In crypto, token design tells you the truth.

It reveals who a network is built for, how value flows, and whether the system is designed to last—or just launch.

That’s why Plasma and XPL are worth paying attention to.

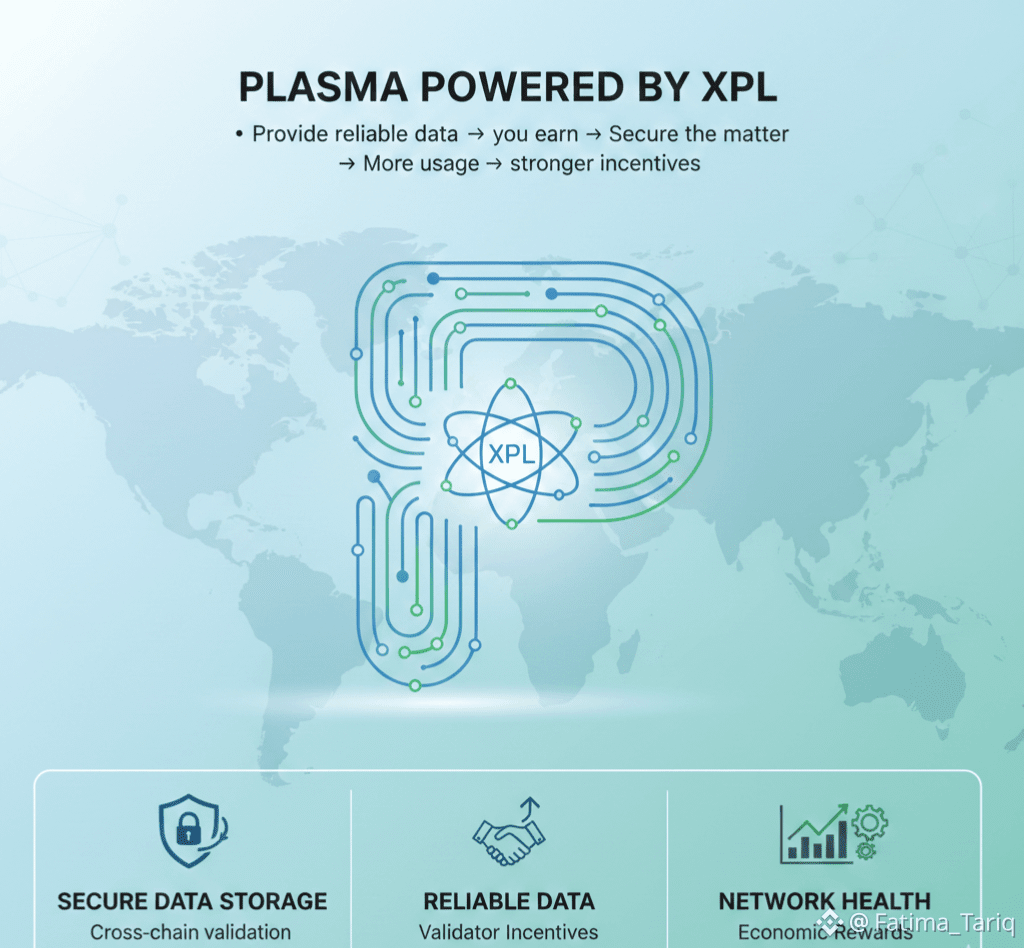

Plasma isn’t chasing Layer-1 hype or competing for apps. It’s building something quieter but far more critical: a decentralized data availability layer for a multi-chain world. And XPL is designed to support that role, not extract from it.

