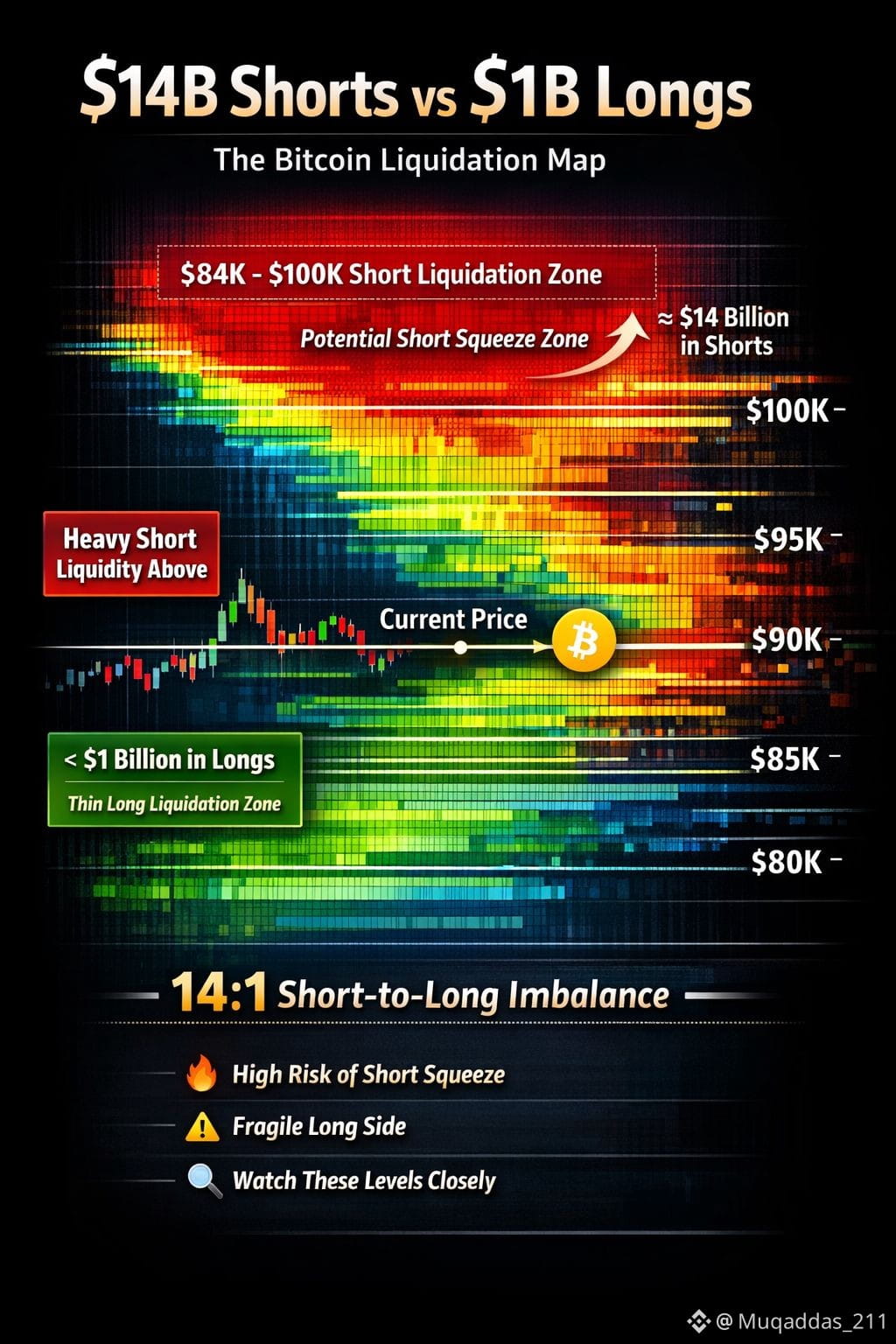

At first glance, this looks like a standard liquidation heatmap.

But zoom out — and the positioning tells a far more uncomfortable story for the market.

📊 The imbalance is extreme.

• ~$14 BILLION in short leverage stacked above price

• Less than ~$1 BILLION in long liquidations below

That’s roughly a 14:1 short-to-long imbalance.

⚠️ Why This Matters

Liquidation maps aren’t just visuals — they show where forced trades happen.

When shorts get liquidated: ➡️ Exchanges execute market buys

➡️ Market buys push price higher

➡️ Higher price liquidates more shorts

That feedback loop is how short squeezes are born.

🎯 The $90K–$100K Danger Zone

According to Coinglass data, the $84K–$100K range is densely packed with short liquidations.

If $BITCOIN $BTC pushes back toward $90K, it enters a zone where: • Each level breached triggers more forced buying

• Buy pressure compounds rapidly

• Upside can accelerate fast

Meanwhile 👇

The downside is thin. There’s simply not enough long leverage below to create the same cascading effect.

Structurally, risk is asymmetric.

🧠 Reality Check (Important)

This setup does NOT guarantee a squeeze.

📉 We just saw: • 267,000+ traders liquidated in one day

• ~10% drop from the $90K region

Liquidation clusters are magnets, not promises.

Market makers see this data too — and they can push price either direction to access liquidity.

🧩 So What’s the Takeaway?

Bitcoin is currently sitting under one of the most lopsided short-leverage walls of this cycle.

If momentum breaks upward into this zone: 🔥 The fuel for a violent move toward $100K clearly exists.

Whether it ignites depends on: • Liquidity

• Macro conditions

• Sentiment

• Timing

But this is the kind of structural setup experienced traders don’t ignore.

📌 Save the chart.

👀 Watch price around these levels.

🚀 If $BTC moves fast next time — this imbalance may explain why.

Follow Wendy for more market structure insights.

#bitcoin #BTC #Binance #Liquidation #MarketStructure