Discipline, Timing, and Execution — This Is How Real Trading Is Done

Trading is not about luck. It’s not about hype. And it’s definitely not about entering random positions and hoping the market will be kind. Trading is a game of discipline, patience, and decision-making under pressure. Today’s trade is a perfect example of how clarity and execution separate consistent traders from emotional gamblers.

When a position is running in profit, the hardest decision is not entering — it’s knowing when to close. Many traders lose good profits simply because greed takes over. They want more. They wait for the “next candle.” They convince themselves the move will continue forever. That mindset is exactly what turns winning trades into regrets.

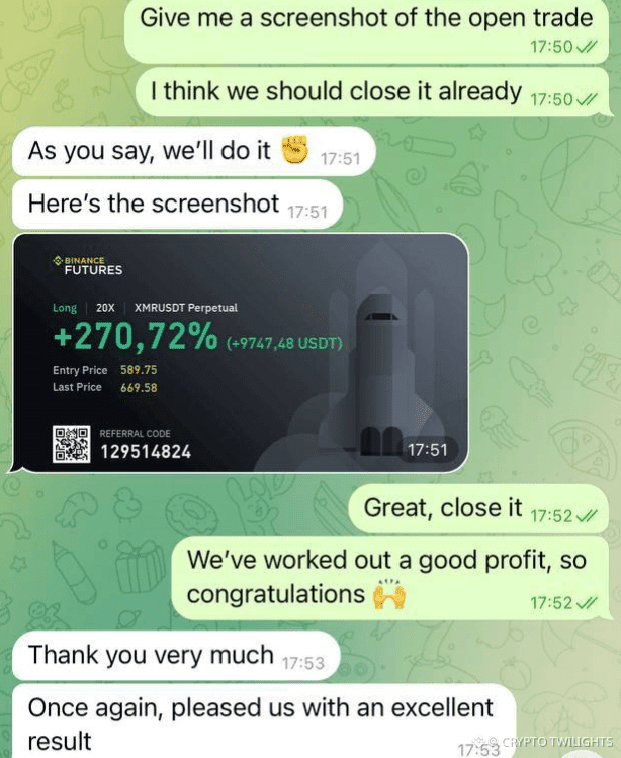

In this case, the plan was clear from the beginning. The market moved strongly in our favor, the numbers were visible, and the profit was already substantial. Instead of getting emotional or overconfident, the decision was made to secure the result. That’s what professionals do — they respect profits.

Look at the structure of this trade:

Entry was clean and well-timed

Leverage was used with confidence, not recklessness

Price moved exactly as expected

And most importantly — the exit was executed without hesitation

A 270%+ move is not something you ignore. When the market gives you such an opportunity, you don’t argue with it. You don’t become stubborn. You take what the market offers and walk away with confidence.

Another important lesson here is communication and control. Before closing, confirmation was taken. A screenshot was shared. Everything was transparent. There was no rush, no panic, and no confusion. Just calm execution. This is how trust is built in trading — through clarity, not promises.

Many people think trading success comes from indicators or secret strategies. The truth is much simpler:

Respect your plan

Respect your risk

Respect your profit

If you can do these three things consistently, results will follow.

Also notice something very important: the trade was closed not at the top, but at the right time. Waiting for the absolute top is a mistake most traders make. The goal is not to catch the exact high or low — the goal is to catch a solid portion of the move and protect it. Perfection is not required. Consistency is.

This result didn’t come from chasing the market. It came from patience. From waiting for confirmation. From trusting analysis. And from understanding that capital preservation matters more than ego.

One more key takeaway: profits feel best when they are secured. Unrealized profit is not profit. Only closed trades count. The moment the position was closed, the stress was gone, and the result became real. That feeling — calm, confident, and controlled — is what every trader should aim for.

To everyone watching and learning: focus less on how fast you can make money, and more on how well you can manage it. Big results are built from small, correct decisions repeated over time.

Today was not about showing off numbers. It was about showing process. And when the process is right, results speak for themselves. 💪📈