The history of capital markets is essentially the history of settlement. While trading has become increasingly digital, global, and instant, settlement has remained governed by legal finality, record transfer, beneficial ownership updates, and compliance checks all of which operate at the “securities layer” rather than the “execution layer.” Most blockchains assume that settlement finality equals block finality. In institutional finance, that assumption is fundamentally incorrect.

The history of capital markets is essentially the history of settlement. While trading has become increasingly digital, global, and instant, settlement has remained governed by legal finality, record transfer, beneficial ownership updates, and compliance checks all of which operate at the “securities layer” rather than the “execution layer.” Most blockchains assume that settlement finality equals block finality. In institutional finance, that assumption is fundamentally incorrect.

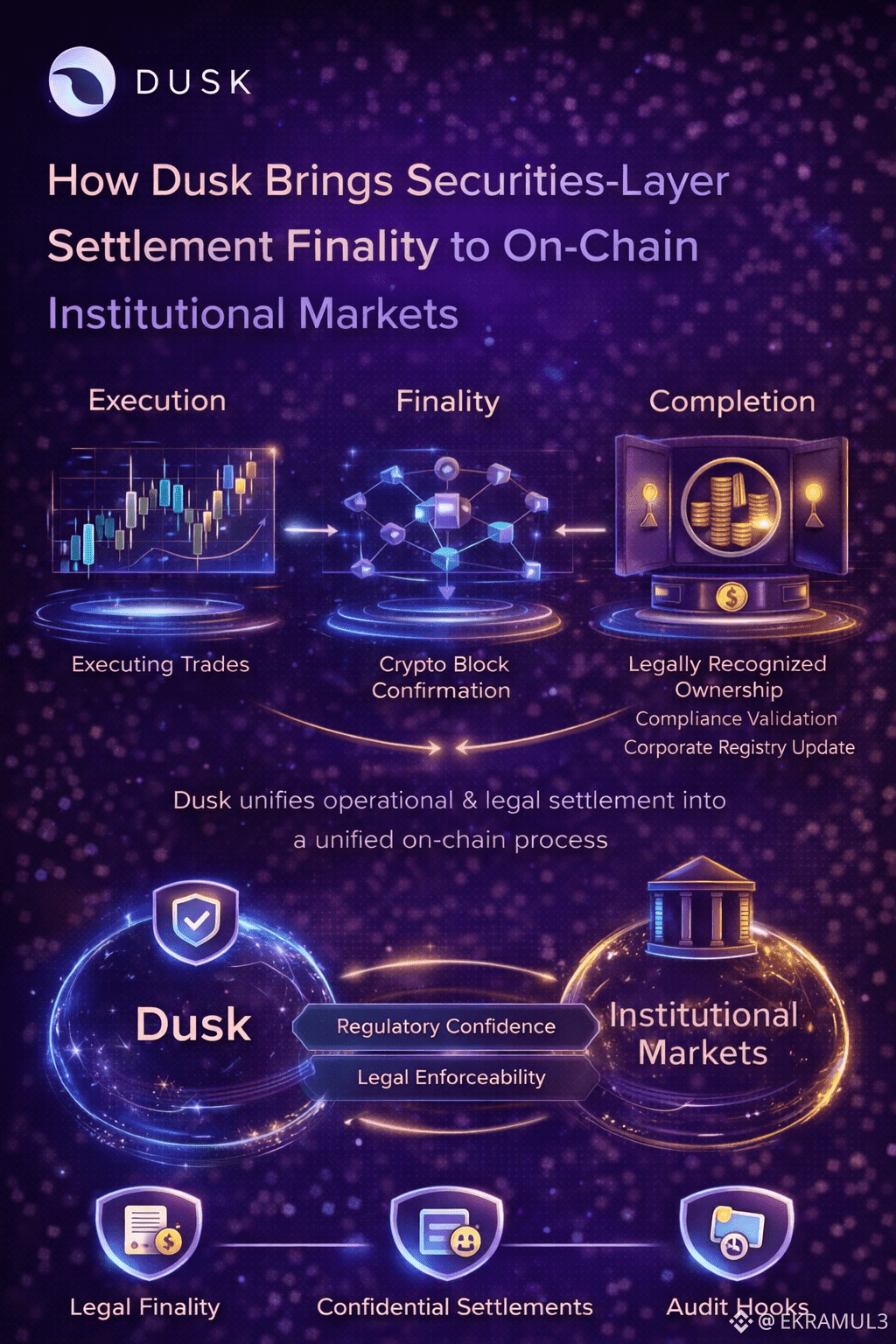

True settlement finality requires more than cryptographic confirmation. It requires the legally recognized transfer of beneficial ownership, compliance validation, and corporate registry updates. This distinction is why legacy markets continue to operate on T+2 settlement windows despite electronic trading. On-chain infrastructure cannot serve institutional markets unless it can collapse both forms of finality into a unified process operational and legal.

