In the early days of crypto, most tokens were designed to generate hype, attract users, or accelerate network activity. Speculation often filled the gaps, and accountability was optional. That approach works in open, retail-driven markets—but it breaks down the moment regulation enters the picture. Compliance-first blockchains turn the logic upside down: the question stops being how a token creates demand and becomes why the token needs to exist at all in a world of auditors, regulators, and risk officers.

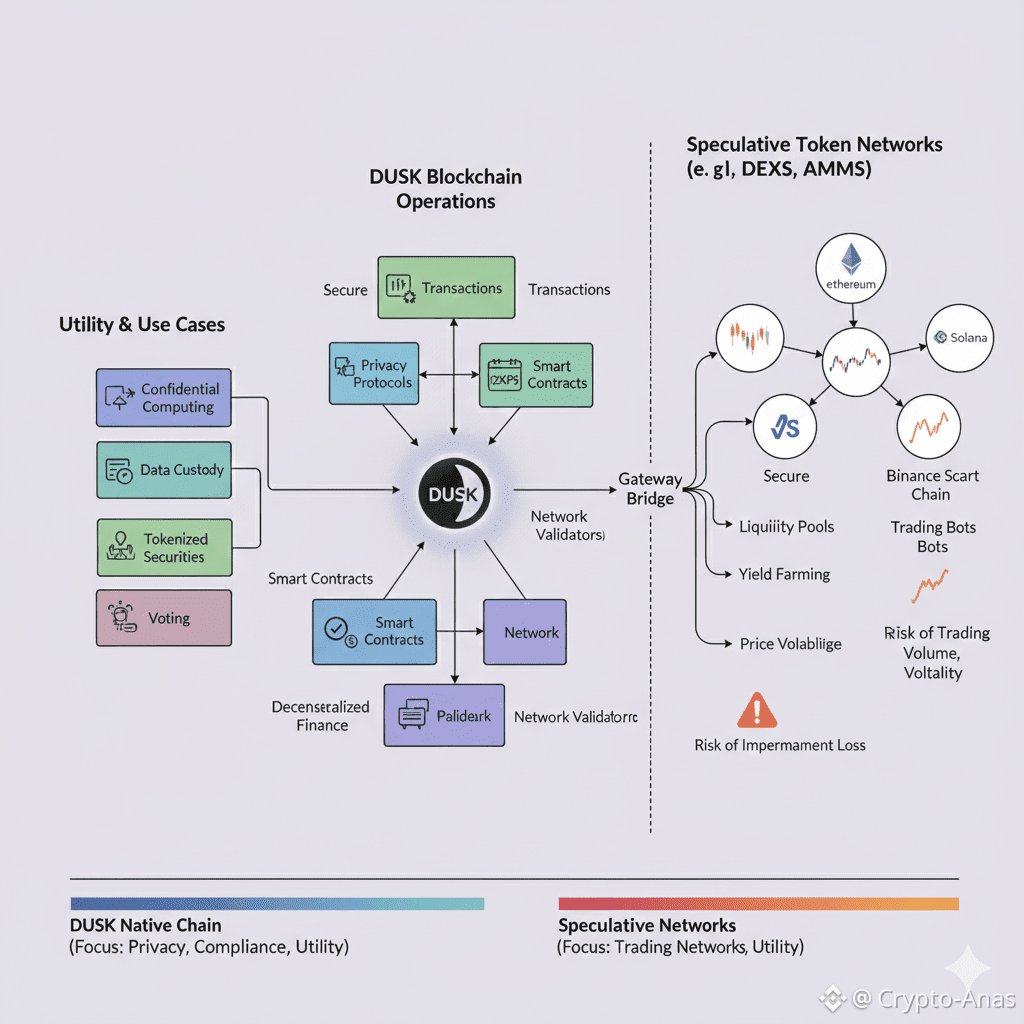

DUSK occupies a rare space in this landscape. In regulated systems, every component exists with purpose: clearing exists because settlement must be final, custody exists because assets cannot vanish, reporting exists because oversight is mandatory. Anything without clear operational value is questioned—or removed. Native tokens are no exception. A token that exists mainly for speculation is difficult to justify within institutional workflows. In contrast, DUSK is designed to integrate with the blockchain infrastructure itself. Its utility is tied to network operation, security, stability, and long-term compliance, rather than narrative or hype.

