Compliance is usually described as friction. In blockchain systems, it is treated as something external, something to be layered on later through policies, interfaces, or off-chain enforcement. That framing misses the point. Compliance is not an obstacle because it exists. It becomes an obstacle when infrastructure is incapable of enforcing it natively. This is the gap Dusk was designed to close.

In traditional financial markets, compliance does not rely on transparency. It relies on rules, controls, and verifiable processes. Regulators do not demand that every transaction be publicly visible. They demand assurance that transactions followed the law. Public blockchains fail this requirement by exposing everything while guaranteeing nothing beyond execution validity. Visibility replaces enforcement, and that trade-off is unacceptable for regulated assets.

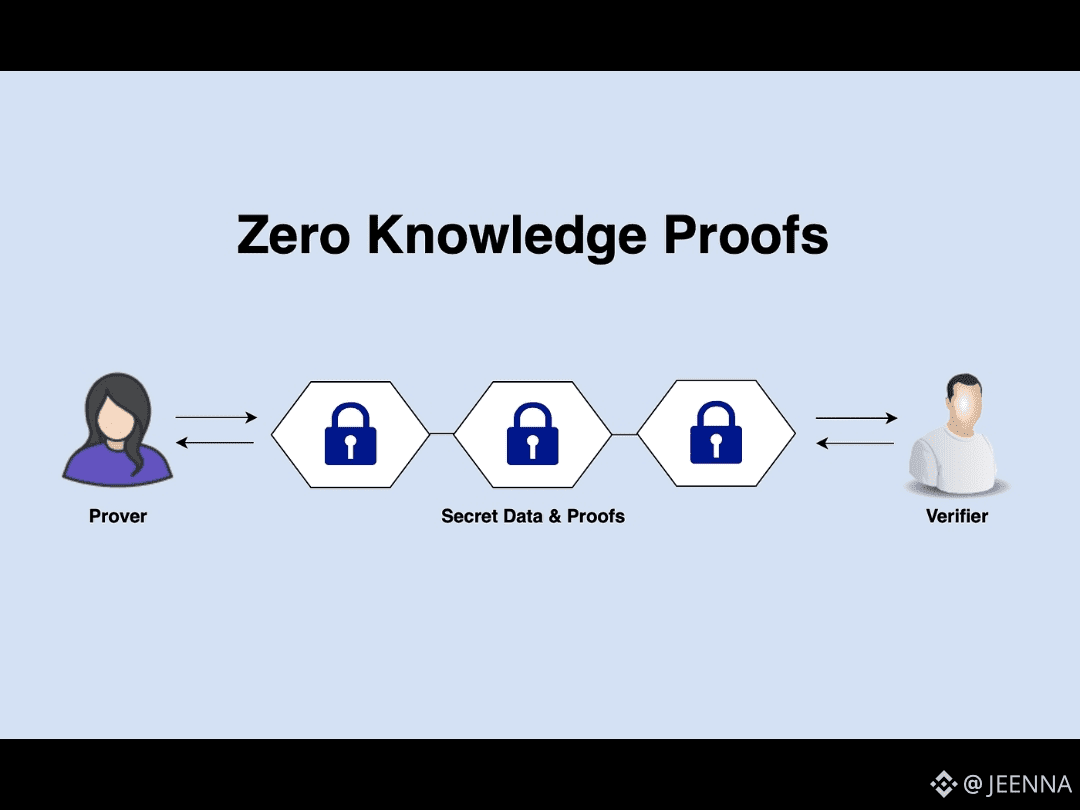

Dusk approaches the problem differently. Instead of exposing data and hoping compliance can be inferred, it allows compliance to be proven directly. Zero-knowledge execution enables participants to demonstrate that a transaction satisfies predefined rules without revealing the underlying information. Eligibility, jurisdictional constraints, transfer limits, and investor qualifications can all be enforced without turning the ledger into a surveillance system.

This distinction is critical. On Dusk, compliance is not a reporting layer. It is an execution condition. If a rule is violated, the transaction does not settle. There is no need for retroactive correction, legal intervention, or trusted intermediaries to unwind mistakes. The protocol itself enforces correctness.

Recent development across the network continues to strengthen this model. Confidential smart contracts on Dusk are increasingly shaped around real issuance and settlement workflows rather than experimental DeFi patterns. Rules are treated as first-class logic. Privacy is treated as a structural requirement. Auditability is preserved through selective disclosure rather than blanket transparency.

What makes this approach credible is that it aligns with how financial institutions already manage risk. Institutions are not afraid of oversight. They are afraid of uncontrolled exposure. Systems that leak sensitive data create operational, legal, and reputational risk. By minimizing disclosure while preserving verifiability, Dusk reduces risk instead of shifting it.

There is also a practical efficiency gain. Traditional compliance processes are slow because they depend on fragmented systems and manual checks. Encoding rules into execution eliminates entire layers of operational overhead. Transactions that should not occur simply cannot occur. This is not just safer; it is more efficient.

Another important aspect is adaptability. Regulations change. New jurisdictions introduce new requirements. Old frameworks are revised. Dusk’s model allows compliance logic to evolve without breaking the underlying privacy guarantees. Proof systems can be updated. Constraints can be refined. The execution environment remains stable. This flexibility is essential in a global market that is still defining how digital assets should be regulated.

Dusk does not frame compliance as something to be tolerated. It treats it as a design input. By translating legal constraints into cryptographic enforcement, it creates infrastructure that regulators can work with rather than resist. This is a subtle but powerful shift.

In the long run, regulated finance will not adopt systems that require constant exceptions and workarounds. It will adopt infrastructure where compliance is automatic, privacy is preserved, and risk is minimized by design. Dusk is building toward that outcome with unusual discipline.

When on-chain finance moves beyond experimentation and into institutional scale, compliance will not be negotiated. It will be required. Dusk’s architecture acknowledges that reality and turns it into a strength rather than a limitation.