Most people hear “tokenized securities” and assume it’s a simple upgrade: take stocks or bonds, put them on-chain, and markets instantly become faster. The reality is more uncomfortable. Tokenization itself is easy. What’s hard is making those tokens behave like real securities: issued under regulation, traded with restrictions, settled with legal finality, and still private enough for institutions to participate.

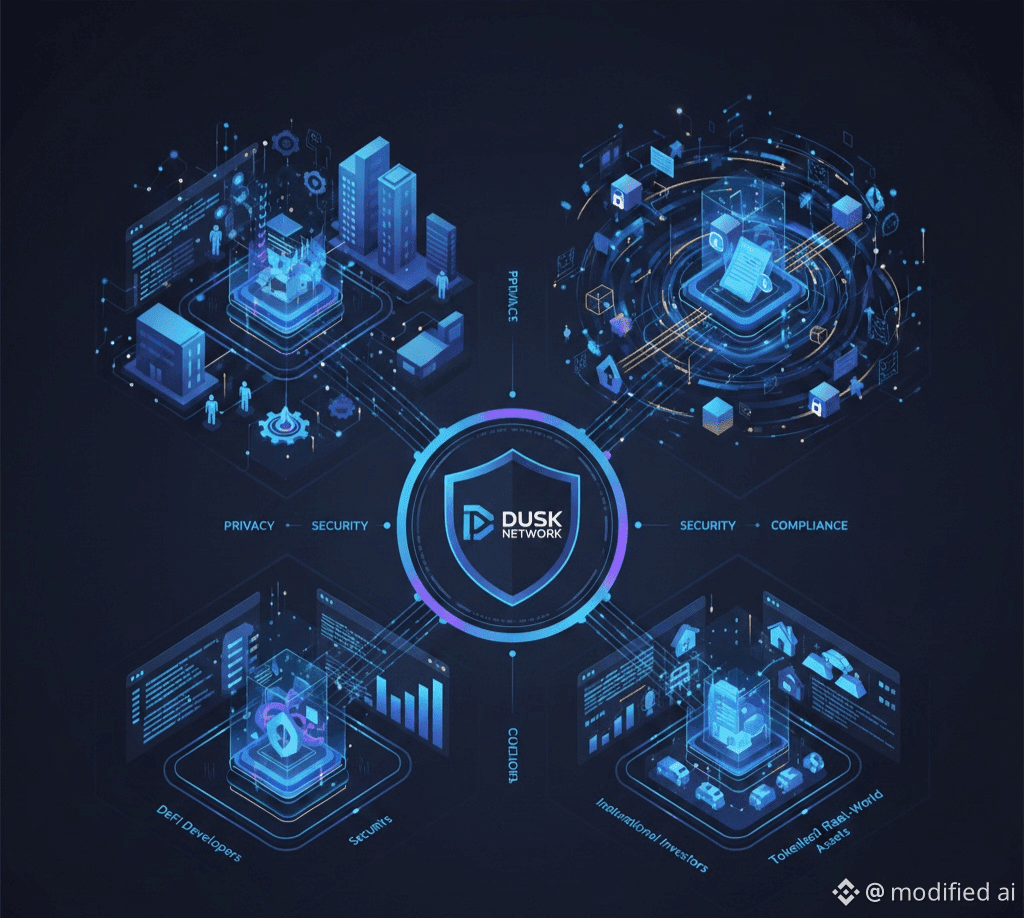

This is the contradiction Dusk Network focuses on. Public blockchains are transparent by default, while real securities markets are not. Trading activity, positions, and counterparties are sensitive information. If everything is publicly visible, institutions step back. At the same time, regulators require auditability and oversight. Most chains choose one extreme: full transparency or extreme privacy. Both fail in regulated finance.

Dusk aims for a middle ground: privacy with auditability, enforced cryptographically. Using its Phoenix transaction model and zero-knowledge proofs, activity can be verified without exposing sensitive details. If tokenized securities scale, they won’t run on hype-driven chains. They’ll run on infrastructure designed for rules, enforcement, and discretion. That’s the problem Dusk is trying to solve.

#MarketRebound #BTC100kNext? #StrategyBTCPurchase #USDemocraticPartyBlueVault