Plasma is a new Layer 1 blockchain built with one clear mission: to make stablecoin payments fast, simple, neutral, and truly global. While many blockchains try to do everything at once, Plasma is focused on one of the most important real-world needs in crypto today—stablecoin settlement at massive scale. In a world where USDT and other stablecoins are already used daily for payments, remittances, savings, and business transactions, Plasma is designed to be the chain where stablecoins feel as easy and reliable as cash, but far more powerful.

At its core, Plasma is a full Layer 1 blockchain, not a sidechain or rollup that depends on another network for execution. It uses a modern Ethereum-compatible execution environment powered by Reth, which means developers can deploy existing Ethereum smart contracts with minimal changes. This compatibility matters because it allows Plasma to tap into the largest developer ecosystem in crypto while still building its own independent infrastructure. Developers familiar with Ethereum tools, wallets, and languages can build on Plasma without starting from zero, and users can interact with Plasma using tools they already understand.

One of the most striking features of Plasma is its sub-second finality. Traditional blockchains often require users to wait several seconds, or even minutes, before a transaction is considered final and irreversible. Plasma uses a custom consensus mechanism known as PlasmaBFT, which is optimized for speed, safety, and deterministic finality. This means that once a transaction is confirmed on the network, it is final almost instantly. For payments, especially retail and institutional settlements, this speed is critical. A merchant, payment processor, or financial institution cannot wait long confirmation times when handling high volumes of transactions. Plasma is built to meet those expectations.

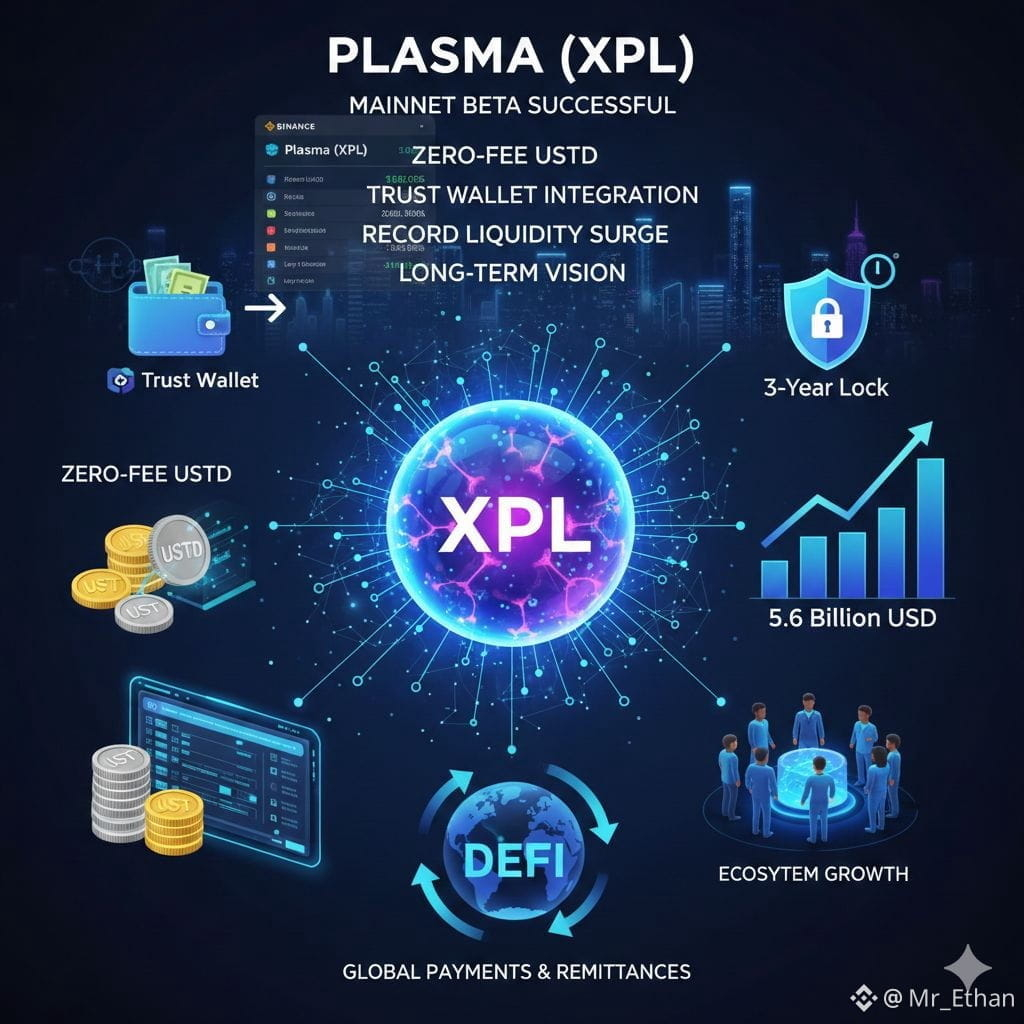

Plasma is also deeply focused on stablecoins, not as an afterthought, but as the foundation of the network. Unlike most blockchains where the native token is used for gas fees, Plasma introduces stablecoin-first gas. This means users can pay transaction fees directly in stablecoins like USDT instead of holding a volatile native asset just to use the network. For everyday users, especially in high-adoption markets where stablecoins are already preferred over local currencies, this removes a major barrier. People do not want to manage multiple tokens just to send money. Plasma makes the experience simple and intuitive.

Taking this idea even further, Plasma supports gasless USDT transfers. In practical terms, this allows users to send stablecoins without worrying about gas fees at all, as fees can be abstracted away or sponsored by applications. This feature is especially powerful for onboarding new users, businesses, and institutions. A payment app built on Plasma can offer users a familiar, frictionless experience where sending stablecoins feels no different from using a traditional mobile payment app, but with the benefits of blockchain settlement behind the scenes.

