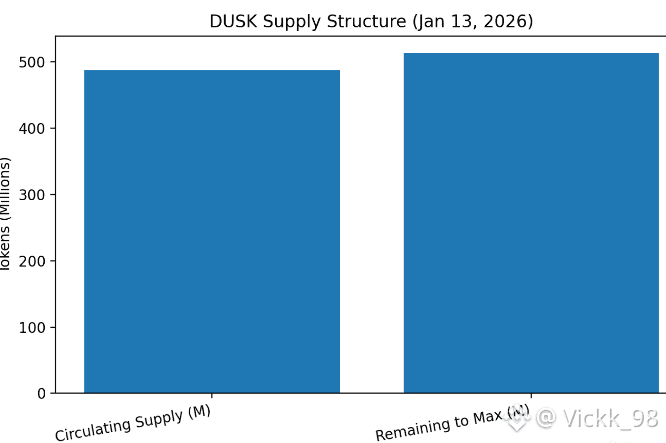

As of January 13, 2026, DUSK trades around $0.073 with roughly $41 million in 24-hour volume and a market cap of $35.7 million, with about 487 million tokens circulating out of a 1 billion maximum supply. These numbers show liquidity and market attention, but they don’t capture the real investment thesis: building regulated, privacy-enabled financial infrastructure that works with the rules instead of ignoring them.

The tension at the heart of public blockchains explains why Dusk’s approach is unusual. Transparency is powerful, but it is often unrealistic for institutional finance. In traditional markets, transaction details are confidential. A market maker rebalancing inventory, a fund accumulating a position, or a bank settling an asset transfer—all of this occurs without public disclosure. Crypto culture equates openness with fairness, but in institutional finance, radical transparency often renders systems unusable.

Yet institutions cannot operate in a purely private system with no audit trail. A chain that is private but unverifiable is effectively unusable for regulated markets. Dusk positions itself at this intersection: privacy where it matters, auditability where it’s required.

@Dusk framework combines zero-knowledge technology with on-chain compliance, enabling selective disclosure. Activity remains confidential, but verification is possible for the right parties. The concept is simple: you don’t reveal everything. You reveal exactly what needs to be verified.

This is more than theory—it reshapes how financial products are built. Tokenized real-world assets, regulated securities, and institution-focused DeFi all require KYC, AML, reporting, and supervision. Trading books cannot be fully public. A desk doesn’t want competitors front-running its flows, and regulated issuers need proof that buyers are eligible without broadcasting their identities to the network.

@Dusk “zero-knowledge compliance” allows participants to meet these requirements without exposing sensitive information. Consider a regulated fund issuing shares as on-chain tokens. Transfers must remain within verified holders. On a fully public chain, every transfer exposes counterparties, timing, and positions—potentially revealing strategy shifts or concentration risks. Even if legal, the optics create risk.

@Dusk design lets these transfers occur privately while proving compliance. It is the middle path institutions seek: not anonymity, not radical transparency, but controlled visibility.

Honesty matters for investors: building this infrastructure slows growth. Compliance requires designing for multiple jurisdictions, governance maturity, robust architecture, and credibility. The short-term market may be smaller. Retail favors speed and chaos; institutions favor reliability and certainty.

The key question is not whether Dusk will pump. The question is whether markets are moving toward the type of infrastructure Dusk is building. There are strong indications they are. Global regulation is tightening. Europe’s MiCA framework and other initiatives are shifting the narrative from “crypto as rebellion” to “crypto as financial technology.” Dusk has been explicitly positioning itself within this regulated reality for years.

For investors, the most important insight is this: if regulated token markets scale, privacy and compliance will no longer be optional—they will be inseparable. No serious institution wants a system where balances are public. No serious institution wants a market that cannot be audited. That is the lane Dusk is pursuing.

@Dusk remains a crypto asset, subject to sentiment-driven volatility and liquidity cycles. But for long-term investors, the story is not the candlestick. It is whether Dusk’s model of compliant privacy becomes a market standard rather than a niche preference.

From a market structure perspective, privacy is a feature everyone ignores until they need it. Retail rarely feels the impact. Institutions feel it immediately. And when institutions move, they adopt solutions that reduce risk, not hype.

If Dusk succeeds, it will not be because it outshouted other chains. It will be because it solved a problem most chains avoided: enabling financial activity to remain private while operating fully within regulatory boundaries.