🌒 The Problem Most Blockchains Avoid Talking About

Most blockchains love two things:

• Speed

• Hype

But when the conversation moves to real financial markets, something breaks.

Traditional finance demands:

• Privacy

• Finality

• Compliance

• Auditability

Public blockchains usually answer with:

“Trust transparency solves everything.”

Reality says otherwise.

This is where Dusk Foundation enters the room — not loudly, but confidently.

🧩 Dusk Was Never Designed for Retail Speculation

That alone already separates it from most crypto projects.

Dusk Foundation did not start with:

• NFTs

• Meme coins

• Yield farming

It started with a question:

“Can a blockchain support regulated financial assets without sacrificing privacy?”

That question shaped every design choice.

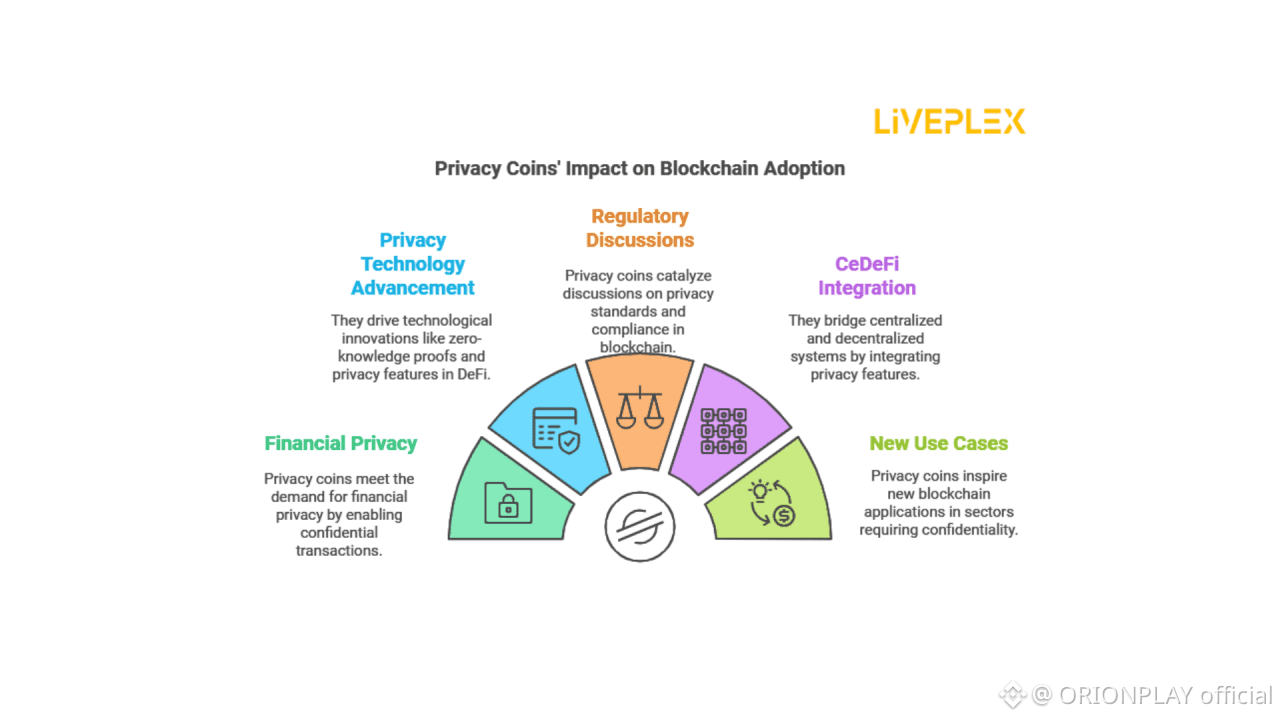

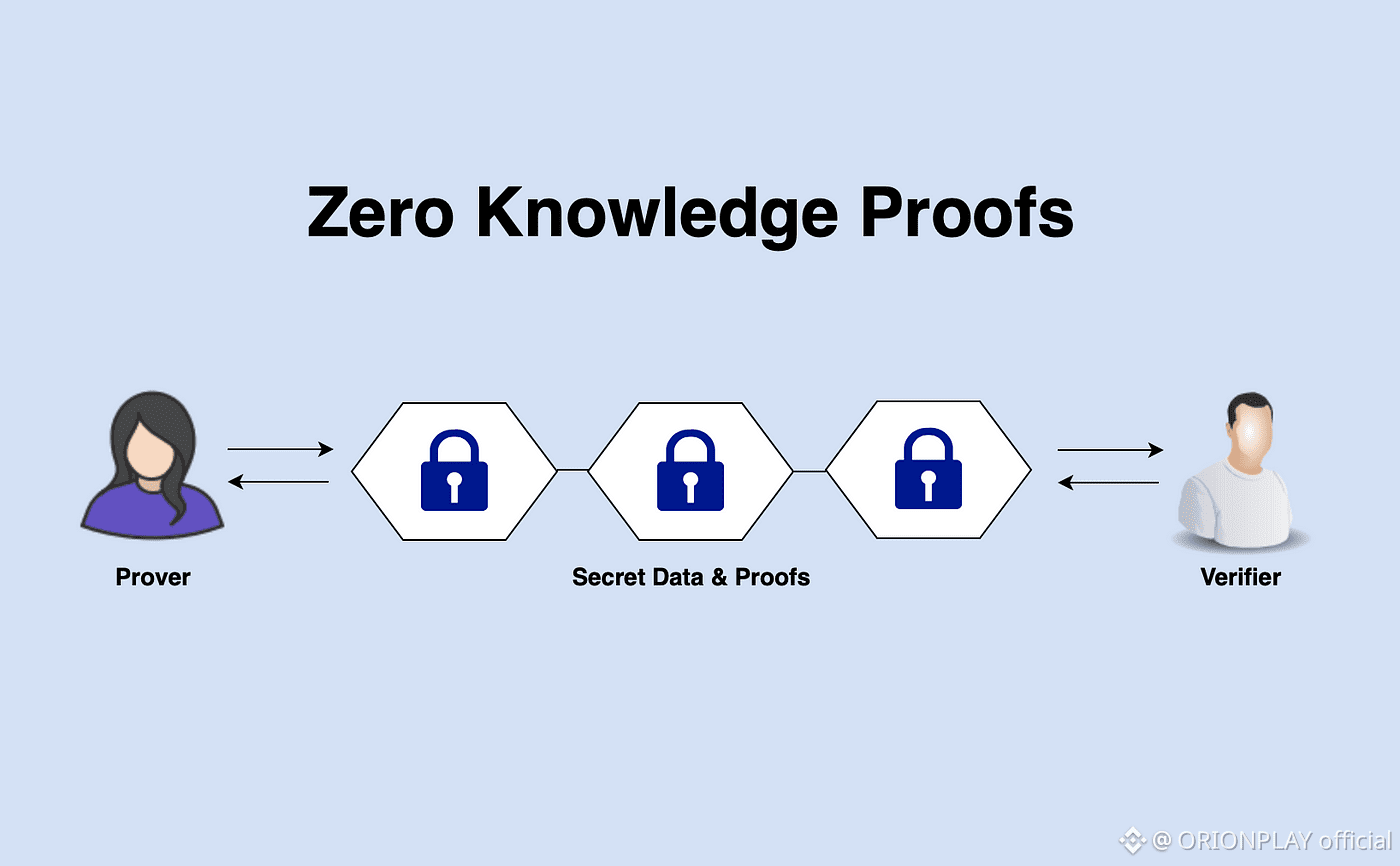

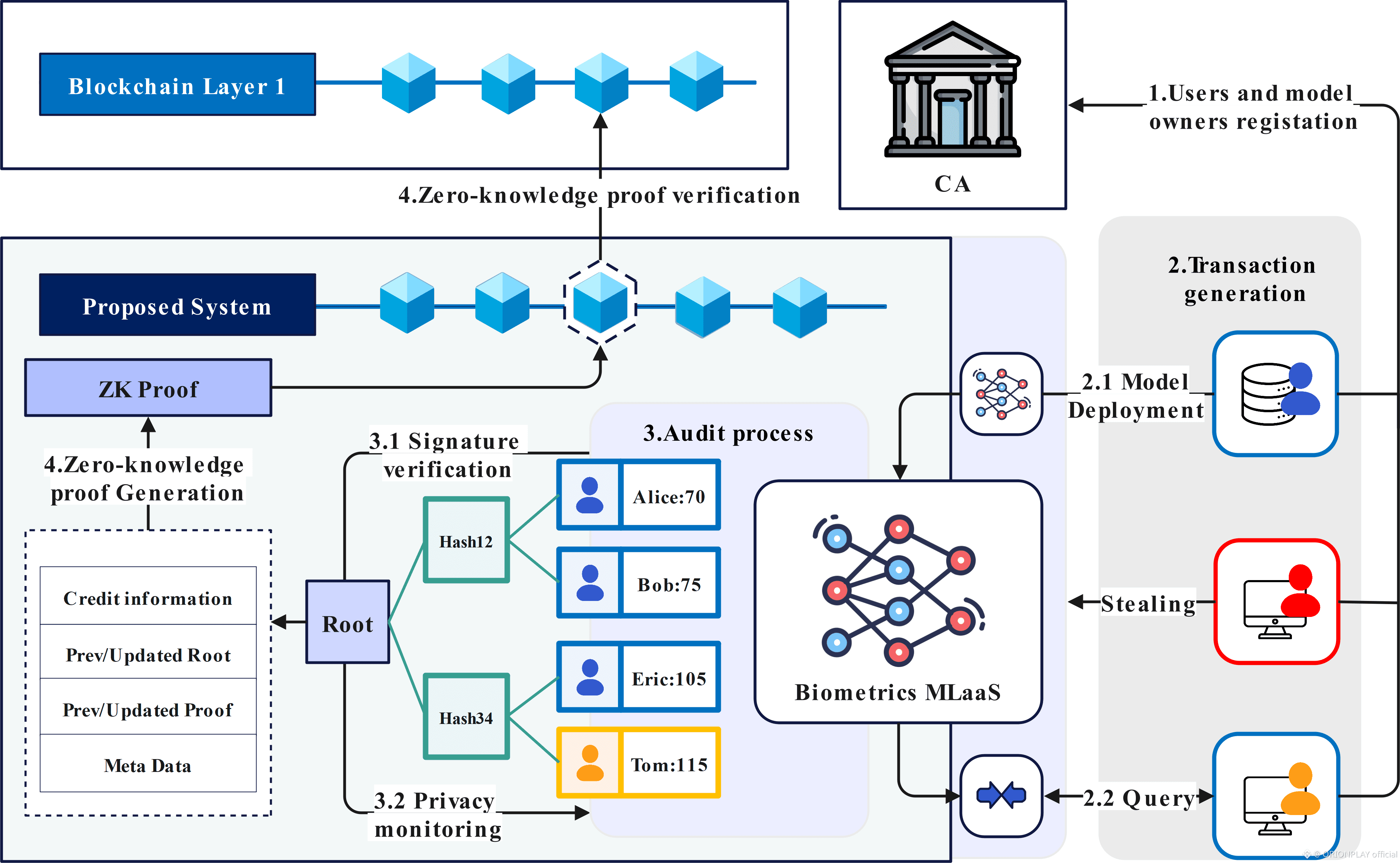

🔐 Privacy ≠ Darkness (A Common Misunderstanding)

Privacy in Dusk is selective, not absolute.

Think of it like:

• Curtains, not walls

• Frosted glass, not black boxes

Transactions can be:

• Confidential

• Verifiable

• Regulation-friendly

This balance is achieved through native zero-knowledge primitives, not bolt-on solutions .

⚙️ Why Dusk Didn’t Copy Ethereum (And Never Tried To)

Ethereum chose:

• Global transparency

• Account-based state

• Open execution

Dusk chose:

• Confidential execution

• Hybrid transaction models

• Explicit finality

This is not a “better vs worse” debate.

It is a different problem set.

