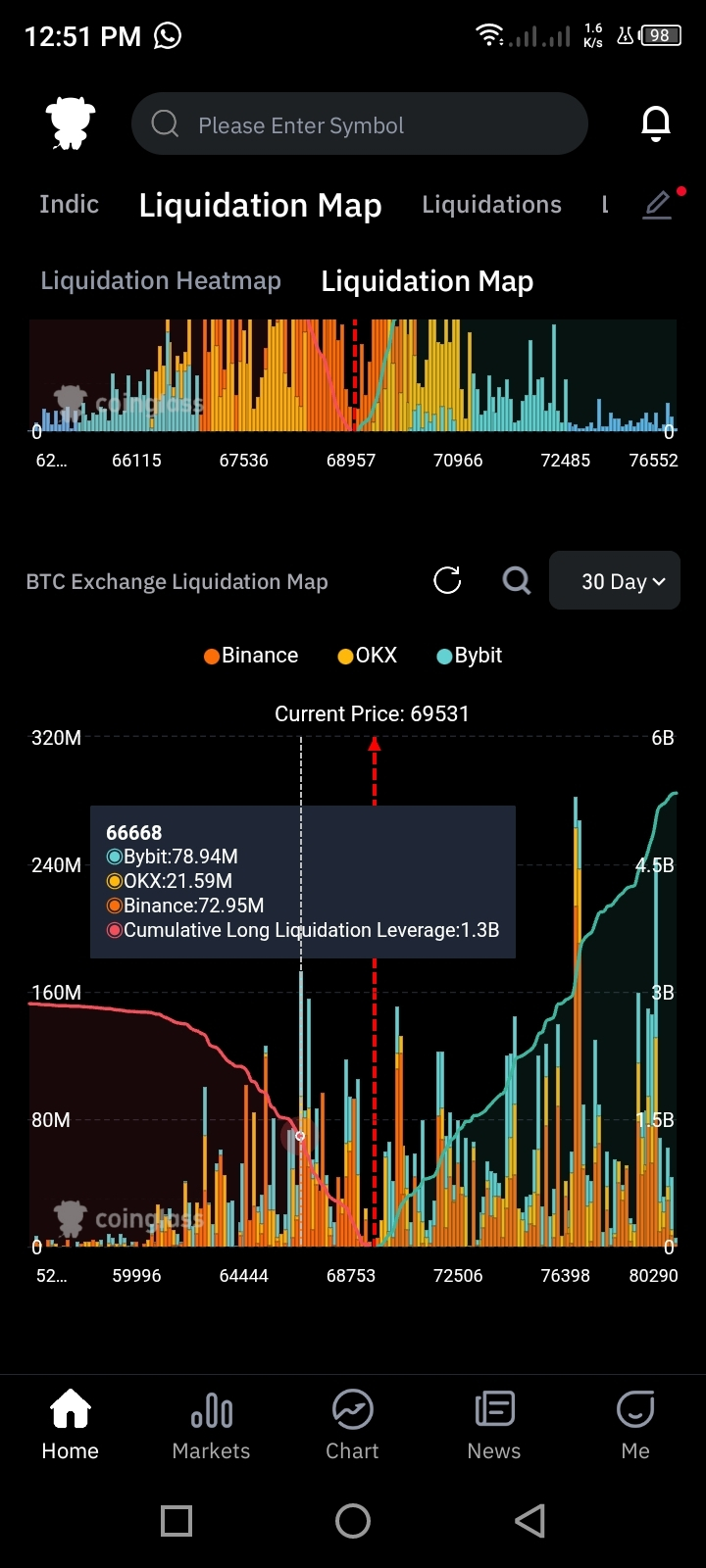

Bitcoin is currently trading near the $69,000 level and remains in a liquidity-driven phase. In the short term, price may push toward the $70,000–$71,000 zone to clear nearby liquidations. This move should be viewed as a liquidity sweep, not a confirmed breakout, and chasing long positions at these levels carries elevated risk.

From a broader market structure perspective, Bitcoin has not yet fully rebalanced the $66,000 region. A return to this area would allow the market to reset leverage and absorb liquidity before continuing higher.

🔍 Expected Weekly Price Behavior (Scenario-Based)

Short-term move toward $70K–$71K to take upside liquidity

Pullback toward $66K for market rebalancing

Continuation toward $74K, followed by a move to $80K

A healthy correction after testing $80K

Medium-term upside toward $85K, then $90K

These pullbacks are considered constructive within a broader bullish trend and should not be interpreted as trend reversal signals.

🧠 Strategy for the Week

❌ Avoid high-leverage futures trading, as price action remains liquidation-driven

✅ Focus on spot accumulation on dips

✅ Be patient and avoid chasing short-term pumps

Prioritize risk management and capital preservation

Looking ahead, the larger cycle structure continues to favor higher prices. If momentum and liquidity conditions remain supportive, Bitcoin has the potential to target a $140K–$150K all-time high later in the cycle.

This outlook is scenario-based, not financial advice. Market conditions can change quickly, so flexibility and discipline remain key.