When I first looked at Dusk I felt the same tug as many builders do. Blockchains promise trust, but real finance needs privacy and legal certainty. You cannot put every payment or balance on a public ledger and expect institutions to join. What changed my mind was seeing how Dusk pieces the problem together into a usable system.

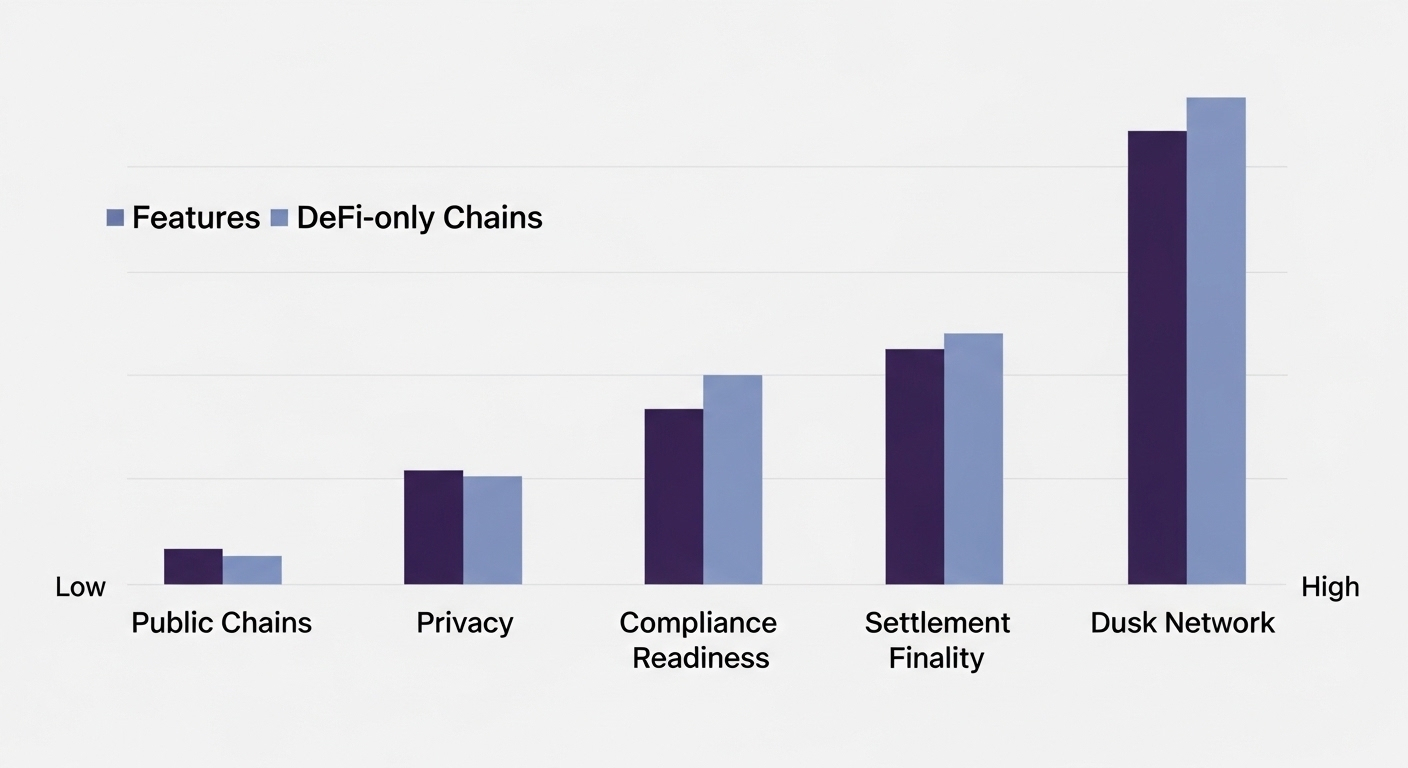

The first thing I noticed was DuskEVM. It gives an EVM-compatible execution layer so I can write smart contracts with tools I already know and deploy finance logic quickly. But DuskEVM is not just "another EVM". It is built as part of a modular stack so the execution layer can inherit settlement and privacy guarantees from the base layer. That makes it straightforward for developers to reuse existing skill sets while relying on a chain designed for regulated use.

