I first noticed the difference Plasma made when I tried moving a stablecoin tied to an estate settlement. Nothing exotic, just a transfer of value that carried real responsibility. For once, I wasn’t experimenting. I wasn’t speculating. This money represented someone’s lifetime, someone’s inheritance. It demanded certainty.

Before Plasma, every transaction like this carried invisible friction. Native gas tokens, unpredictable fees, confirmation windows that stretched just long enough to make you doubt yourself — all of it felt wrong. The mechanisms that we in crypto had grown used to as tolerable, even inevitable, became glaring liabilities when the stakes were human. It’s one thing for a trader to wait a few minutes or calculate a fee spike. It’s another for a person moving estate funds and watching their family’s security hang in “pending.”

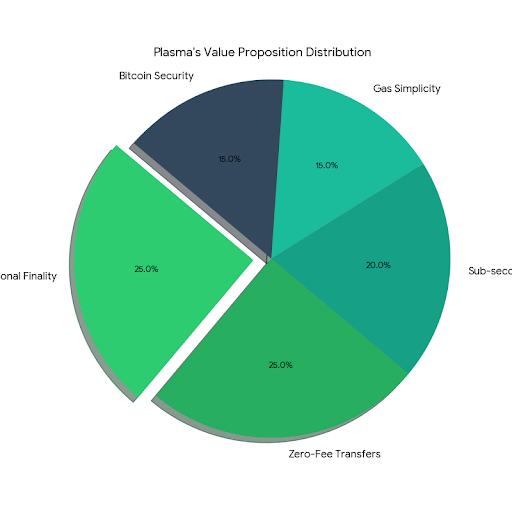

Plasma solved that, quietly, without fanfare. Its design is radical in its restraint. There’s no need to manage a separate gas token for simple stablecoin transfers. There’s no need to calculate microsecond timing windows to avoid price swings in gas. There are no arbitrary delays. Finality happens in a blink — sub-second and psychologically satisfying. You don’t just know the transaction is “probably” done; you feel it. That emotional finality is something I didn’t realize I craved until I saw it in action.

For anyone used to general-purpose Layer 1s, this is striking. Most blockchains optimize for developer visibility, for transaction volume, for ecosystem attention. Plasma optimizes for silence. Its infrastructure-first philosophy is almost invisible. The EVM exists, but as plumbing. Developers can build on it without thinking about it. Users don’t see it at all. The system exists to work, not to impress. And that invisibility is exactly what estates, trusts, and real-world financial systems demand.

The zero-fee stablecoin transfers are the first, most obvious advantage. But the principle behind them is what matters: fees on the movement of value that is already stable feel wrong. Paying a fee to preserve someone’s inheritance is a philosophical misstep as much as a financial one. Plasma’s approach isn’t about discounting costs for marketing purposes. It’s about acknowledging that some transactions shouldn’t carry friction, and then building a system where that friction doesn’t exist.

Stablecoin-first gas reinforces the same philosophy. It’s a recognition that asking someone to hold or convert a native token just to move money they already own is unnecessary cognitive load. For traders and protocol enthusiasts, managing multiple tokens is a minor inconvenience. For someone handling real-world assets with emotional weight, it’s a source of anxiety. Plasma strips that away. The system absorbs the complexity so that users don’t have to.

Sub-second finality is more than a technical benchmark. It’s emotional hygiene. In most blockchains, confirmation delays create a space of doubt. Even a minute of “pending” can trigger questions: Did I make a mistake? Will it revert? Could someone exploit this window? Plasma eliminates that limbo. Transactions are final before doubt has a chance to form. You can release a family’s inheritance without lingering anxiety. That’s the kind of reliability that matters outside of trading rooms and developer conferences.

Security in Plasma is deliberately conservative. Anchoring to Bitcoin isn’t a flashy statement; it’s a practical guarantee. For the kind of value that estates and real-world assets represent, confidence matters more than novelty. You don’t need the latest consensus algorithm to feel secure. You need a backbone that’s proven, tested, and unglamorous. Bitcoin provides that without ego, and Plasma integrates it seamlessly.

What struck me most about Plasma is how it reframes the conversation around blockchain adoption. Most discussions start with velocity: how many transactions per second, how many developers onboarded, how many shiny dApps exist. Plasma starts with restraint: how little the user has to think, how invisible the mechanics, how reliably value moves. It’s infrastructure-first thinking applied to moments where infrastructure is all that matters.

I came to this understanding slowly. I’d spent years defending crypto friction as inevitable. I had arguments ready for fees, for confirmation times, for gas tokens. They all sound reasonable in the abstract: incentivizing validators, securing consensus, rewarding early adopters. But in the moment where real human stakes meet crypto infrastructure, none of those arguments holds water. You can be technically correct and still emotionally wrong.

Plasma doesn’t try to be flashy. It doesn’t need to. Its value lies in the quiet confidence it provides. That quiet confidence is not an absence of innovation; it is the careful application of engineering discipline to human needs. It’s designing a system that works so well that you forget it exists, until you try something else and realize how much you were compensating for friction all along.