The U.S. government knows that crypto is the "backdoor" to the global economy. In response to the new sanctions, we are seeing aggressive enforcement:

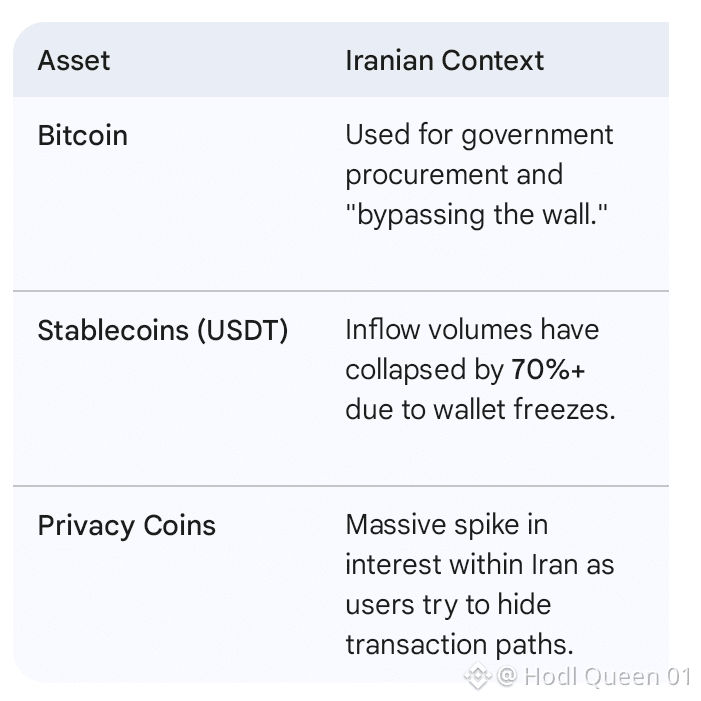

Massive Liquidity Freezes: Tether (the company behind USDT) has carried out its largest-ever freeze of Iranian-linked wallets. This is a direct hit to the "shadow markets" that use stablecoins to buy supplies for Iran.

The Trust Gap: Iranian crypto users are fleeing from major centralized exchanges (like Nobitex) toward Decentralized Exchanges (DEXs). They are trading on-chain to avoid being caught in the "blast radius" of U.S. policy.

2. Bitcoin as a "Neutral" Reserve

While the Iranian Rial is collapsing, Bitcoin's role in Iran has shifted from an investment to a utility currency.

National Mining: Iran currently controls roughly 5–10% of global Bitcoin mining. The government is now using this mined BTC to pay for sensitive imports (like machinery or technology) that no bank will touch.

BRICS Digital Trade: Iran is pushing hard for a BRICS-wide digital currency system to trade with India and China, specifically designed to bypass the U.S. dollar "operating system."

3. The "Secondary Sanction" Risk for Crypto Firms

This isn't just about Iran; it's a warning to the tech world.

Exchanges on Notice: Global exchanges are now terrified of the "25% tariff rule." If a crypto exchange is found to be facilitating trade with Iran, their entire home country could face U.S. tariffs.

Stricter KYC: Expect "Know Your Customer" (KYC) rules to get even more brutal. Exchanges are preemptively banning users from any region that even smells like a "trading partner" with Iran to avoid Trump's wrath.The Bottom Line

Trump’s move has turned the crypto world into a front line. If you are a crypto investor, you are no longer just watching price charts; you are watching the U.S. Treasury's "ban list." The "invisible war" is now being fought in code and on the blockchain.