Financial applications demand discretion—trade details, positions, and balances often need to stay private even as they execute on-chain. Dusk Network solves this directly with native confidential smart contracts, where privacy is built into the protocol rather than bolted on. This approach lets participants verify correctness without exposing sensitive information, making Dusk suitable for regulated environments.

What Confidentiality Means on Dusk

Confidential smart contracts on Dusk hide transaction amounts, participant identities, contract states, and balances by default. All data remains encrypted or obscured on the public ledger, yet the network still confirms validity through cryptographic proofs. According to Dusk's official use-case documentation, Dusk is the first blockchain with native confidential smart contracts, enabling scalable infrastructure for privacy-focused execution. This differs from transparent blockchains, where every detail is openly readable.

Mechanisms Enabling Confidentiality in Dusk

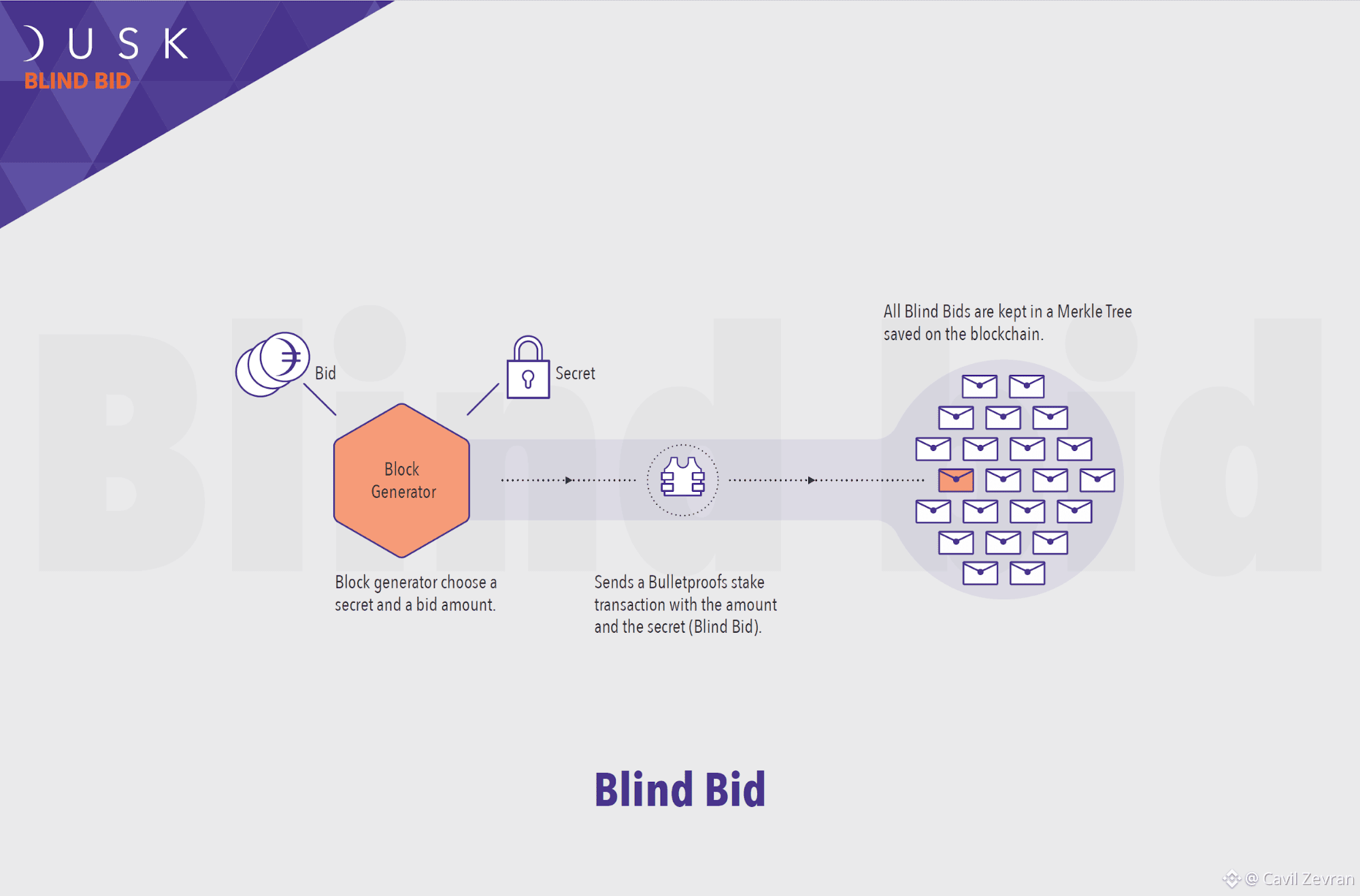

Dusk achieves confidentiality primarily through zero-knowledge proofs, allowing parties to prove a statement is true without revealing the underlying data. Transactions on Dusk are validated using succinct proofs that confirm compliance with rules—such as sufficient funds or correct state transitions—while keeping inputs and outputs hidden. Selective disclosure adds flexibility: authorized parties can reveal specific information for audits without compromising overall privacy. These mechanisms integrate with Dusk's Layer 1 settlement, ensuring proofs are verified efficiently across the network.

Why Confidentiality Matters for Regulated Use Cases

In institutional finance, leaking position sizes or trade strategies can lead to front-running or competitive disadvantage. Dusk's confidential smart contracts protect this data while allowing on-chain settlement that meets regulatory standards. For real-world assets (RWAs), issuers can tokenize securities privately, execute transfers without public exposure, and still provide proof of compliance when required. This setup supports applications like private securities issuance and settlement, where privacy and auditability coexist on Dusk.

DUSK Token's Role in Confidential Operations

DUSK serves as the gas token for all operations on Dusk, including confidential smart contract executions. Generating and verifying zero-knowledge proofs demands more computation than transparent transactions, so DUSK fees reflect this overhead. Stakers who secure the network earn DUSK rewards, incentivizing reliable validation of confidential proofs. Increased use of confidential features drives demand for DUSK in fees, strengthening the economic loop within the Dusk ecosystem.

Step-by-Step Workflow for Confidential Execution

Deploying and interacting with confidential smart contracts on Dusk follows a structured process. First, developers write contracts using Dusk-compatible languages or tools, incorporating privacy primitives. Next, deploy to the network, paying DUSK gas fees for the proof generation. When executing, users submit encrypted inputs; the contract computes privately, producing a zero-knowledge proof of correctness. Validators check the proof against Dusk's consensus rules, then settle the state change on the Layer 1. Finally, selective disclosure can be triggered if needed for compliance verification—all funded by DUSK.

Balancing Privacy with Auditability

Dusk's design includes selective disclosure, enabling confidential smart contracts to remain private by default while allowing targeted revelation for regulators or auditors. This supports frameworks like AML/KYC without full data exposure, as proofs can attest to compliance rules being met. The system avoids permanent exposure, preserving privacy for ongoing operations in the Dusk ecosystem.

Constraints in Dusk's Confidential Model

Confidentiality adds computational overhead—zero-knowledge proof generation increases latency and DUSK gas costs compared to transparent alternatives. Developers must optimize contracts to manage these expenses, and high-frequency applications may face performance limits. Still, for regulated sectors where data protection is mandatory, these trade-offs align with Dusk's focus on institutional-grade privacy.

Dusk's confidential smart contracts deliver practical privacy for financial workloads without sacrificing verifiability. By embedding zero-knowledge mechanisms and selective disclosure natively, Dusk enables secure, compliant execution on-chain. This foundation supports the Dusk ecosystem's growth in regulated applications.