As of January 14, 2026 (right now in Colombo time!), the smart contract wars are heating up. Ethereum remains the king of institutional DeFi and security, while Solana crushes it in speed, user activity, and retail frenzy. Both are pumping today with ETH up ~6-7% and SOL up ~4% – but which one has the edge for the rest of 2026?

Fresh Metrics Snapshot (Mid-January 2026)

- Price: ETH ≈ $3,330–$3,340 | SOL ≈ $145

- Market Cap: ETH ≈ $400B+ | SOL ≈ $82B

- Daily Active Addresses: Solana dominates massively (often 3–7x more, e.g., millions vs ~500k–900k on ETH L1)

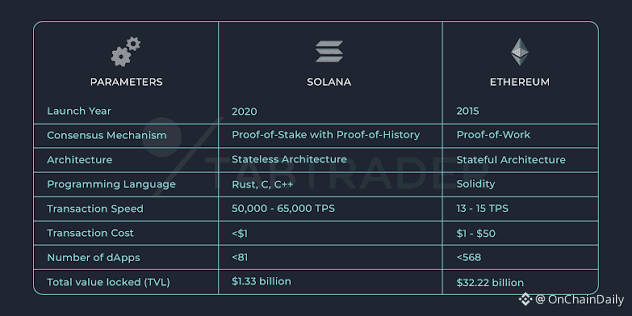

- Transactions & TPS: Solana real-world 3,000–5,000+ TPS (theoretical 65k+), instant finality | ETH L1 ~15–30 TPS, but L2s boost the combo higher

- Fees: Solana super-cheap (~$0.00025 avg) | ETH variable but affordable on L2s (~$0.10–$1+)

- TVL (DeFi Locked Value): Ethereum crushes with ~$75B (including L2s, ~68% of total DeFi TVL) | Solana strong at ~$9.2B but growing fast

- DEX Volume: Solana often grabs >50% of global share thanks to ultra-low fees and memecoin/trading mania

Ethereum ($ETH) – The Institutional Fortress 🏰

Pros:

- Unrivaled decentralization & battle-tested security (900k+ validators, no major outages in years)

- Deepest liquidity + mature ecosystem (thousands of dApps, dominant in high-value DeFi, RWAs, stablecoins)

- Institutional love: Spot ETH ETFs with billions in inflows (staking yields possible soon), seen as digital gold/commodity

- 2026 upgrades incoming: Glamsterdam (H1 2026) targets parallel processing, higher gas limits, and up to 10,000 TPS potential – plus better MEV fairness!

Cons:

- L1 still slower/ pricier → heavy L2 reliance (adds some UX fragmentation)

- Activity often shifts to L2s, so mainnet revenue can lag

Solana ($SOL) – The Speed & Retail Rocket 🔥

Pros:

- Blazing performance + near-zero fees → ideal for high-volume trading, gaming, memecoins, everyday apps

- Explosive user growth: Record daily addresses/transactions, massive DEX dominance

- Firedancer client now live (from late 2025), boosting resilience & pushing toward 1M+ TPS dreams

- Rising institutional heat: Spot SOL ETFs seeing strong inflows, potential for bigger adoption in 2026

Cons:

- Less decentralized (~1,500 validators) → history of outages (though Firedancer + recent fixes are improving stability big time)

- Higher centralization/regulatory risks (SEC scrutiny possible)

- TVL & high-value secure apps still trail ETH significantly

2026 Verdict: Who Wins?

No single winner – they're complementary!

- Ethereum = The safe, institutional money magnet with upgrades making it faster & fairer. Many analysts target $4,000–$8,000+ if Glamsterdam delivers and RWAs/tokenization boom.

- Solana = The high-beta rocket for retail momentum & explosive growth. Bullish scenarios see $280–$500+ if Firedancer scales everything and memecoin/DeFi seasons return.

Most smart players hold both – ETH for stability + capital inflows, SOL for speed + upside volatility!

ETH fortress or SOL rocket? What's your pick for bigger gains in 2026? Drop your targets & why below! 👇

#Ethereum #Solana #ETHvsSOL #Crypto2026 #BinanceSquare #TrendingTopic #viralpost #ViralTrends $ETH $SOL $BTC