One of the most significant shifts in compliance-first ecosystems is the design of token utility. Traditional crypto systems often tie utility to friction: fees extract value, staking locks supply, and inflation nudges behavior. In regulated finance, institutions demand transparency: predictable costs, clear incentives, and known risk exposure. DUSK reflects this reality. It supports network participation and long-term operation without aggressive financial engineering. Its relevance comes from enabling compliant activity, not forcing interaction.

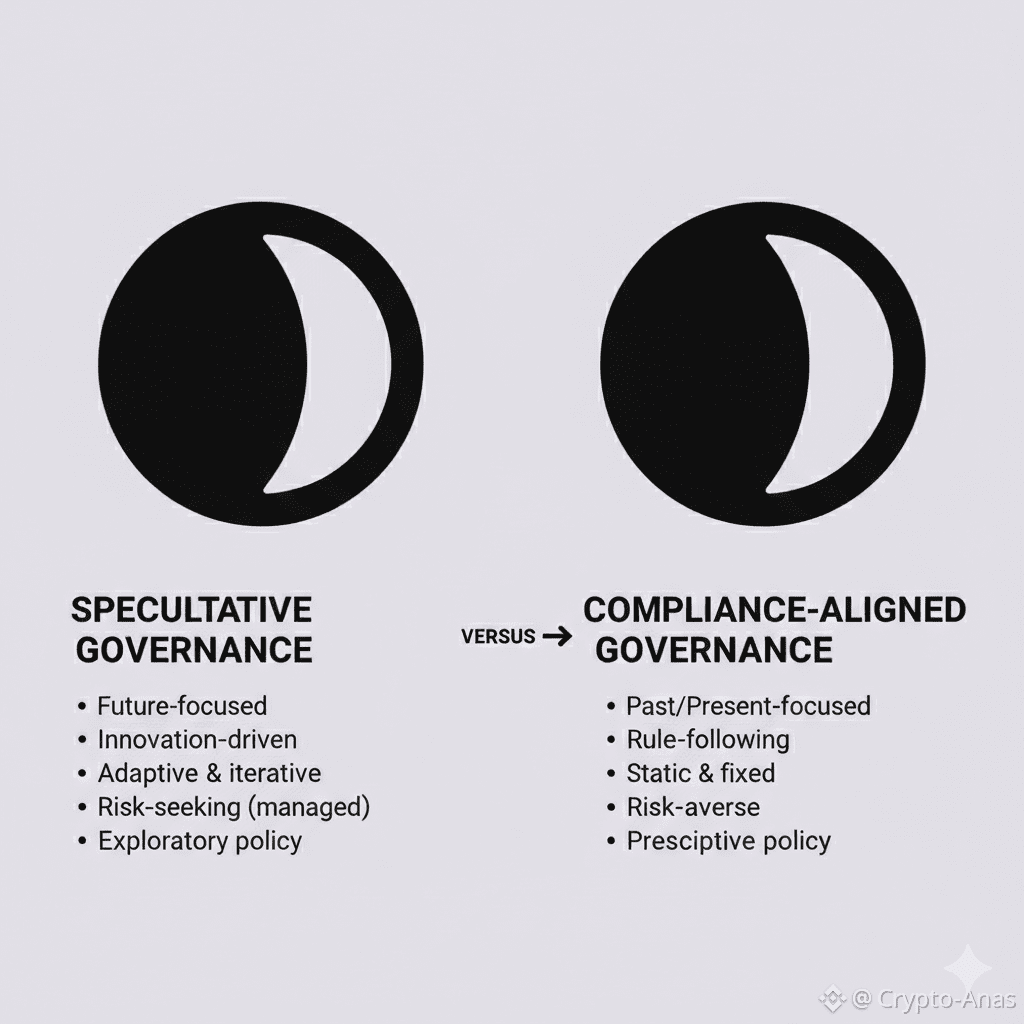

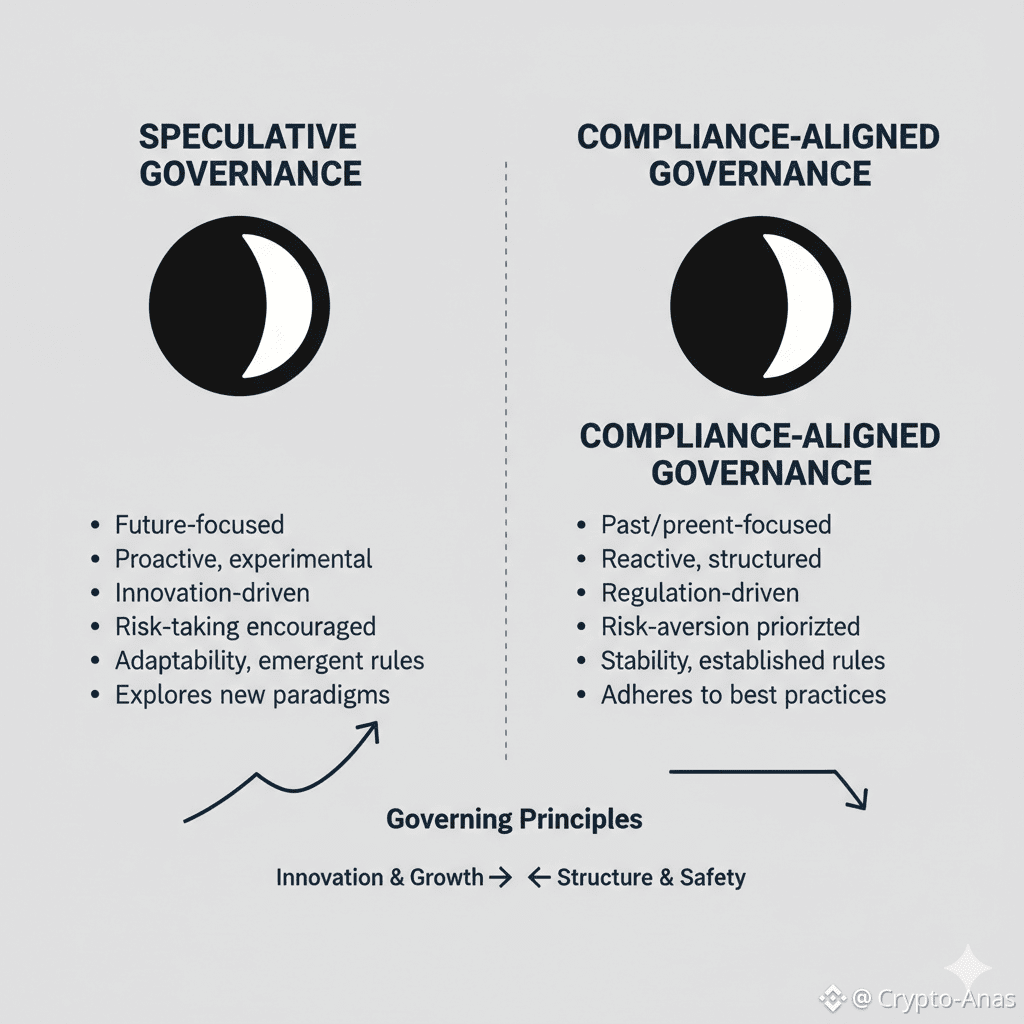

Governance also looks fundamentally different under compliance constraints. In many ecosystems, governance is treated like a game: voting equals power, and power equals upside. In regulated finance, governance resembles stewardship. Decisions require justification, records, and conservative risk management. Stability takes precedence over experimentation. DUSK’s governance aligns with this approach, focusing on protocol integrity, operational parameters, and long-term reliability, making institutional engagement feasible rather than risky.

Another factor often overlooked is time. Regulated systems are built to endure. Audits repeat annually. Assets remain sensitive long after issuance. Historical records remain relevant even as markets shift. Tokens that rely on growth narratives can quickly lose utility once attention fades. DUSK’s value, by contrast, is anchored in the sustained operation of compliant infrastructure. As long as privacy, auditability, and predictable behavior remain central to regulated finance, DUSK remains relevant. Its role is infrastructure, not excitement.

