Plasma is built around one clear idea that keeps repeating across everything the team ships and documents, which is that stablecoins are already the most practical form of crypto for daily movement, and the blockchain that wins long-term is the one that makes sending stablecoins feel effortless, fast, and dependable at massive scale. Plasma positions itself as a Layer 1 designed specifically for high-volume, low-cost global stablecoin payments, and instead of treating stablecoins like “just another token on a chain,” it treats them like the default currency of the network, which is why the project keeps emphasizing stablecoin settlement as the main purpose rather than trying to be a chain for every possible narrative.

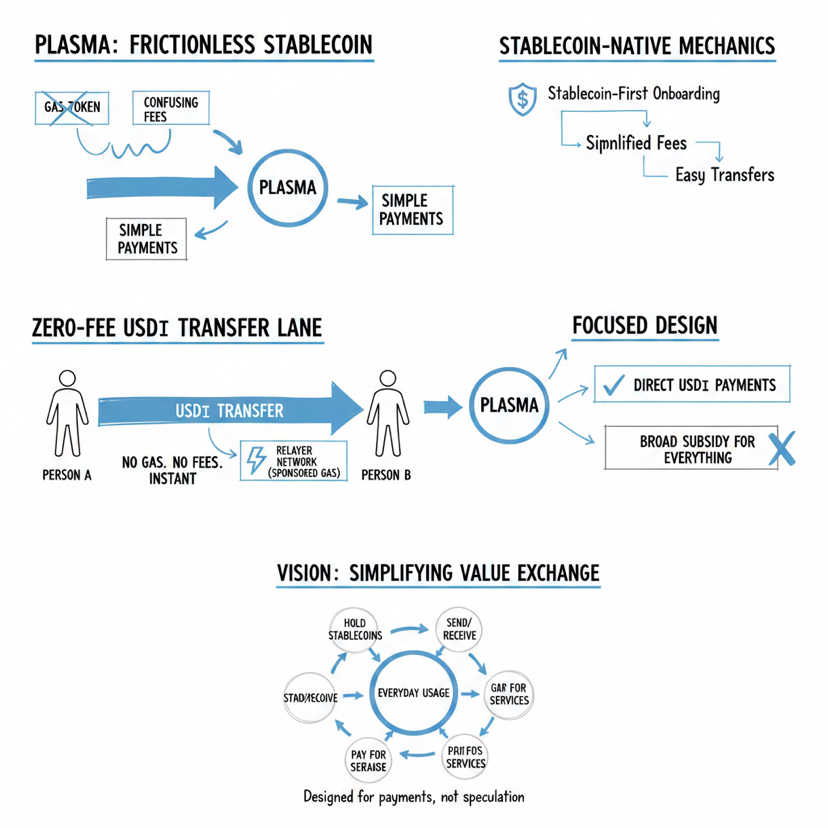

What makes Plasma feel different is the way it tries to remove the friction that usually stops stablecoins from feeling like a real payment rail, because on most networks the user experience still ends up depending on a separate gas token, confusing fee behavior, and onboarding steps that are fine for traders but terrible for everyday usage. Plasma pushes a stablecoin-first experience through stablecoin-native mechanics that are meant to simplify how fees work, how transfers feel, and how apps can onboard people who only want to hold stablecoins and do not want to manage extra assets just to perform basic actions.

One of the most talked-about pieces in Plasma’s design is the zero-fee transfer lane for USD₮, and it matters because it targets the single most common action in a stablecoin economy, which is sending stable value from one person to another without thinking about “gas,” without pausing to calculate whether the fee makes sense, and without feeling like you are doing something technical. Plasma documents this as a relayer-based approach that sponsors gas for direct USD₮ transfers within a controlled scope, which keeps the feature focused on payments behavior instead of turning it into a blanket subsidy for everything on the chain, and that kind of narrow, intentional design choice usually tells you a lot about what a project is actually trying to become.

The second big piece is the stablecoin-native gas approach, because Plasma explicitly leans into the idea that if stablecoins are the main unit people use, then the network should allow fees to be paid in whitelisted ERC-20 assets rather than forcing every user to first acquire a native token before they can do anything meaningful. In practice this is the kind of feature that decides whether a payments app can onboard real users at scale, because the moment you require a separate gas token you introduce an extra step, an extra failure point, and an extra reason for a normal person to stop using the product, and Plasma is clearly trying to delete that moment from the flow.