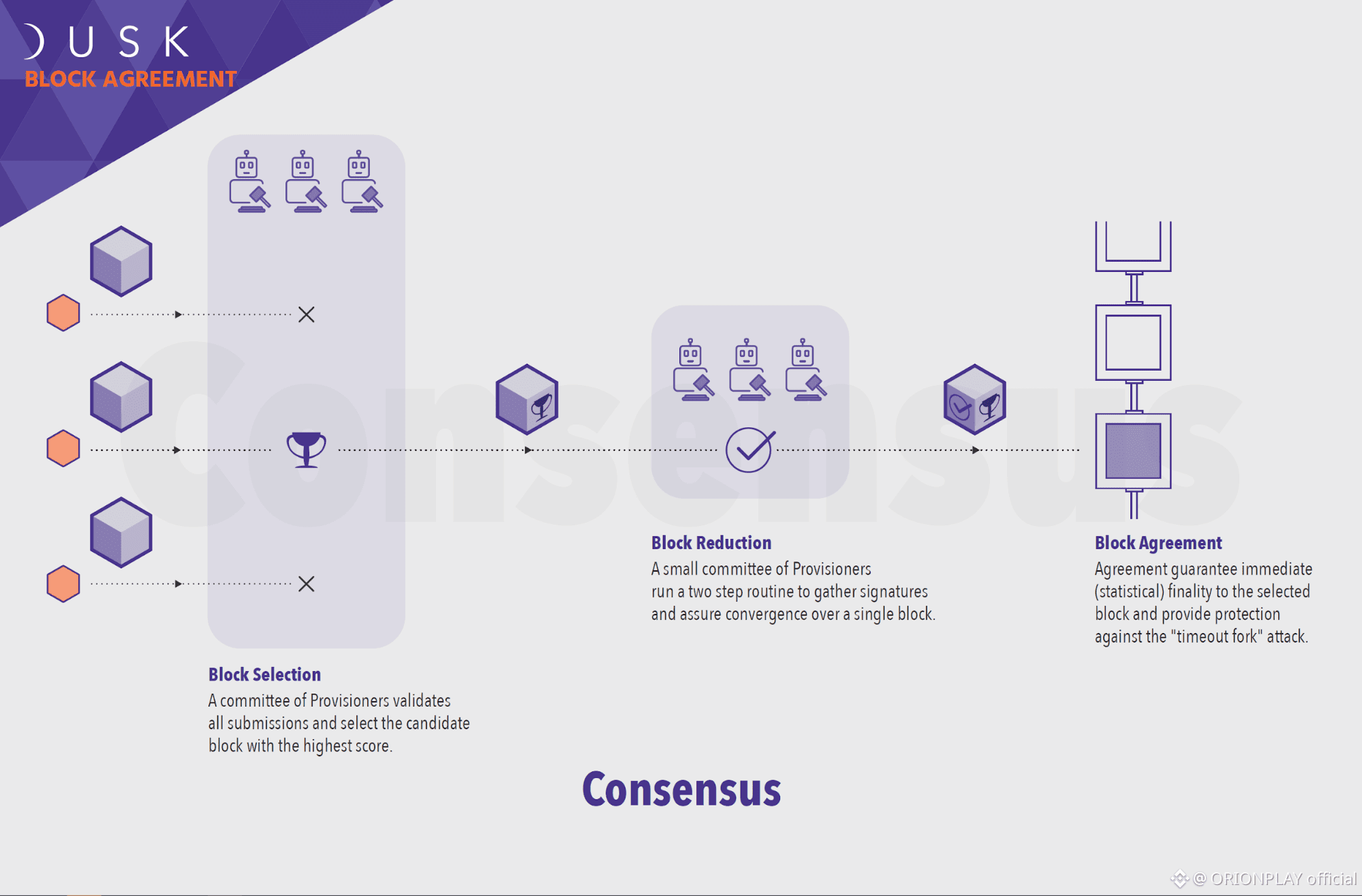

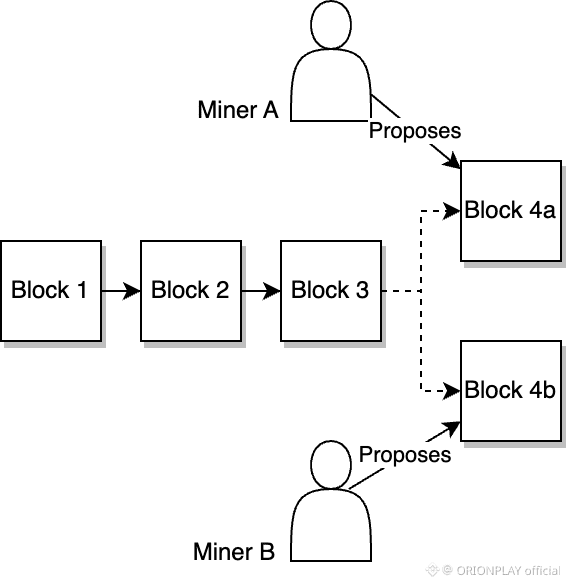

🧠 The Brain of the Network: SBA Consensus

Instead of longest-chain guessing games, Dusk uses Segregated Byzantine Agreement (SBA).

