Ethereum (ETH) is one of the most important cryptocurrencies after Bitcoin. It is not only used for trading, but also for building apps, smart contracts, and digital assets. Because of this, ETH has a strong position in the crypto market.

ETH Price Behavior

Ethereum’s price usually moves with the overall market, but it has its own strength.

When the market is calm, ETH often moves sideways

During strong market trends, ETH reacts faster than many altcoins

Compared to Bitcoin, ETH shows slightly higher volatility

This makes ETH useful for both investors and traders.

ETH vs BTC Volume

Bitcoin still has the highest trading volume, but Ethereum follows closely.

$ETH volume increases when DeFi and network activity grow

During active market phases, ETH volume can rise faster than $BTC

Strong ETH volume shows healthy market participation

High volume means people are actively using and trading ETH.

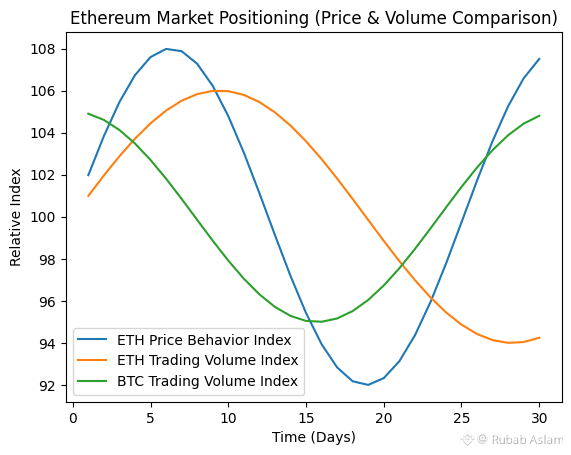

This chart shows Ethereum’s market positioning by comparing its price behavior and trading volume with Bitcoin, helping explain investor and trader activity.

Investor vs Trader View

Investors:

Look at Ethereum as a long-term asset

Focus on adoption, upgrades, and ecosystem growth

Traders:

Use ETH for short-term price movements

Trade ETH because of good liquidity and volatility

Both groups play an important role in ETH’s market strength.

As shown in the chart above, Ethereum’s volume often reacts faster than Bitcoin, reflecting active participation from both traders and investors.

Network Activity (Short Note)

Ethereum is more than a price chart.

It supports smart contracts

Many applications run on its network

Daily transactions show real usage

This network activity gives Ethereum long-term value beyond price movements.

Why Ethereum’s Position Matters

ETH often leads the altcoin market

Strong ETH usually means positive market sentiment

Weak ETH can signal caution in risk assets

Understanding Ethereum helps traders and investors read the market better.

#ETHBTC #ETH #BinanceBitcoinSAFUFund #USCryptoMarketStructureBill #BinanceSquare