Bitcoin and major altcoins pushed higher today as cooling U.S. inflation and positive U.S. crypto regulation news boosted risk appetite 📈. BTC broke above $95K while ETH held over $3.3K, lifting total market cap toward $3.25T 💰.

📉 Inflation = Tailwind

The latest CPI showed inflation easing (2.7% headline, 2.6% core), keeping hopes alive for rate cuts in 2026. Lower inflation and falling energy and mortgage costs support risk assets like crypto 🚀. Gold also rallied, confirming demand for inflation hedges 🟡.

🏛️ CLARITY Act = Regulatory Boost

Lawmakers advanced the CLARITY Act, aiming to clearly split oversight between the SEC and CFTC and give most tokens a more predictable framework. This shift away from regulation by enforcement is a big win for institutions and long-term crypto growth 🔐.

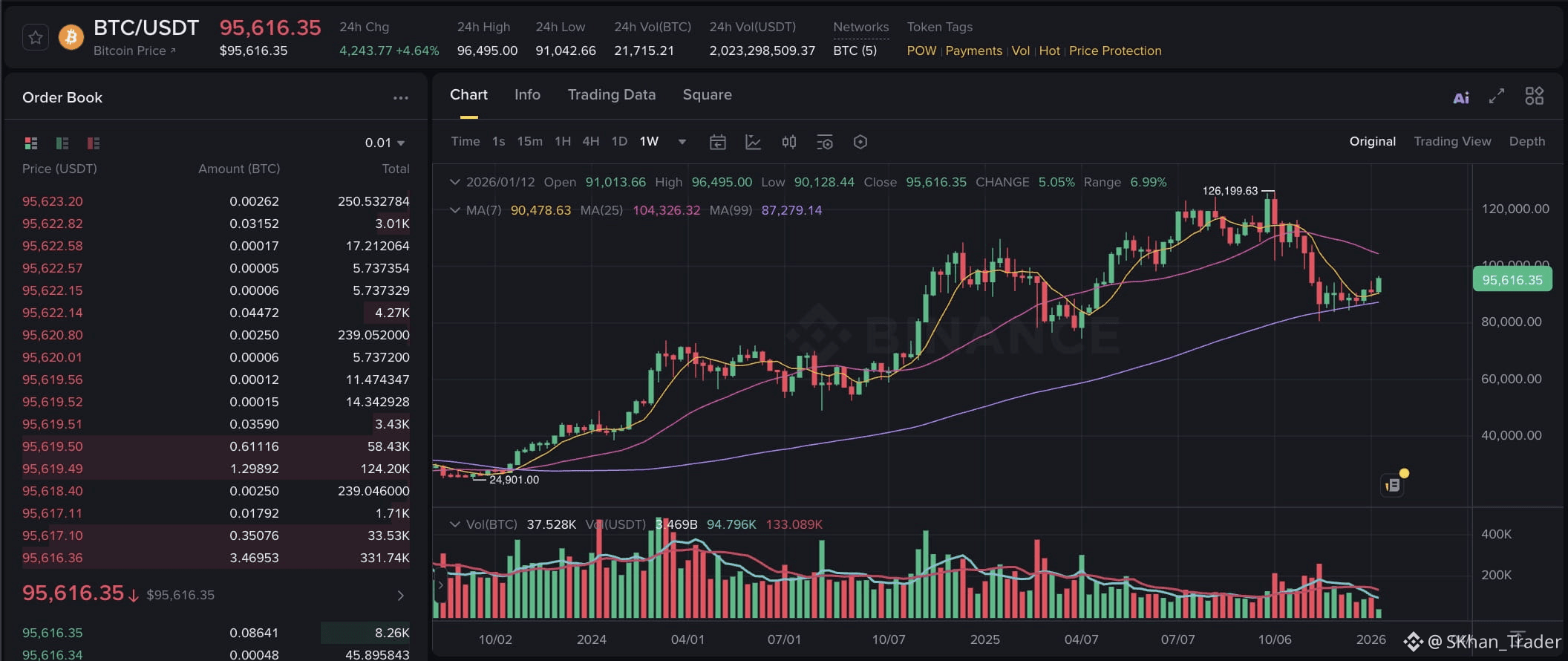

📊 Bitcoin Levels

BTC broke out of its $88.5K–$95.5K range. Holding above $94K–$95K could open $98K–$100K next 🎯. Support sits near $91K and $89.8K. Futures positioning is improving, though volumes remain controlled.

🔄 Altcoin Rotation

Money is rotating, not flooding everything. XMR and DASH jumped on niche momentum, while XRP, DOGE, and ADA lagged after earlier runs. This looks like selective accumulation, not a full altseason yet 🧭.

🏦 ETF Flows

Spot BTC and ETH ETFs saw net inflows, adding steady institutional demand and helping stabilize the market 🐳.

😌 Sentiment Check

Fear & Greed is around 45 (neutral). Traders are cautious but accumulating, which often creates a healthier base for upside.

Bottom line ⚡

Crypto is rising because inflation is easing, rate-cut hopes are growing, and U.S. rules are getting clearer. If BTC holds above $95K, the path toward $100K stays open 🚀.

#crypto #market #altcoins #Binance #GlobalFinance