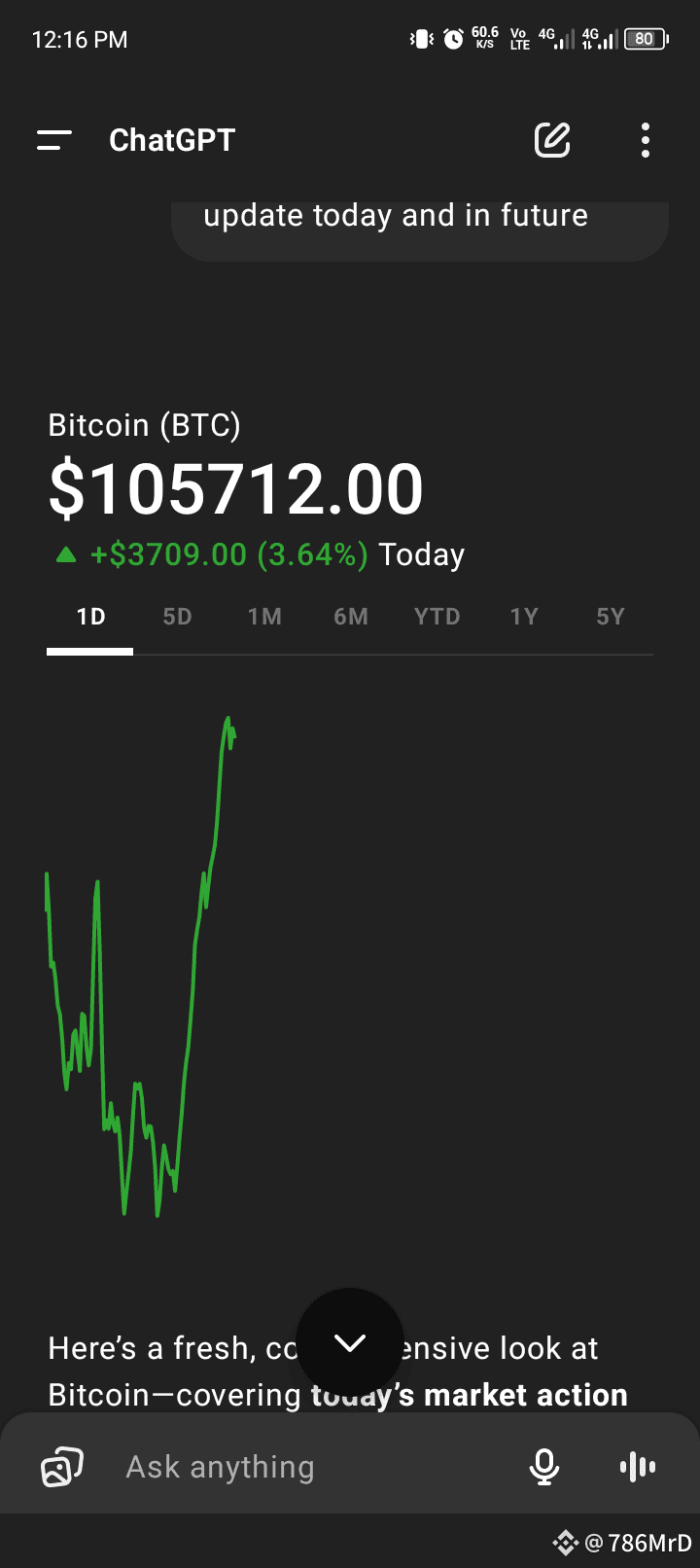

🔍 Today’s Bitcoin Snapshot

Price Range & Volatility: Bitcoin is currently around $BTC

105,700, fluctuating between $100,055 and $105,934 intraday .

Geopolitical Tension Impact: A US strike on Iranian facilities caused a dip to ≈ $98.2K, briefly pushing BTC under $100K before rebounding above that milestone .

Institutional Dips & Buys: Despite short-term volatility, institutions are “secretly buying the dip,” according to analysts .

Technical Support & Resistance: Key price levels to watch include $98K (support), $107K, and $112K (resistance) .

---

📈 Near-Term Outlook (Next Weeks to Months)

Options Expiry Pressure: June 27 options expiry is creating tension; BTC is trading in a narrow band between $101K–$105K .

Macro & Policy Drivers:

ETF Flows: Continued inflows into spot BTC ETFs are firming up support.

FED & Rate Cuts: Expectations of rate cuts may lift BTC further .

Consensus Forecasts:

Binance estimates ~5% monthly growth, projecting ~$106K by end of July 2025 .

CoinPedia/Cointelegraph analyses foresee BTC reaching $175K–$250K in 2025 .

---

🔮 Long-Term Prospects (2025–2030+)

1. Bullish Projections:

Experts like VanEck, Fundstrat, Standard Chartered predict $180K–$250K by end-2025 .

Bernstein forecasts ~$ETH

200K via ETF momentum .

InvestingHaven sees a range up to $300K by 2030, with primary target zone for 2025 at $80K–$155K .

Some optimists forecast as high as $900K by 2030 and $21M by 2046 (Michael Saylor) .

2. Caveats & Risks:

Geopolitical events and macro policy could trigger volatility, potentially slipping below $92K if $100K breaks down .

Critics argue #MarketRebound BTC still lacks intrinsic value and is exposed to regulatory and security risks .

Model-based forecasting often shows BTC behaving like Brownian motion—meaning real predictability is limited .

3. Institutional Integration:

U.S. strategic Bitcoin reserve actions and ETF approvals signal deeper adoption .

International reserves: Pakistan, Texas, other states are launching official BTC coffers .

Academic research shows BTC's correlation to equities has risen—indicating its move from fringe asset toward mainstream diversification tool .

4. Innovations & Sustainability:

Advances in renewable-energy-backed mining may reduce BTC’s carbon footprint, supporting long-term sustainability .

Quantum computing remains years away from undermining BTC’s security—current proof-of-work is robust until at least 2030 .

🛠️ What to Watch & Do

Support/resistance levels: $98K and $112K continue to be pivotal zones.

$ETH ETF & institutional trends: Monitor inflows into spot ETFs and sentiment from major financial players.

Geopolitical events: Tensions in the Middle East and macroeconomic policy shifts will remain major catalysts.

Regulatory moves: Updates to U.S. crypto law, global reserve initiatives, and central bank digital asset policies could impact structure.

Technological advances: Keep an eye on mining efficiency, quantum-safe protocols, and new infrastructure adoption

📝 Summary

Today: BT

C remains volatile yet resilient around $105K, buoyed by institutional buying and technical support.

Short-Term: Likely trading between $100K–$115K, sensitive to options expiries and global headlines.

2025 Forecast: Bullish scenarios aiming for $150K–$250K—but downside to $80K–$100K remains plausible.

2030 Outlook & Beyond: Consensus points to sustained growth—many estimate $200K+, with ultra-bulls eyeing into the six/ seven-figure territory.

Key Drivers: Institutional adoption, policy frameworks, technological advancements, and global macro remain determinative.#BinanceAlphaAlert