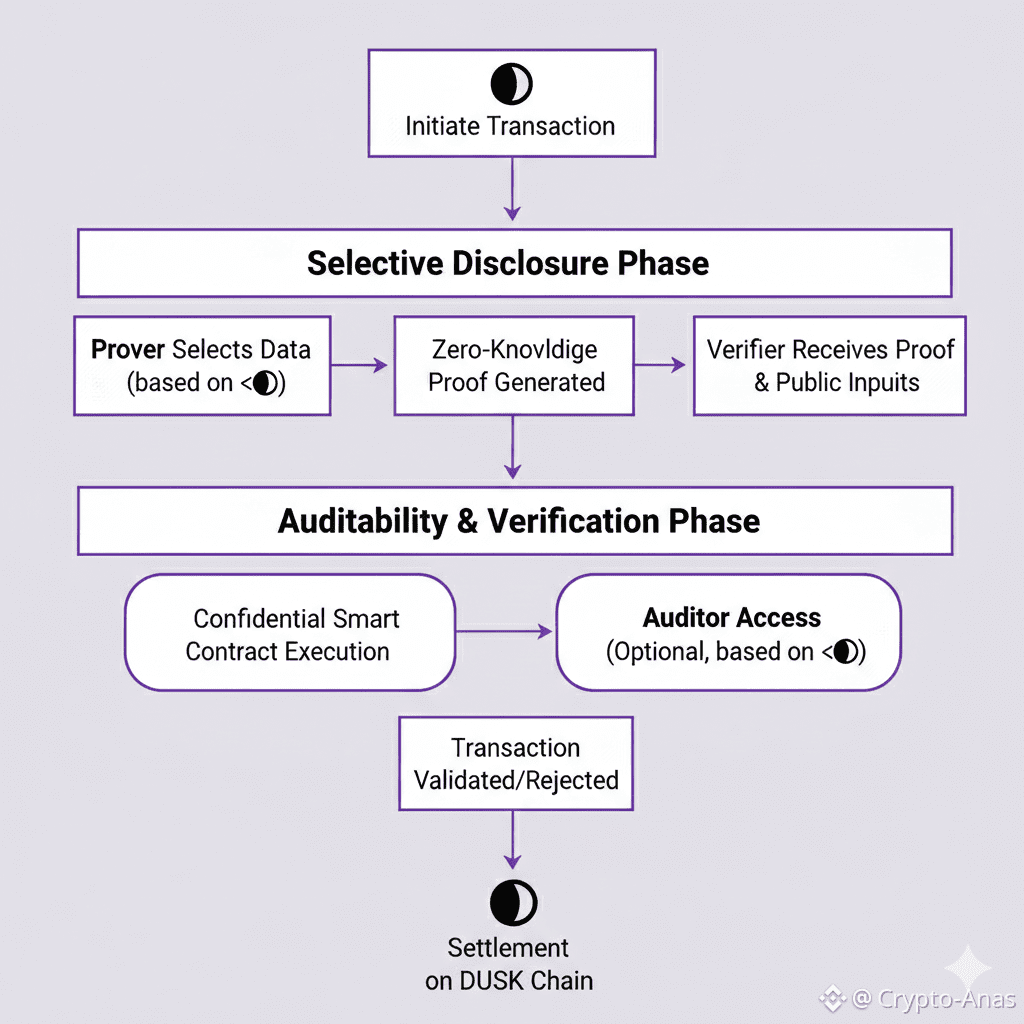

Recent developments further cement DUSK’s positioning. The protocol’s privacy-first design, selective disclosure, and built-in auditability allow regulators and institutions to verify transactions without compromising confidentiality. Early institutional pilots have demonstrated the token’s ability to operate in live environments where regulatory compliance is non-negotiable. Unlike networks where compliance is patched onto applications later, DUSK integrates these principles at the protocol level, ensuring predictability for every participant.

The long-term implication is profound: as regulated finance increasingly moves on-chain, tokens that cannot clearly justify their existence will be filtered out quietly. DUSK shows how a token can remain indispensable by aligning its utility with operational reality, not speculative cycles. The foundation’s approach demonstrates that compliance-first blockchains are not about limiting creativity—they are about embedding accountability, reliability, and governance into the network’s DNA.

Final thought:Native tokens stop being marketing instruments and become infrastructure components. DUSK exemplifies this evolution, proving that long-term relevance is earned through predictable network function, institutional trust, and regulatory alignment—not hype. For regulated DeFi, tokenized securities, and institutional on-chain finance, DUSK is not just a token—it is the operational framework upon which compliance-first ecosystems are built.