Most blockchain projects talk about the future. Dusk Network is quietly preparing for it. While much of the industry still debates speed, fees, and retail adoption, Dusk is focused on a harder and far more important question: how blockchain can function inside real financial markets without breaking privacy laws, regulatory frameworks, or institutional standards. That focus is what makes Dusk different—and why its progress deserves attention.

From the beginning, Dusk Network was never designed to be a general-purpose playground. It was built for environments where mistakes are costly, rules are strict, and trust is earned slowly. Financial institutions do not experiment with systems that expose sensitive data or rely on legal assumptions that may not hold. Dusk acknowledges this reality and designs around it, rather than trying to work around it.

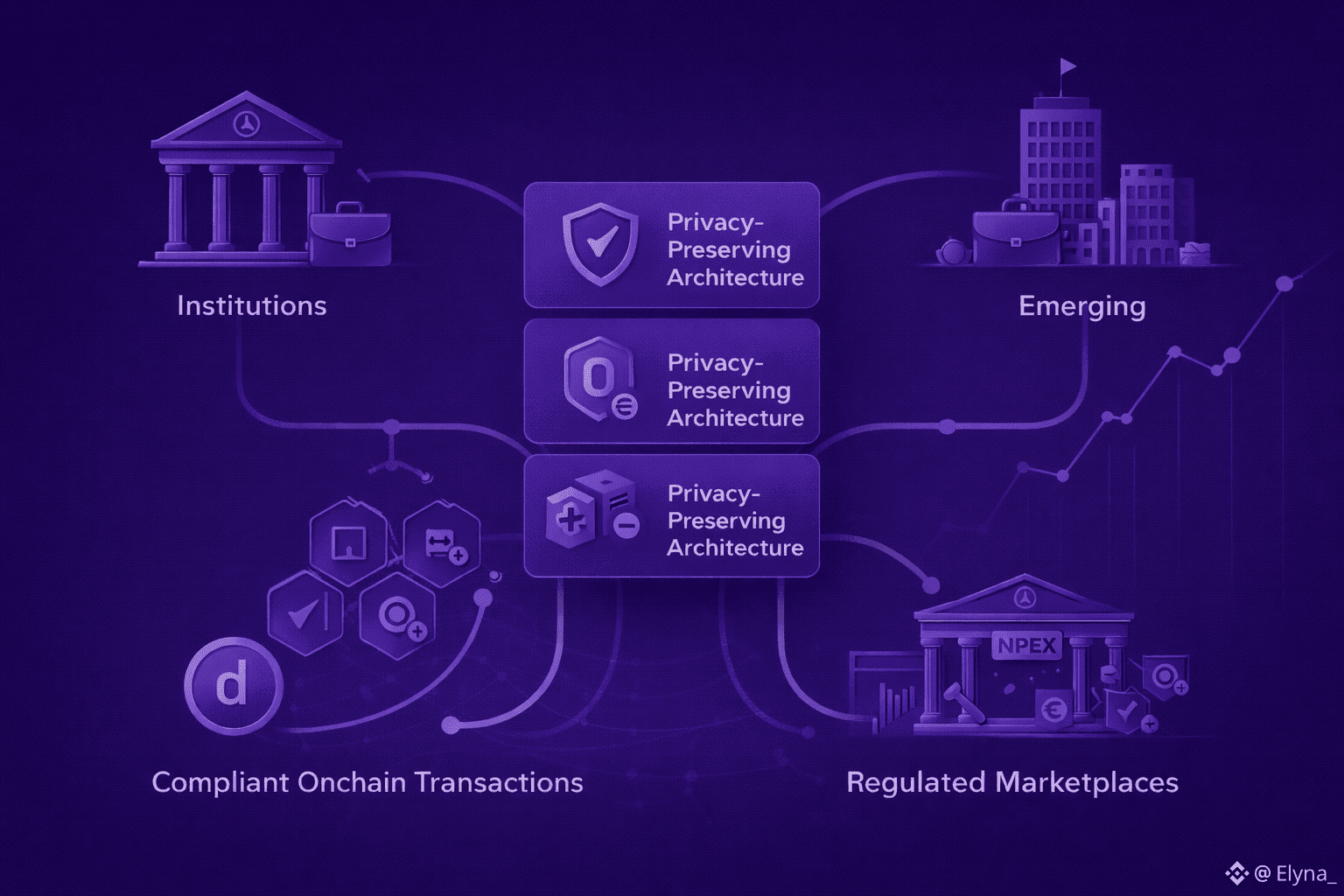

One of the biggest misconceptions in crypto is that transparency alone creates trust. In real finance, uncontrolled transparency often creates risk. Banks, exchanges, and asset issuers cannot publicly reveal balances, positions, or settlement activity. At the same time, they must be able to prove that transactions are valid and compliant when regulators or auditors request it. Dusk is built precisely for this balance. It allows data to remain confidential by default while still enabling verification under the right conditions. This approach mirrors how financial systems already operate off-chain.

What makes this especially important is that Dusk treats compliance as a system-level feature, not a bolt-on solution. Many blockchains assume regulation can be handled externally, through legal agreements or off-chain reporting. That assumption works only at small scale. As activity grows, fragmentation and operational risk follow. Dusk integrates legal and technical constraints directly into how the network functions. This reduces complexity for developers and lowers risk for institutions that want to build or operate onchain.

This design philosophy shapes the types of use cases Dusk supports. The network is optimized for regulated assets such as tokenized securities, compliant digital instruments, and institutional settlement workflows. These are not speculative experiments. They are extensions of existing financial processes into a programmable environment. By aligning blockchain mechanics with legal requirements, Dusk creates conditions where institutions can participate without rewriting their entire compliance framework.

