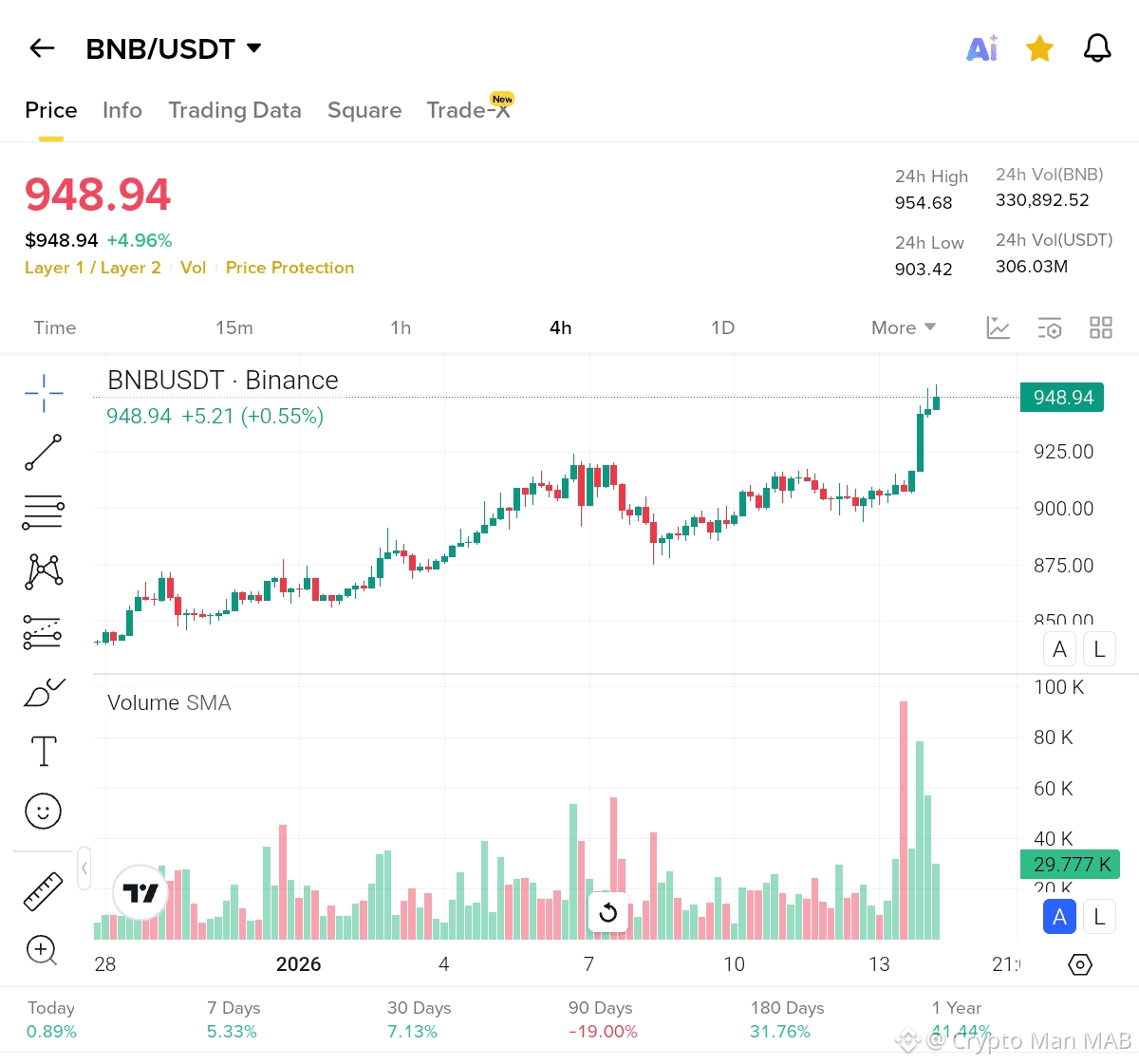

If you've been sleeping on Binance Coin (BNB), it's time to wake up and smell the gains. As we kick off 2026, BNB/USDT is straight-up flexing on the charts, clocking in at a juicy $948.94 with a solid +4.96% pump in the last 24 hours. This isn't just another altcoin wiggle--it's a full-on resurgence that's got traders buzzing from Lahore to LA. Let's dive into this chart like it's the hottest drop of the season and break down why BNB is positioning itself as the king of utility tokens in a post-bull market world.

The Price Action: A Classic Bounce-Back Story

Looking at the 15-minute candlestick chart on Binance, BNB's been on a wild ride lately. We see a sharp dip earlier in the session, bottoming out around $875 before bulls charged in like it's Black Friday at the crypto exchange. That green candle spike? Pure adrenaline. The price blasted through resistance levels, hitting a 24-hour high of $954.68 and settling at $948.94--up over 5% from the open. It's giving "underdog comeback" vibes, especially after that sneaky pullback from the $900 mark.

Zoom out a bit, and the narrative gets even spicier. Over the past week, BNB's up 5.33%, and the 30-day view shows a respectable 7.13% climb. Sure, the 90-day dip of -19.00% screams "bear trap," but that's just the market shaking out the weak hands. Flip to the bigger picture: +31.76% in 180 days and a whopping +41.44% over the year. In a world where Bitcoin's hogging the headlines, BNB's quietly building an empire on the back of Binance's ecosystem--think DeFi, NFTs, and that sweet, sweet transaction fee burn mechanism that's reducing supply like clockwork.

Volume and Indicators: The Hype is Real

Peep the volume bars at the bottom--they're lighting up like a New Year's Eve party. The Simple Moving Average (SMA) on volume is trending upward, with the latest bar hitting 29.777K, signaling fresh money flowing in. This isn't retail FOMO; it's institutional interest, baby. Traders are piling in, pushing that 24-hour volume to 330,892.52 BNB (that's over $306 million in USD terms). Low volume dips earlier? That's where smart money accumulated before the breakout.

Tech-wise, the chart's screaming bullish. Those green candles are overpowering the reds, with the price hugging the upper Bollinger Bands (implied, based on the volatility). If we factor in the broader market--Binance's expansions into AI-driven trading tools and regulatory wins in emerging markets--BNB's utility is unmatched. No wonder it's outperforming in a sea of meme coins and flash-in-the-pan projects.

What's Driving the Surge? The 2026 Crypto Vibes

This isn't happening in a vacuum. With global adoption ramping up (shoutout to Pakistan's growing crypto scene, where BNB's low fees are a game-changer for remittances), Binance's ecosystem is thriving. Recent burns have torched millions of BNB, tightening supply while demand spikes from Launchpad projects and Web3 integrations. Add in the macro tailwinds--cooling inflation, potential rate cuts, and Ethereum's scaling woes--and BNB looks primed to smash through $1,000 soon. But hey, crypto's volatile; that 24-hour low of $903.42 reminds us to DYOR and set those stops.

Disclaimer: This is not financial advice. Crypto markets are wild trade at your own risk.