What this means in human language:

• Blocks don’t fight each other

• Finality is near-instant

• Fork probability is mathematically negligible

This matters a lot when dealing with:

• Securities

• Settlement

• Legal ownership

You don’t “wait and see” if a stock trade finalized.

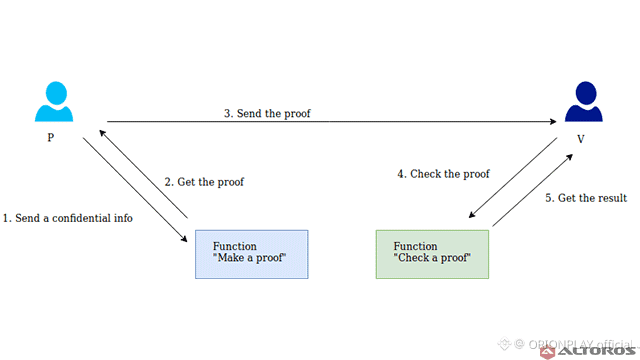

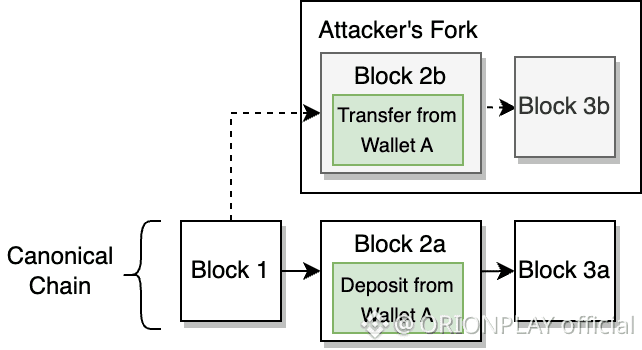

🎯 Proof-of-Blind Bid: Privacy at the Consensus Layer

Most networks expose:

• Who validates

• How much is staked

Dusk hides this without weakening security.

Proof-of-Blind Bid allows:

• Leader selection

• Stake weighting

• Zero identity exposure

Validators prove eligibility without revealing themselves .

This is rare. And powerful.

😄 A Fun Way to Imagine It

Imagine a sealed auction where:

• Everyone bids

• No one sees bids

• Winner is provably fair

That’s how Dusk picks block leaders.