Another critical factor is interoperability. Financial markets do not exist in isolation, and neither can blockchain-based systems. Assets interact with pricing feeds, liquidity venues, custody services, and reporting tools. Moving assets across chains is technically easy, but preserving their legal context is not. Dusk approaches interoperability with this constraint in mind. The goal is not just asset mobility, but continuity of compliance. This allows regulated assets to interact with broader ecosystems without becoming legally ambiguous.

Dusk’s slower, more deliberate pace is often misunderstood in a market obsessed with rapid launches. In financial infrastructure, speed is rarely the primary goal. Stability, correctness, and auditability matter more. Systems that move too fast often accumulate hidden risk. Dusk prioritizes long-term reliability over short-term excitement, which aligns more closely with how financial institutions evaluate technology. This patience is not a weakness; it is a signal of intent.

The role of the DUSK token fits naturally into this framework. It is not positioned as a narrative-driven asset, but as a functional component of the network. The token supports staking, transaction execution, and governance. Its relevance grows as real activity increases on the network. This ties token value to usage rather than attention, which is uncommon in crypto but familiar in traditional infrastructure systems.

What truly stands out about Dusk is its clarity. It does not claim to replace traditional finance. It does not chase every new trend. It does not market itself as a solution for all users. Instead, it focuses on a specific gap that most blockchains ignore: the need for privacy-aware, compliant financial infrastructure. This clarity reduces noise and increases execution quality. Projects that know what they are building tend to make fewer strategic mistakes.

As blockchain adoption evolves, specialization will become unavoidable. Retail-focused networks, gaming ecosystems, and financial infrastructure will diverge. Each will optimize for different constraints. Dusk is clearly positioning itself within the financial infrastructure category, where regulation is unavoidable and privacy is non-negotiable. This market may grow more slowly, but it is also deeper and more durable.

In the long run, the success of blockchain in finance will depend less on ideology and more on operational fit. Systems must work within legal boundaries while still delivering technological advantages. Dusk Network is building for that reality. Not loudly, not aggressively—but with a level of focus that suggests it understands exactly where blockchain adoption is heading.