If you are bigenners and tired of inconsistent trading results and losses? Want to create a strategy that works for you? Here's a 90-day challenge to help you develop a profitable trading strategy:

Day 1-30: Learn and Research

If you are begennirs and learning crypto and frustrated.Don't fear trading is very easy .We ourself made trading very complicated .

1. Study successful traders and their strategies.

2.write your goals first

What You want to become a scalper٫swing trader٫Intraday trader or invested.

3. Learn technical analysis

PRICE ACTION

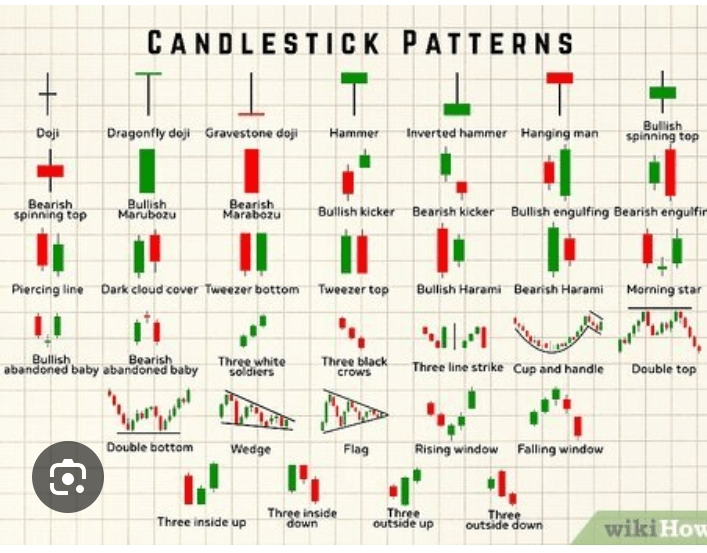

learn about candle psychology and candlestick patterns like Hammer ٫inverted Hammer ٫doji candles

After that you learn about chart patterns like Bullish flag bearish flag etc.

Master about supply and demand/support and resistance

Strong Grip on volume

Learn about trend lines.

Price action with volume confirmation show strong result.

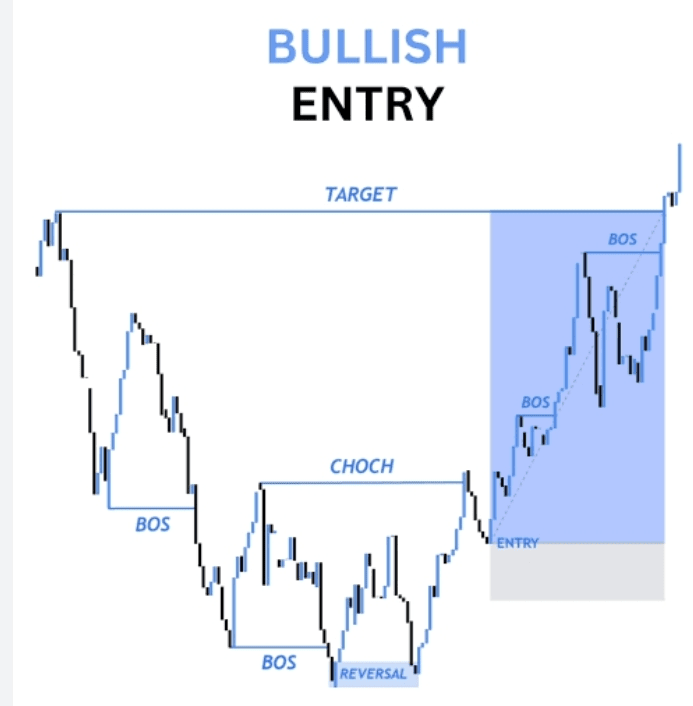

Market structure

Market structure is backbone of crypto٫ forex and stock trading.

Master how marks higher highs and higher lows

Learn about inducement and pullbacks.

Master BOS(break of structure)

Master choch (change of character)

BOS and CHOCH are sign of trend reversals

Master trading view tools

Fibonacci retrasment

Volume profiles

Moving averages

RSI

Mastering trading view is very very important.

MASTRING LIQUIDITY

Liquidity is fuel of market.

Crypto is game of liquidity.

Types of liquidity

Enternel liquidity

Externel liquidity

Trend line liquidity

Fundamental Analysis

Stay focused on incoming news٫ geopolitical situations and war situations.

Important websites for fundamental Analysis:

Coinmarketcap.com

Coingeko.com

Coin telegraph.com

Forex factory(for important economics data) like cpi٫ ppi٫core cpi that influence whole market.

Cryptoqouant.com

Day31 -60:Backtesting

1. Choose a trading platform and tools

2. Backtest different strategies using historical data using onchain analysis

Eyes on whale activities

4. Experiment with indicators and parameters

4. Analyze results and refine your approach

5. Start a trading journal to track progress

Improve psychology

Improve Psychology means high win ratio

Don't panic due to fear or FOMO

Always do your in research.

Risk Management

Always manage risk

Use low leverage. Use High leverage when position size is so small.

Use 1 to 2 percent portfolio per trade

Use DCA(doller cost average to mimize risk and not use all portfolio in single coin.

Day 61 -90:Refinement and live trading

1. Start with a small live trades

2. Implement your refined strategy

3. Monitor and adjust as needed

4. Focus on consistency and discipline

5. Continuously learn and improve

Key Principles

1. Start small: Don't risk too much capital

2. Stay disciplined: Stick to your plan

3. Keep learning: Trading is a continuous process

4. Be patient: Success takes time

Take the challenge and develop a profitable trading strategy that works for you! 💪

#Trading #Strategy #Profitable #90DayChallenge #tradingtips