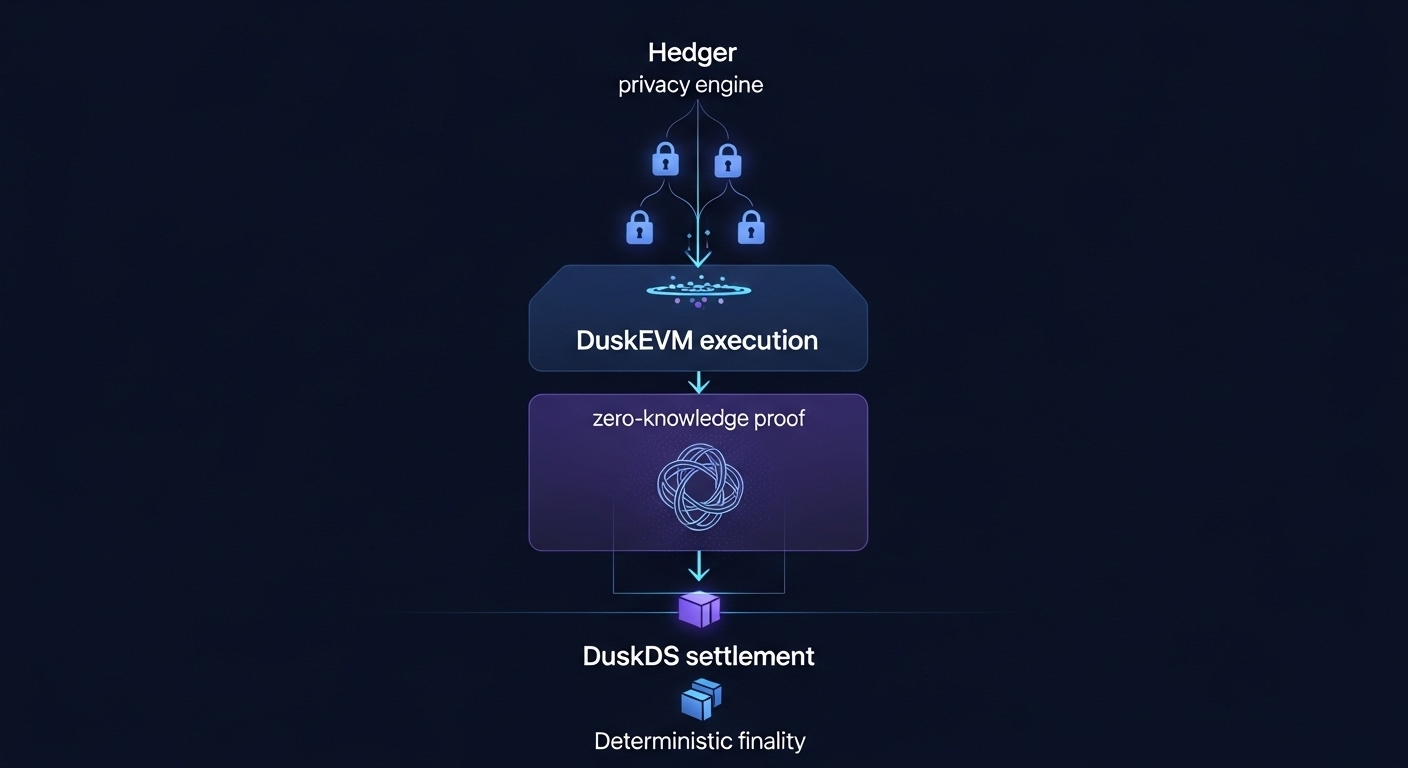

Privacy is where Dusk becomes interesting for payments. The project introduced Hedger as a confidentiality engine for DuskEVM. Hedger mixes homomorphic encryption with zero-knowledge proofs so transactions and amounts can stay hidden by default, yet the chain can still verify correctness without seeing raw values. In plain words this means a transfer can be validated on-chain while most details remain private, and authorized parties can still audit or prove compliance when needed. That cryptographic balance is what lets payments be private and provable at the same time.

Settlement and finality are the other half of the story. For payments and clearing you need deterministic finality, once a block settles it must be final in practice and law. Dusk’s settlement layer, often described as DuskDS and powered by Succinct Attestation, aims for fast and deterministic finality so institutions can treat on-chain settlement like traditional clearing. That matters because it removes the lingering risk of reorgs and gives accountants and legal teams a firmer footing to reconcile on-chain events with off-chain books.

