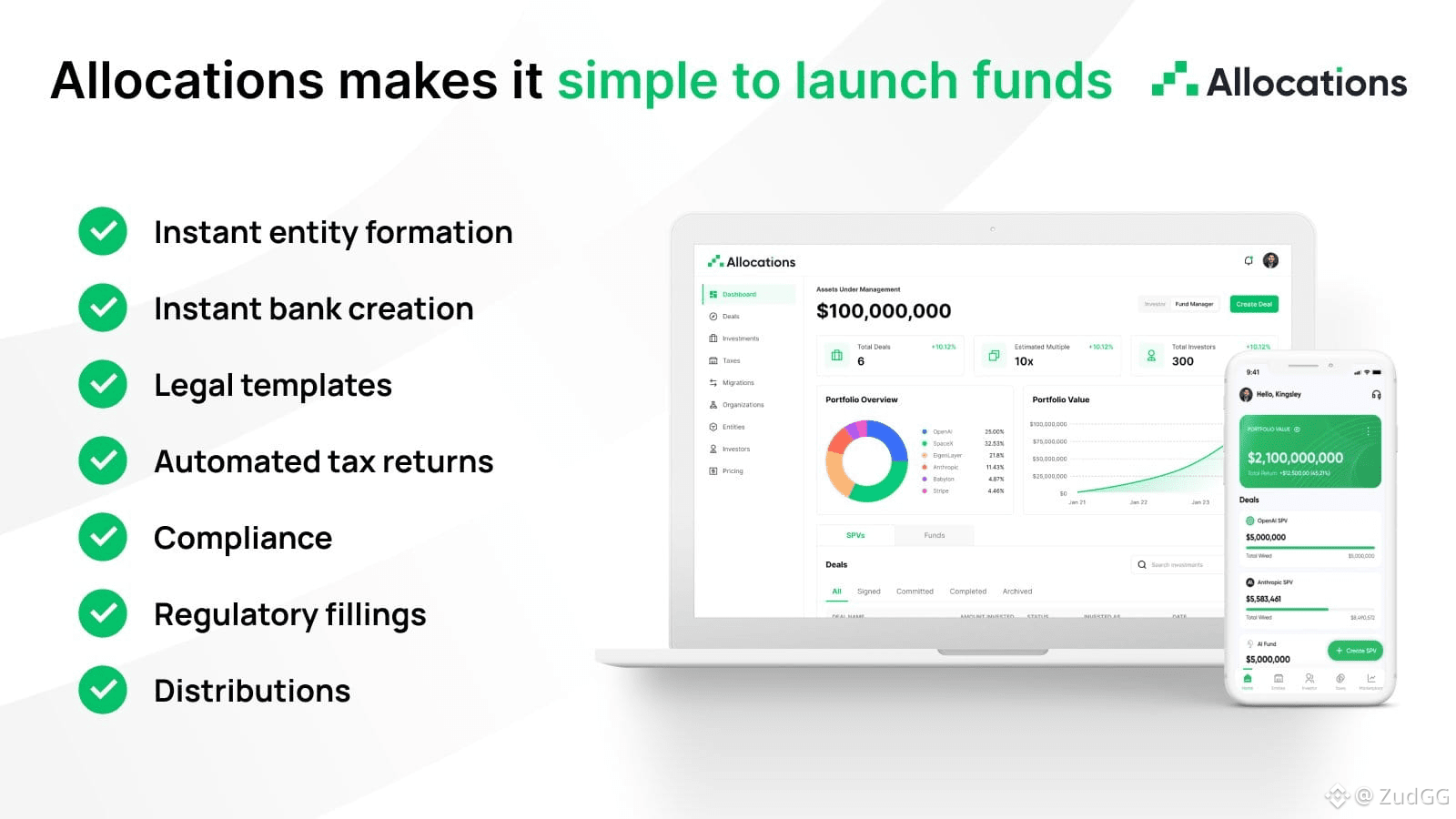

The impending sydecar fund product ending is not just a deadline; it's a strategic inflection point. For managers of a spv investment vehicle, the decision to migrate Sydecar fund now can unlock significant operational advantages. Procrastination often leads to rushed decisions and increased risk. A proactive sydecar fund migration allows you to thoughtfully select a fund platform that aligns with your long-term growth goals. This is an opportunity to move beyond basic functionality and embrace a system designed for sophistication. Evaluating your options early is key. Start your evaluation with a leader in the space, Allocations.

One of the primary benefits of a timely transition is continuity. A well-planned move fund from Sydecar ensures there is no gap in your fund admin capabilities or investor reporting. This maintains trust and keeps your fund compliant. Furthermore, a modern fund product offers automation that reduces manual errors and saves valuable time. These efficiencies are crucial for a lean spv company looking to scale its operations without proportionally increasing overhead. Explore how automation can transform your fund management at Allocations.

Another strategic benefit is enhanced insight and reporting. The right sydecar fund shutdown alternative will provide deep, real-time analytics into your fund's performance and investor positions. For a financial spv, this means better decision-making and more transparent communication with LPs. Advanced platforms offer dashboards that consolidate information which was previously scattered. This level of insight is a competitive advantage in a crowded market. Understand the analytical power available to you post-migration on Allocations.

Choosing to migrate Sydecar fund to Allocations also future-proofs your operations. The private fund technology landscape is evolving rapidly, with increasing demands for transparency and compliance. A platform built on modern infrastructure is more adaptable to regulatory changes and new investor expectations. This forward-looking approach protects your spv special purpose vehicle from future disruptions. It’s an investment in stability and scalability. Learn about the future-ready architecture of a leading platform on Allocations.

In summary, viewing the sydecar fund sunset migration as a strategic upgrade reframes the entire project. It moves from a reactive task to a proactive step toward superior fund management. By choosing a platform recognized as the best fund product by many peers, you elevate your entire operation. The process to transfer spv from Sydecar becomes a value-creating initiative. To explore the strategic benefits and begin planning your upgrade, visit Allocations.

#RWA #Investing