🧱 Not Just One Ledger, But Two Models Working Together

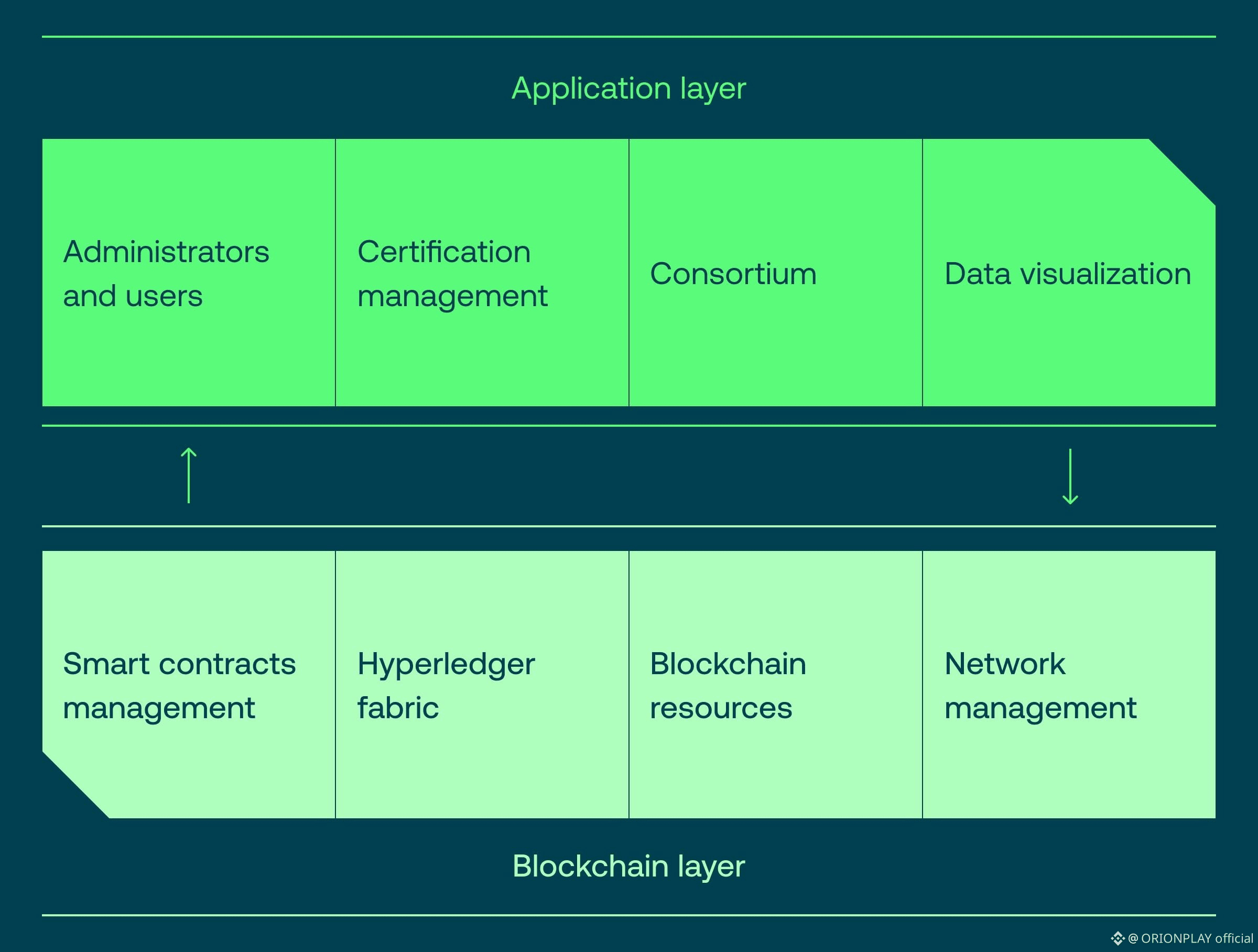

Dusk doesn’t force one transaction style.

Instead, it uses:

• Phoenix → UTXO privacy for users

• Zedger → Account-based privacy for regulated assets

This dual design is intentional — and extremely hard to implement correctly .

🧠 Why This Matters Long-Term

Most blockchains optimize for:

• Short-term usage

• Developer convenience

Dusk optimizes for:

• Legal compatibility

• Institutional confidence

• Long-term relevance

That choice slows hype — but strengthens foundations.