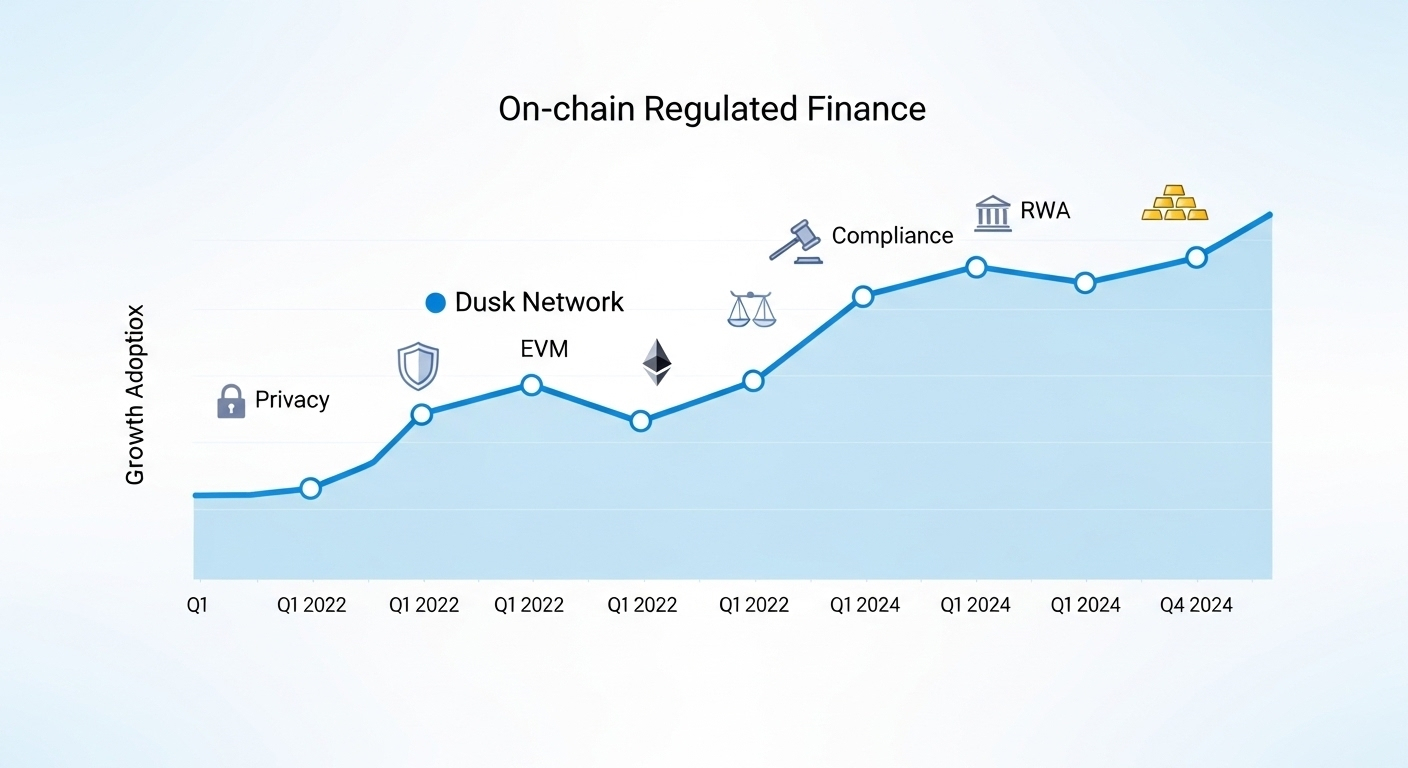

Technology alone is not enough. Real markets need real partners. That is why the Dusk and NPEX collaboration felt important to me. Working with NPEX, a licensed Dutch market, creates a pathway for tokenised securities to exist inside existing European frameworks. When a regulated exchange and a privacy-first chain align, token issuers, custodians, and brokers have a credible route to move assets on-chain without breaking rules. For builders that reduces a lot of legal friction.

Practical product work followed the architecture. DuskTrade is an example where the platform aims to bring tokenised real world assets to investors with compliance and custody in mind. Its focus is not quick yield farming but careful asset lifecycle management, KYC, and investor protection. That shows the project is aiming to be infrastructure for institutional flows rather than a speculative playground.

If we look under the hood the system combines a few clear technical patterns that I like. First, confidential assets and encrypted state keep commercial data private. Second, zero-knowledge proofs give mathematical evidence that rules were followed. Third, selective disclosure and identity primitives let an issuer or regulator reveal just enough information for audit without blowing privacy for everyone. Fourth, a deterministic settlement layer ensures legal finality. And finally, modular EVM compatibility keeps developer friction low. Together these are a practical recipe to run payments, settlements, and tokenised securities on chain.

I also want to be honest about limitations. Any new cryptographic engine adds complexity. Integrations with legacy custody and banking rails take time. Tooling must mature so auditors, compliance officers, and dev teams can all work the same way. But these are engineering and process problems, not theoretical blockers. The design choices Dusk uses are aimed precisely to lower those barriers.

My experience with Dusk left me with a simple view. Confidential payments are not about secrecy for its own sake. They are about making blockchain fit into how institutions already operate. Privacy protects clients and business rules. Deterministic settlement builds legal certainty. EVM compatibility eases development. Partnerships with regulated markets make on-chain finance usable today. If you are building payments, tokenised funds, or settlement systems, this combination is the map you want to study.