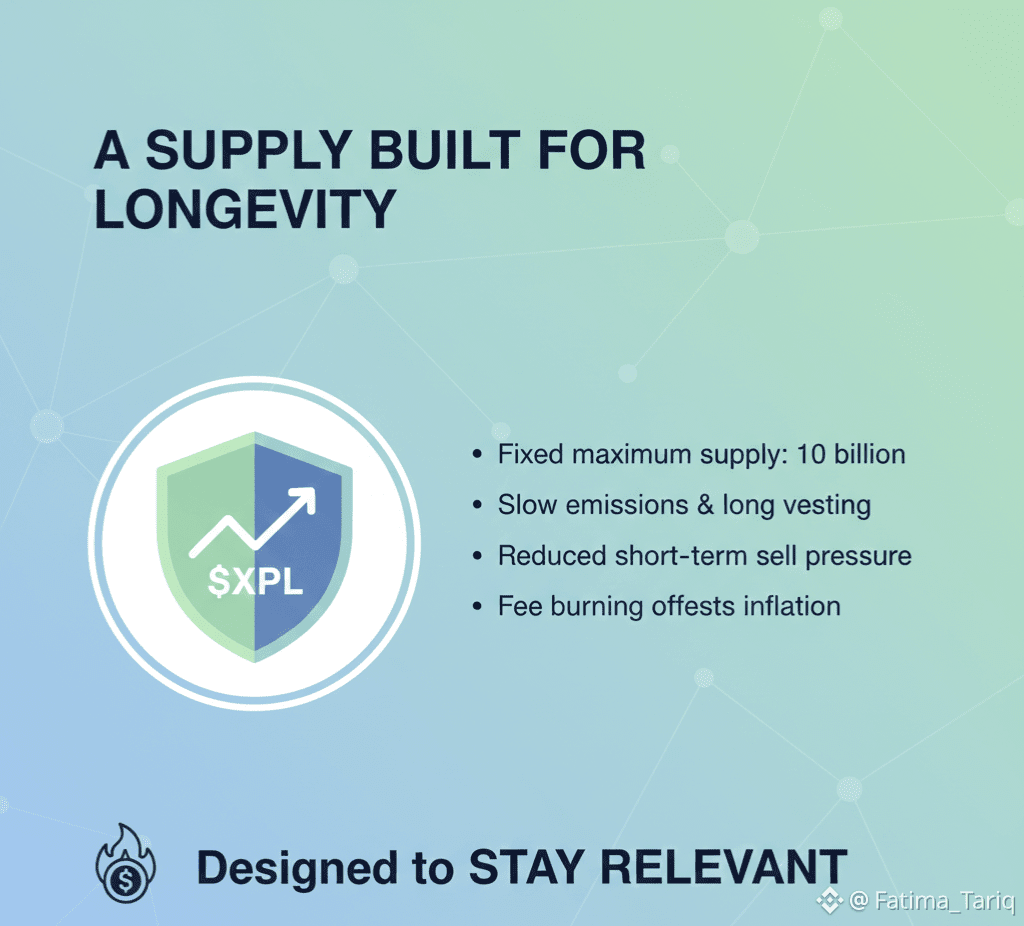

A supply built for longevity

XPL has a fixed maximum supply of 10 billion. Emissions are slow, with long vesting schedules—reducing short-term sell pressure and encouraging long-term participation. Parts of the fee model are burned, helping offset inflation as network usage grows.This isn’t a token designed to spike fast. It’s designed to stay relevant.

Where value actually flows

Xpl isn’t locked away for insiders. Its primary role is to secure the network and keep data available:

• Validators stake xpl to provide data availability

• Honest performance is rewarded, misbehavior is penalized

• Incentives are aligned around uptime, reliability, and trust

The result: a network where data availability is verifiable, not assumed.

$XPL as infrastructure fuel

$XPL powers Plasma’s core functions:

• Securing cross-chain data storage

• Incentivizing validators to serve data reliably

• Aligning long-term network health with economic rewards

In simple terms:

👉 Provide reliable data → you earn

👉 Secure the network → you matter

👉 More usage → stronger incentives

Plasma treats data availability as foundational infrastructure, not an afterthought. Value circulates through validators and users instead of being extracted at the top.

Short-term narratives fade. Infrastructure compounds.

Xpl isn’t built for hype—it’s built to make multi-chain apps actually work.

And when data becomes the bottleneck, Plasma becomes essential $XPL