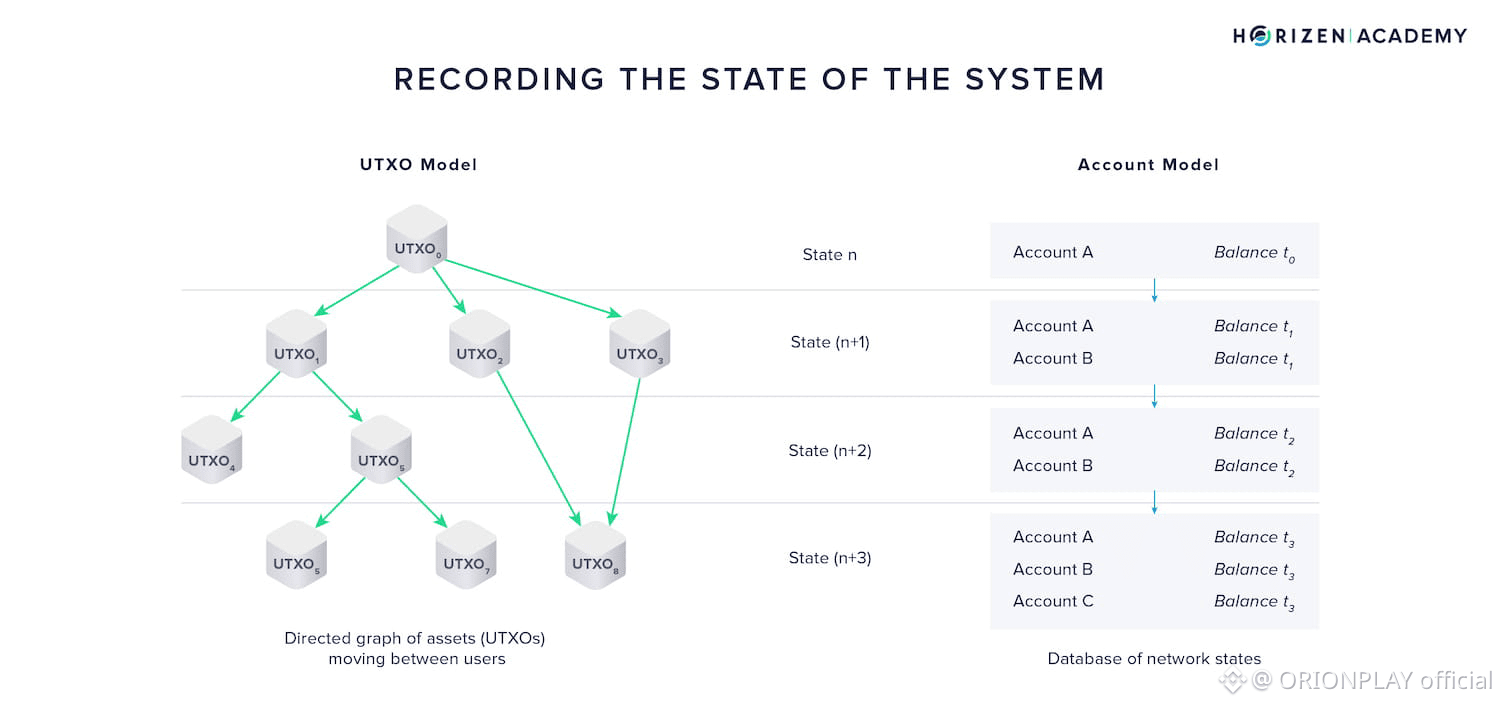

🧠 Why One Privacy Model Is Never Enough

Most blockchains try to solve everything with one transaction model.

Dusk doesn’t.

Instead, it quietly accepts a hard truth:

What works for anonymous peer-to-peer transfers does not work for regulated financial assets.

So the protocol splits responsibility — cleanly and deliberately.

🔄 Phoenix: Privacy That Scales With Time

Phoenix is Dusk’s UTXO-based privacy engine.

But unlike classic privacy systems, it avoids common traps:

• No ring-size limitations

• No shrinking anonymity sets

• No traceable miner behavior

Here’s the clever part:

👉 Every transaction ever created increases privacy for future ones

So instead of privacy decaying, it compounds.

That’s rare.

🧠 Simple Mental Model

Imagine a crowd where:

• Every new person joins silently

• Everyone looks equally suspicious

• Nobody stands out

That’s Phoenix.

🧾 But Finance Needs Memory (And Audit Trails)

Now comes the uncomfortable truth many crypto communities ignore:

Regulated finance requires:

• Account history

• Balance tracking

• Lifecycle control

• Selective disclosure

Pure UTXO systems struggle here.

This is why Zedger exists.

🧩 Zedger: Privacy With Accountability

Zedger introduces a hybrid privacy model designed for:

• Security token issuance

• Whitelisted participants

• Compliance-friendly audits

But without exposing balances publicly.

How?

Through a structure called Sparse Merkle-Segment Tries .

🤯 What That Actually Means (No Math)

Instead of revealing:

• Full balances

• Full history

Zedger reveals:

• Proofs of correctness

• Segment-level state roots

• Cryptographic commitments

Auditors see truth, not raw data.

Users keep privacy, not secrecy.

😄 A Fun Analogy

Think of Zedger like a bank vault where:

• Inspectors verify totals

• Individual deposit boxes stay sealed

• The math always checks out

⚙️ Rusk VM: The Silent Enabler

All of this would collapse without execution control.

That’s where Rusk VM enters.

Key idea:

• Smart contracts execute with bounded computation

• Zero-knowledge verification is native, not patched in

This avoids:

• Infinite loops

• Gas abuse

• Privacy leaks during execution

It’s not flashy — it’s responsible engineering .

🧠 Why This Architecture Is Rare

Because it’s hard.

Very hard.

• Two transaction models

• Custom VM

• Privacy-aware consensus

• Compliance-aware design

Most teams choose speed.

Dusk chose correctness.

