RWA (Real-World Assets) tokenization is exploding right now – it's the process of turning tangible or traditional assets (like real estate, bonds, commodities, stocks, art, or even Treasuries) into "digital tokens on a blockchain". This creates a bridge between TradFi (traditional finance) and crypto/DeFi, making high-value assets more accessible, liquid, and efficient.

As of early January 2026, the global tokenized RWA market (excluding stablecoins) sits around **$19-21B** distributed on-chain, with represented value much higher (hundreds of billions including off-chain backing). Projections see it hitting trillions by 2030! Ethereum dominates (~65% share), but **Solana** is surging with its ecosystem hitting an **$873M ATH** (up massively in 2025), driven by speed, low fees, and institutional plays like tokenized Treasuries and funds.

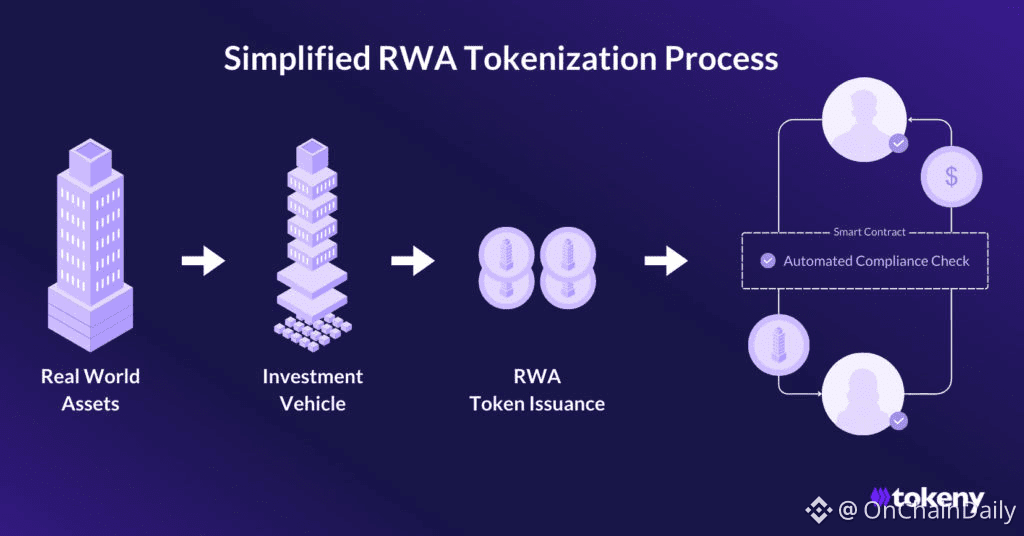

How RWA Tokenization Works – Step-by-Step Breakdown

Here's the core process (simple & visual-friendly):

1. **Asset Selection & Legal Setup** – Pick a real asset (e.g., U.S. Treasury bill, real estate, or gold). Verify ownership, value, and create legal structure (often via SPV or regulated entity) to ensure the token is backed 1:1.

2. **Token Creation (Minting)** – Use smart contracts on a blockchain (e.g., ERC-20/721 standards on Ethereum or SPL on Solana) to issue digital tokens representing fractional or full ownership.

3. **On-Chain Representation** – Tokens live on the blockchain, with ownership tracked immutably. Oracles (like Chainlink) feed real-world data for pricing/redemptions.

4. **Trading & Management** – Tokens can be traded 24/7, fractionalized (buy 0.001% of a property!), used as collateral in DeFi, or earn yield (e.g., tokenized T-bills pay interest via smart contracts).

5. **Redemption & Servicing** – Holders can redeem for the underlying asset (where permitted), with automated payouts, compliance checks, and reporting.

