I've been analyzing how real-world asset funds integrate with blockchain, and one issue consistently stands out: how to access accurate, live market data without exposing sensitive positions. That's exactly the problem Dusk and Chainlink’s infrastructure are designed to address together.

Think about it like this: a private fund has tokenized gold. Each token needs to reflect the real market price. But if price updates or execution details are fully visible on a public chain, observers can start inferring the fund’s positions, timing, or strategy. For regulated funds, that’s a privacy and compliance risk.

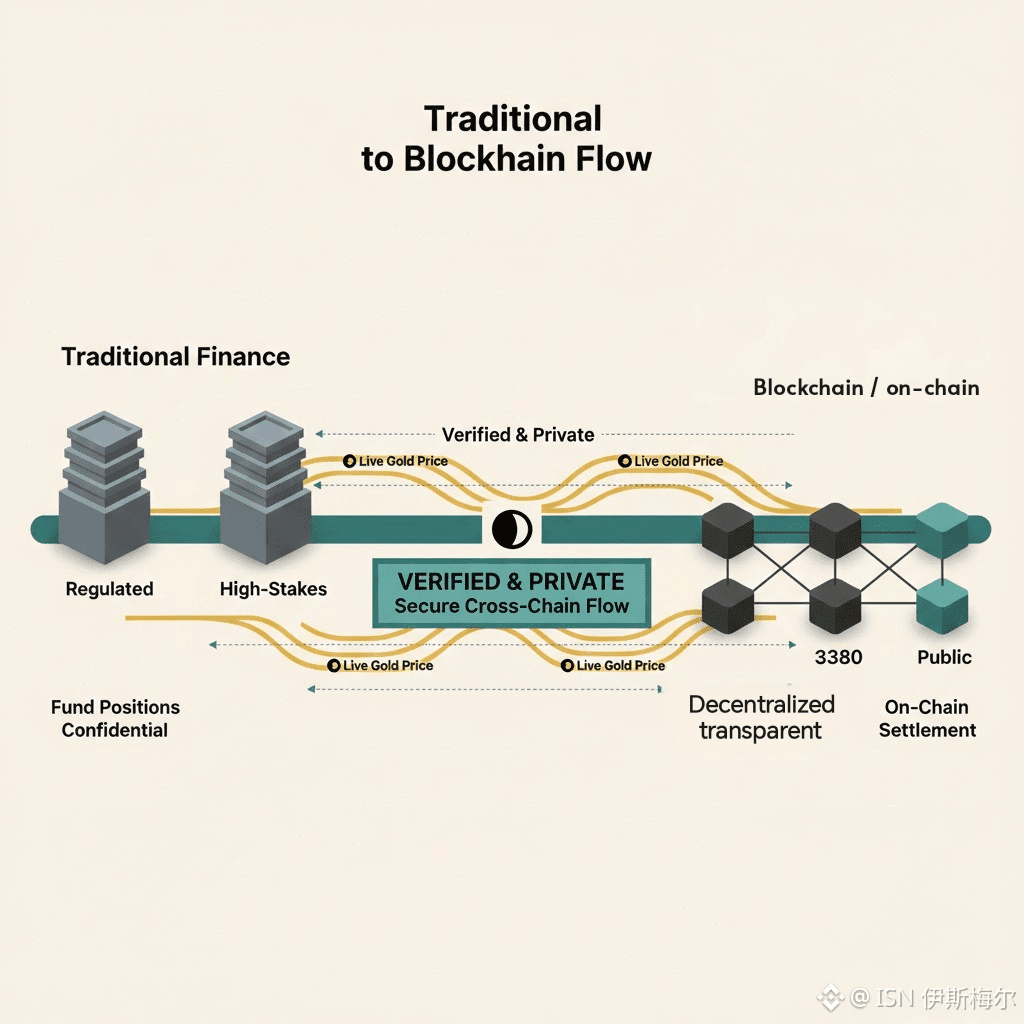

With Dusk, verified price data can be brought on-chain while shielding fund positions, balances, and execution details from public view. Builders and fund managers still get the data they need to settle accurately but outsiders don't get a window into the fund’s inner workings.

What’s clever here isn't just that the pricearrives on-chain — it’s how the system handles it. Chainlink’s oracle network sources and verifies market data from multiple inputs, while CCIP enables that verified data to move securely across chains. Dusk’s privacy-preserving settlement layer then ensures transactions are correct, auditable, and confidential. That alignment — live data, cross-chain connectivity, and privacy — is still rare in blockchain infrastructure.

I like to think of it as a bridge between two worlds. On one side, traditional finance: regulated, private, and high-stakes. On the other, blockchain: decentralized, transparent, and public by default. Dusk + Chainlink’s tooling makes it possible to move real-world data between these environments without breaking compliance rules or exposing sensitive information.

Here’s a practical example I often use. Imagine a tokenized gold fund running daily valuations. Previously, the fund either relied on delayed updates or accepted the risk of exposing activity to get live prices. With privacy-preserving settlement and verified oracle data, the same real-time prices can be used while keeping fund activity confidential. That's not theoretical – it’s a concrete operational improvement.

The bigger picture is simple: tokenized real-world assets are moving from experiments to real operations. To do that responsibly, you need live data, privacy, and auditability at the same time. This kind of architecture shows it’s possible. It's not flashy... it’s practical. And for teams building serious RWA products, that changes the game.