📉 Why Traders Misunderstood This (Then)

Early market reactions often asked:

• “Where is the hype?”

• “Why so slow?”

The answer is simple:

You don’t rush infrastructure meant to handle:

• Securities

• Ownership

• Legal accountability

Airports aren’t built like skate parks.

📈 Why Perception Is Changing (Now)

As crypto matures:

• Institutions ask harder questions

• Regulators stop ignoring blockchains

• Privacy becomes a requirement, not a luxury

Suddenly, Dusk’s design looks less “overengineered”

—and more early.

🧠 The Hidden Strength

Dusk never tried to be:

• Everything for everyone

It chose to be:

• Precise

• Narrow

• Durable

That’s why its architecture ages slowly.

🧠 The Biggest Misread About Dusk

For a long time, Dusk was evaluated using the wrong lens.

People tried to measure it by:

• Hype cycles

• Social noise

• Short-term price action

But Dusk was never competing in that arena.

It behaves like:

• A protocol first

• An asset second

That mindset quietly filters out shortcuts.

🏗️ Infrastructure Has a Different Personality

Infrastructure projects share common traits:

• Slow but deliberate development

• Heavy emphasis on correctness

• Fewer promises, more constraints

This is exactly how Dusk Foundation operates.

Nothing here screams “viral”.

Everything whispers “durable”.

🔍 Why Dusk Doesn’t Chase Trends

NFTs. Memecoins. Sudden narratives.

Dusk observed them — and stayed focused.

Because regulated finance does not care about:

• Seasonal narratives

• Community excitement spikes

It cares about:

• Finality guarantees

• Data minimization

• Legal clarity

• Predictable execution

Dusk’s design answers those questions before they are asked.

🧠 The Long Game Most Miss

The real bet behind Dusk is simple:

Regulation will not disappear.

Privacy will not disappear.

Finance will demand both.

Most chains compromise one side.

Dusk refuses to.

😄 A Light Joke (Because Even Serious Systems Need One)

If blockchains were vehicles:

• Some are race bikes

• Some are sports cars

Dusk is a high-speed train:

• Not flashy

• Not loud

• But impossible to ignore once adopted

📉 Why Progress Looked “Quiet”

Silence was never stagnation.

It was:

• Research

• Formalization

• Testing edge cases

• Designing failure-resistant systems

You don’t notice this work until:

• Institutions show interest

• Use cases require it

• Regulators start asking questions

That’s when silence becomes signal.

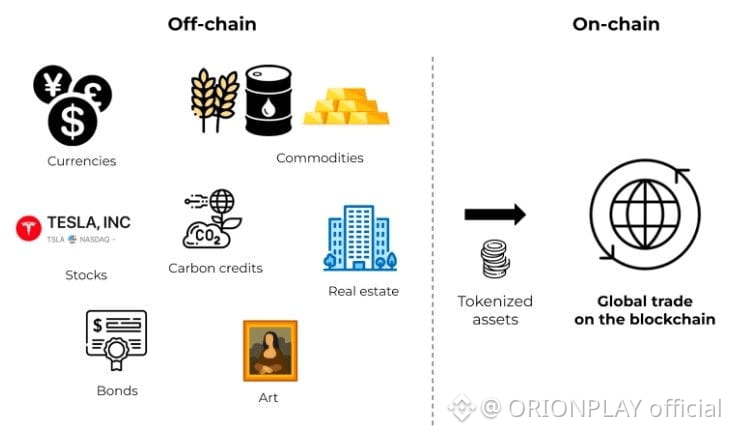

📈 Where Dusk Quietly Gains Strength

The moment crypto enters:

• Securities

• Bonds

• Regulated assets

• Institutional settlement

Dusk’s architecture stops being “complex”

—and starts being necessary.

Phoenix handles users.

Zedger handles institutions.

SBA handles certainty.

Rusk VM keeps execution honest.

No duct tape.

No compromises.

🧠 The Psychological Shift Happening Now

Earlier perception:

• “Why is this taking so long?”

Current realization:

• “Oh… this is not built for quick wins.”

That shift matters.

Because infrastructure doesn’t ask for patience —

it demands it.

🔮 Final Thought

Dusk Foundation never tried to win attention.

It tried to solve a problem most chains postponed:

“How does blockchain survive contact with real finance?”

The answer is not louder marketing.

It is better design.