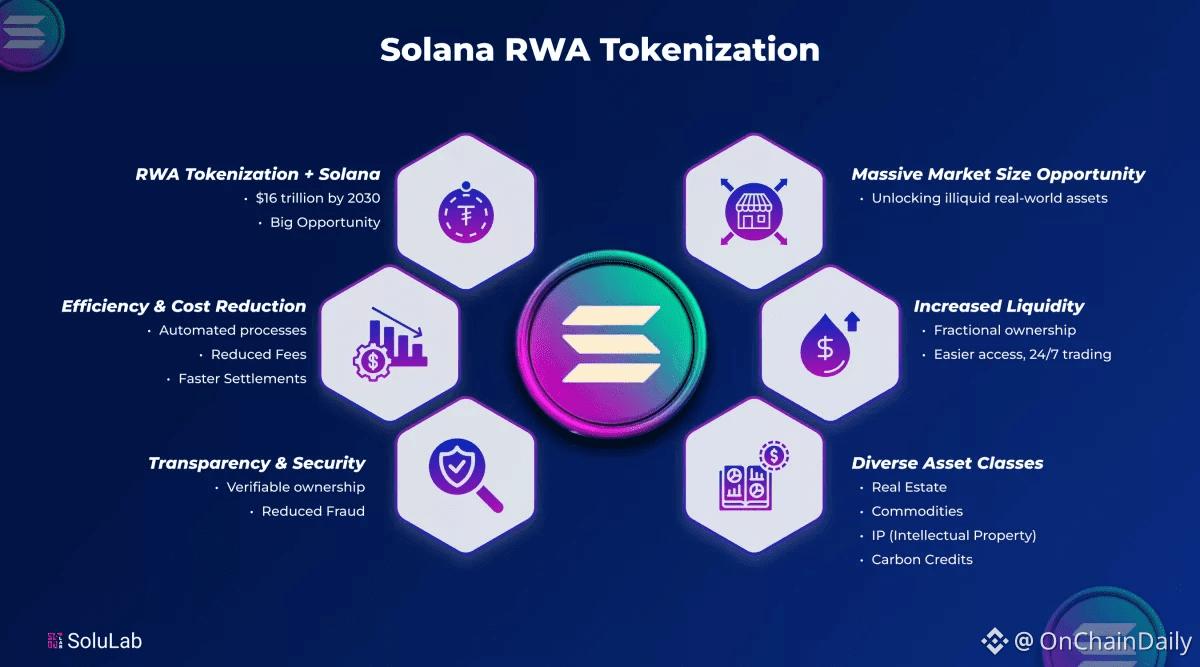

🚨 Key Benefits of RWA Tokenization

✅ **Fractional Ownership** → Democratizes access (invest in a slice of prime real estate or fine art for pennies).

✅ **Increased Liquidity** → Illiquid assets become tradable 24/7 on global markets.

✅ **Transparency & Efficiency** → Immutable ledger + smart contracts reduce intermediaries, speed up settlements (T+0 vs. days), and automate yields/dividends.

✅ **Yield & Diversification** → Stable, real-world backed yields in DeFi (e.g., tokenized Treasuries dominate ~45% of on-chain RWAs).

✅**Global Reach** → Borderless investing with compliance built-in.

🚨 Top Asset Classes in 2026

⚡ **U.S. Treasuries** → Biggest chunk (~$8-9B on-chain).

⚡**Stablecoins** (often included) → Massive volume.

⚡ **Private Credit, Commodities, Institutional Funds, Equities** → Growing fast.

⚡On **Solana** specifically: Heavy in yield-bearing Treasuries, tokenized stocks (e.g., Tesla/Nvidia proxies), and funds – perfect for high-volume, low-cost trades.

Challenges remain: Regulatory hurdles (KYC/AML, jurisdiction rules), custody/security, and ensuring true 1:1 backing – but 2026 is the year of real adoption with institutions like BlackRock, Ondo, and more piling in.

This is why RWAs are hyped as the next big narrative – merging real yield with blockchain speed! What's your take: Are you diving into tokenized Treasuries, real estate fractions, or watching Solana's $873M+ ecosystem explode? Drop your thoughts below + tag a friend! 👇

#RWA #Tokenization #RealWorldAssets #Solana #Crypto #MarketRebound #TrendingTopic #viralpost #ViralTrends $XRP $ETH $BTC