From a builder perspective, Plasma’s EVM compatibility matters because it reduces the cost of experimentation, and it means developers can bring standard tooling and familiar smart contract patterns while still getting stablecoin-focused infrastructure that the base EVM experience does not provide out of the box. When a chain says it is purpose-built for stablecoin settlement, the real test is whether it becomes a home for products that look like payments, remittance, merchant checkout, payroll rails, and stable-value savings experiences, and the only way you get there is if you make building and shipping feel natural for teams that already live in the EVM world.

The reason this matters beyond tech is that stablecoins sit at the intersection of everyday utility and global access, especially in markets where people already think in dollar-pegged units because they want predictable value without local currency volatility, and Plasma is aiming directly at that reality by shaping the chain around speed, low costs, and a transfer experience that does not punish small amounts. If Plasma’s approach works at scale, it becomes less about “another ecosystem” and more about becoming a settlement rail that apps can rely on for stablecoin movement that feels immediate and consistent, which is the type of infrastructure that quietly grows into something big because it solves a boring problem extremely well.

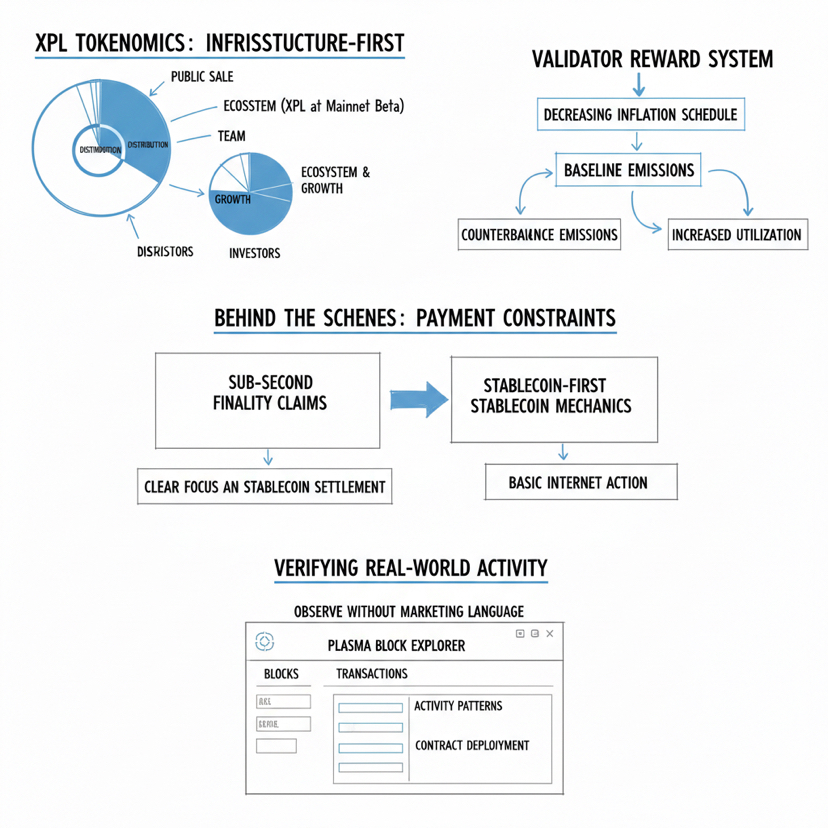

The token story also fits this infrastructure-first framing, because Plasma presents XPL as the network’s core asset for securing and aligning incentives as usage grows, and the tokenomics are structured around long-term operations rather than only short-term hype mechanics. Plasma’s own documentation describes the initial supply at mainnet beta launch as 10 billion XPL and breaks distribution into public sale, ecosystem and growth, team, and investors, while also describing a validator reward system with a decreasing inflation schedule that steps down toward a baseline level, plus an EIP-1559 style base-fee burn design meant to counterbalance emissions as the chain becomes more utilized.

When you look at what “behind the scenes” really means here, it is mainly about the chain choosing constraints that make payments work, because sub-second finality claims and stablecoin-first mechanics are only valuable if they translate into an experience where sending stablecoins feels like a basic internet action. Plasma keeps pushing toward that with clear focus on stablecoin settlement, and the explorer itself is one of the simplest ways to sanity-check whether the network is alive in the real world, because you can observe blocks, transactions, activity patterns, and contract deployment behavior without relying on marketing language.

For “what’s next,” the most realistic way to think about Plasma is that its future is defined by how widely its stablecoin-native features become the default behavior for apps and users, because the chain can only become a payments settlement layer if people actually use it for stablecoin movement at scale and builders keep deploying products that rely on those features. If Plasma continues pushing the gasless USD₮ lane and stablecoin-native gas as first-class primitives, and if the network keeps showing consistent activity and deployment momentum, then the project’s next chapter becomes less about announcements and more about a steady expansion of real usage, where the chain becomes invisible and the stablecoin movement becomes the product.