🪙 What Are Mid-Cap Cryptos?

Mid-cap cryptocurrencies are digital assets with a market capitalization typically between $1 billion and $10 billion, offering a middle ground between large-cap stability and small-cap growth potential. They often balance growth opportunity with moderate risk, though still subject to volatility. �

CoinMarketCap +1

📈 Market Context

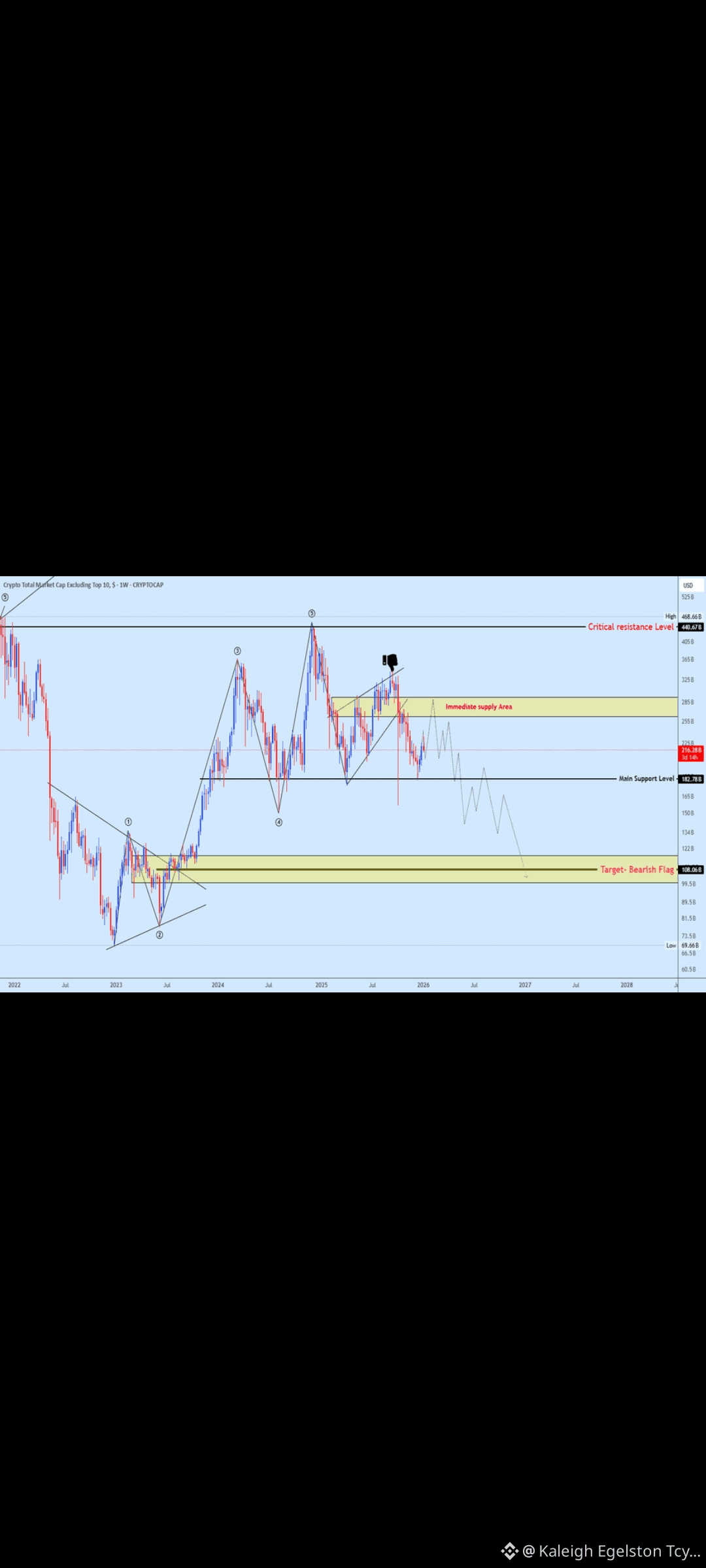

Mid-cap altcoins’ share of the crypto market (excluding Bitcoin and Ethereum) can signal broader altcoin strength or rotation away from large caps — when mid-caps gain market cap relative to BTC and ETH, it often reflects rising risk appetite. �

TradingView

Overall crypto market cap remains above ~$3 trillion with Bitcoin dominance elevated, which can limit mid-cap upside unless broader altcoin participation increases. �

CoinGecko

📊 Recent Price Behavior

Some mid-cap tokens have exhibited notable gains recently, driven by renewed trader interest and sector rotation toward altcoins. �

Bitget

However, the recovery in mid-caps tends to lag large-cap performance, especially when macro uncertainty promotes flight to ‘safer’ assets like BTC and ETH. �

Business Standard

🔍 Short-Term Technical Signals

Market breadth charts (e.g., altcoin-to-BTC ratios) show compression under resistance, suggesting mid-caps may be poised for a breakout if total altcoin market cap expands.

Conversely, if BTC strength continues dominating market cap distribution, mid-caps could struggle to see sustained upside.

📉 Risks

Mid-cap coins are more sensitive to sentiment and liquidity swings than large caps. Downturns in risk assets or tightening of macro conditions can quickly reduce trading volume and price. �

Business Standard

Some tokens lack strong fundamentals or real-world use cases, increasing the risk of deeper corrections. �

CoinDCX

📍 Summary Outlook

Mid-cap cryptocurrencies are currently in a cautious recovery phase — showing pockets of strength within the broader altcoin market but still influenced by larger market trends. Breakouts in altcoin market cap and rotational flows from large caps can catalyze renewed mid-cap rallies, while persistent dominance by BTC and macro caution could keep gains muted. *This analysis is informational and not financial advice.*

#MidCapMadness #MidCapGems #midcap #MidCapAlts