Dusk introduces a blockchain architecture specifically designed for this securities-layer requirement, enabling capital markets to migrate on-chain without breaking compliance, legal enforceability, or regulatory confidence. In doing so, it closes the gap between blockchain finality and the real-world finality that securities markets require to function.

Why Settlement Finality in Finance Is Not the Same as Blockchain Finality

In traditional blockchain narratives, finality is treated as the moment a transaction becomes irreversible. But in regulated securities markets, irreversibility is only one dimension. Securities do not legally transfer until:

✔ the beneficial ownership registry updates,

✔ corporate rights transfer,

✔ compliance checks pass, and

✔ settlement instructions align with regulatory frameworks.

Without these, trades are merely promises, not settlements. Broader markets call this the difference between “trade execution” and “trade completion.” Execution can be instant; completion requires legal and regulatory closure.

This gap is why most tokenization experiments fail to attract institutional liquidity. Tokenizing assets on public chains still leaves the securities layer off-chain, requiring custodians, CSDs, and transfer agents to perform post-trade updates manually. Dusk eliminates that post-trade reconciliation phase entirely.

The Securities Layer as a Protocol Primitive

Dusk is one of the first blockchains to treat the securities layer as a protocol-level feature, not middleware. In legacy infrastructure, securities-layer tasks sit inside structures like DTCC, Euroclear, Clearstream, and national CSDs. Dusk re-architects those functions into cryptographically verifiable components at settlement time. When securities trade on Dusk:

→ beneficial ownership updates automatically,

→ the registry updates atomically,

→ compliance constraints evaluate privately, and

→ settlement reaches legal finality in a single event.

This compression of functions is not just efficiency it is structural realignment. Instead of building an on-chain trading system that still depends on off-chain settlement, Dusk collapses both into a unified protocol.

Finality With Confidentiality

Regulated securities cannot settle publicly with their ownership data exposed. Institutional actors cannot have their holdings, allocations, residency statuses, or strategic positions broadcast to competitors. This is where Dusk deviates from traditional public blockchains.

Dusk integrates zero-knowledge compliance, allowing the protocol to verify transfers against regulatory rules without exposing raw identities or financial positions. The protocol can verify:

✔ eligibility,

✔ residency restrictions,

✔ AML screening,

✔ issuance caps, and

✔ beneficial owner validity,

while preserving privacy for institutional participants. Finality therefore becomes both compliant and confidential, something that no prior L1 has achieved at protocol level.

Eliminating Post-Trade Reconciliation

Legacy financial infrastructure is built around reconciliation the process institutions use to make independently maintained ledgers agree. This exists because the securities layer and execution layer are separate. Reconciliation introduces delays, errors, intermediaries, and settlement risk.

Dusk eliminates reconciliation because there is no ledger fragmentation. The settlement ledger and beneficial ownership ledger are one and the same. When finality occurs, every relevant registry updates instantly and authoritatively.

This directly collapses multiple legacy actors:

— CSD settlement layers,

— transfer agents,

— registries, and

— corporate action intermediaries.

By automating these operations at protocol level, Dusk converts multi-day workflows into atomic settlement primitives.

Institutional Appeal: Risk Compression and Legal Enforceability

Institutions care less about efficiency and more about risk compression. Dusk enables on-chain markets to compress:

• operational risk,

• settlement risk,

• counterparty risk, and

• custody risk.

Removing the securities layer from off-chain intermediaries reduces the risk surface that regulators constantly hedge against. At the same time, Dusk ensures that finality meets the legal standards required for enforceability a major blocker for tokenization platforms built on generic L1s.

Conclusion: Dusk Aligns Blockchain With Market Reality

Institutional markets will not migrate to on-chain infrastructure because tokens are novel they will migrate because settlement becomes safer, faster, compliant, and legally consumable. The bridge between crypto finality and securities finality is not a UI problem, it is a protocol problem. Dusk solves it by absorbing the securities layer into the settlement fabric itself, enabling real-world capital markets to exist on-chain without compromise.

Where most blockchains ask markets to adapt to crypto, Dusk adapts crypto to the way markets already function and that is where adoption lives.