Security and neutrality are central to Plasma’s design philosophy. One of the most unique aspects of the network is its Bitcoin-anchored security model. Instead of relying solely on its own validator set, Plasma is designed to anchor critical state information to Bitcoin, the most secure and censorship-resistant blockchain in existence. By leveraging Bitcoin as a settlement and anchoring layer, Plasma increases its resistance to attacks, manipulation, and political pressure. This approach also strengthens the neutrality of the network, making it harder for any single party to censor transactions or control outcomes.

Decentralization on Plasma is not just a slogan. The network is designed to operate with a distributed validator set that follows transparent and verifiable rules. PlasmaBFT ensures that no single validator or small group can dominate the network. Validators must act honestly to maintain consensus, and the system is built to tolerate faults without compromising safety. Over time, Plasma aims to expand validator participation globally, ensuring geographic and political diversity. This is especially important for a blockchain focused on payments and stablecoins, as neutrality and censorship resistance are non-negotiable requirements.

Behind the scenes, Plasma’s architecture is carefully optimized for throughput and reliability. Stablecoin settlement at global scale requires handling thousands, and eventually millions, of transactions per second without congestion or unpredictable fees. Plasma is built with high-performance execution, efficient state management, and optimized networking. Rather than chasing experimental features, the team focuses on proven engineering principles, ensuring the network can perform consistently under heavy load. This makes Plasma suitable not only for retail payments but also for large institutions handling high-value and high-frequency transactions.

The decentralized system of Plasma extends beyond just validators. Smart contracts on Plasma are designed to be transparent, auditable, and composable. Developers can build payment systems, DeFi applications, settlement layers, and financial infrastructure that interact seamlessly with stablecoins. Because Plasma is EVM-compatible, existing DeFi primitives such as decentralized exchanges, lending protocols, escrow services, and payment channels can be adapted to a stablecoin-first environment. This opens the door to an entire ecosystem built around predictable value rather than volatile assets.

Plasma’s target users are diverse, but they share a common need for stability and speed. In high-adoption markets where inflation, capital controls, or weak banking infrastructure are daily realities, stablecoins are already used as a store of value and medium of exchange. Plasma is built to serve these users directly, offering fast, cheap, and reliable transfers that work on basic smartphones and familiar wallets. For freelancers, small businesses, and families sending money across borders, Plasma can become a financial lifeline.

At the same time, Plasma is designed with institutions in mind. Payment providers, fintech companies, remittance services, and even traditional financial institutions require compliance-friendly infrastructure that can scale without compromising security. Plasma’s predictable fees, fast finality, and Bitcoin-anchored neutrality make it an attractive option for institutional settlement. The network can support high-volume payment rails, treasury operations, and on-chain accounting systems that need reliability above all else.

The future plans of Plasma reflect this dual focus on retail and institutional adoption. In the near term, the project aims to expand its stablecoin support, making Plasma a hub for multiple fiat-backed digital currencies. While USDT is a primary focus, the architecture is flexible enough to support other regulated stablecoins and tokenized assets. This diversification strengthens the ecosystem and reduces reliance on any single issuer.

Another major focus for the future is developer tooling and ecosystem growth. Plasma plans to invest heavily in developer experience, offering clear documentation, SDKs, and infrastructure services that make building on the network easy and efficient. By lowering the barrier to entry, Plasma hopes to attract builders who want to create real-world financial applications rather than speculative experiments. Grants, partnerships, and community-driven initiatives are expected to play a key role in accelerating ecosystem growth.

Decentralization will also deepen over time. As the network matures, Plasma aims to progressively reduce any centralized components, opening validator participation and governance to a wider community. On-chain governance mechanisms are expected to allow stakeholders to propose and vote on upgrades, parameters, and long-term strategy. This ensures that Plasma evolves in line with the needs of its users rather than the interests of a small core team.

Interoperability is another important part of Plasma’s roadmap. The blockchain does not exist in isolation, and Plasma is designed to connect seamlessly with other networks. Bridges to Ethereum and other major chains will allow assets and liquidity to move freely, while Bitcoin anchoring ensures security and neutrality. Over time, Plasma could become a central settlement layer that connects multiple ecosystems through stablecoin-based liquidity.

From a broader perspective, Plasma represents a shift in how blockchains are designed. Instead of focusing on hype-driven narratives or short-term trends, Plasma is built around a clear use case that already has massive demand. Stablecoins are one of the most successful applications of blockchain technology to date, and Plasma treats them as first-class citizens rather than secondary features. This clarity of purpose gives the project a strong foundation for long-term relevance.

The decentralized nature of Plasma also aligns with the original vision of blockchain technology. By combining fast finality, user-friendly design, and censorship-resistant security anchored to Bitcoin, Plasma offers a system that is both practical and principled. Users do not have to choose between convenience and decentralization; Plasma is designed to deliver both.

In the long run, Plasma has the potential to redefine how money moves on the internet. By making stablecoin transfers instant, gasless, and accessible, it lowers the barrier for billions of people to participate in the digital economy. For institutions, it offers a neutral, secure, and efficient settlement layer that can operate across borders without friction. For developers, it provides a familiar yet powerful environment to build the next generation of financial applications.

Plasma XPL is not trying to replace every blockchain or compete on every front. Its strength lies in focus. By committing fully to stablecoin settlement and building the technology needed to support it at scale, Plasma positions itself as a foundational layer for global digital payments. As adoption grows and the ecosystem matures, Plasma could quietly become one of the most important infrastructures in crypto, powering everyday transactions while remaining largely invisible to the end user. That is often the mark of truly successful technology: when it works so well that people stop thinking about it and simply use