Most blockchains talk about payments the way apps talk about dark mode: a feature you add once the rest of the product feels mature enough. Plasma flips that logic on its head. It treats payments the way cities treat roads, electricity, and water—not as a selling point, but as infrastructure so fundamental that everything else quietly depends on it. This difference in framing sounds subtle, but it reshapes nearly every technical and economic decision Plasma makes.

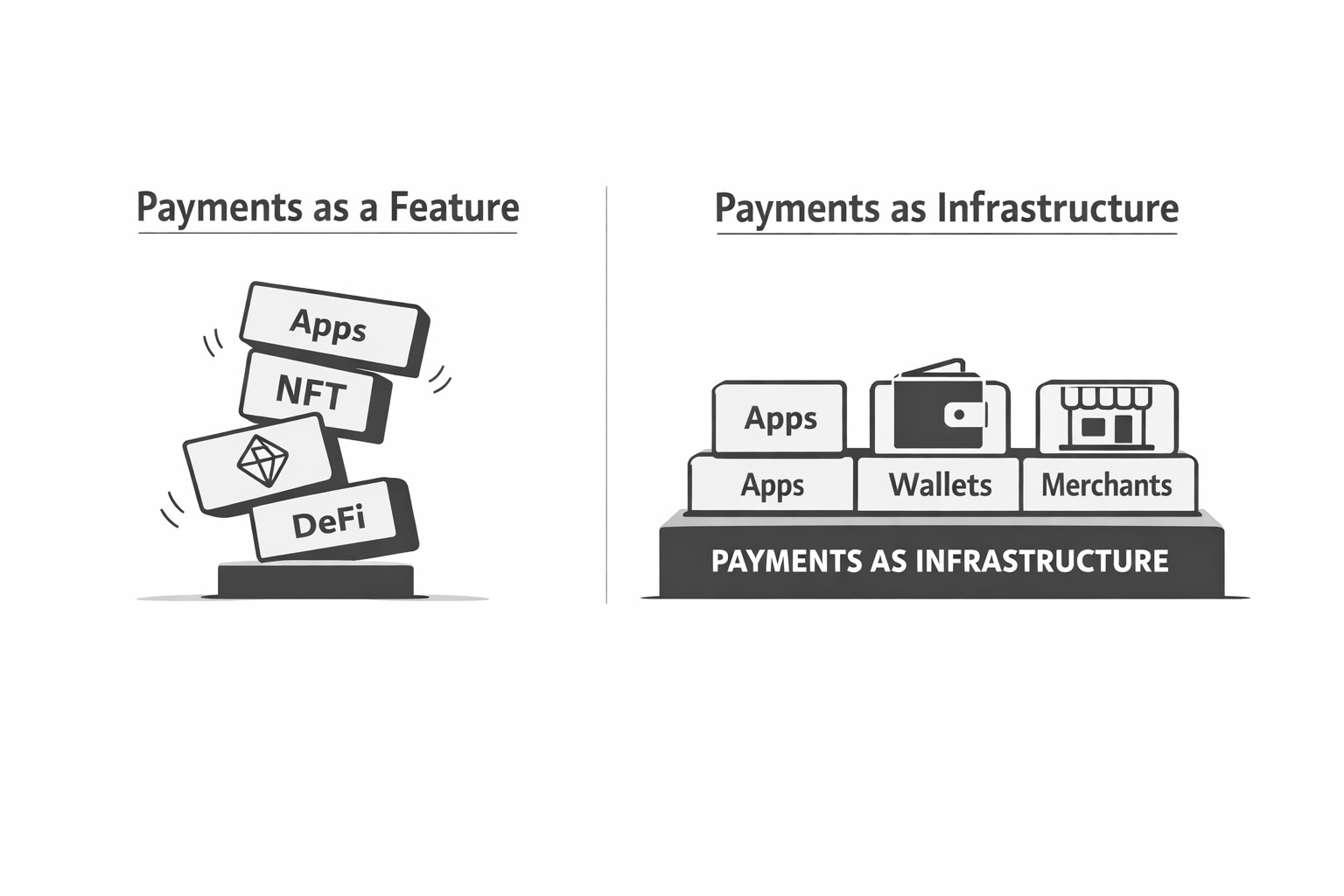

In much of crypto, payments are bundled with spectacle. Faster transactions, cheaper fees, flashier wallets, clever UX tricks that promise frictionless value transfer. These improvements matter, but they often sit on top of systems that were never designed primarily for everyday money movement. Payments become a feature layered onto smart contracts, NFTs, DeFi primitives, or governance experiments. When networks are congested, fees spike. When volatility hits, usability collapses. The system works brilliantly—until people try to use it like money.

Plasma starts from a more sober observation: money does not behave like an app feature. Real payment systems are boring by design. They optimize for predictability, neutrality, and resilience rather than novelty. Visa does not redesign itself every quarter. Central bank rails do not break because too many people used them at once. Payments succeed when users stop thinking about them entirely. Plasma’s philosophy is to replicate that quiet reliability inside a blockchain-native environment, without inheriting the fragility that has plagued many crypto payment experiments.

This is why Plasma frames payments as infrastructure. Infrastructure is not judged by how exciting it is, but by how invisible it becomes when it works. A payment rail should not ask users to speculate on gas prices, understand mempools, or time their transactions like traders. Plasma’s architecture is built to make transaction costs predictable and settlement behavior stable, even under stress. The goal is not to win benchmarks on a good day, but to remain usable on the worst day.

That mindset naturally leads Plasma away from treating fees as a market-driven side effect and toward treating them as a system variable that must be controlled. In traditional finance, merchants know roughly what a payment will cost them before they accept it. In much of crypto, fees float wildly, turning simple transfers into economic gambles. Plasma treats this volatility as a design failure, not an unavoidable reality. By anchoring settlement logic and fee dynamics around stability rather than speculation, it tries to recreate the conditions under which payments can actually scale beyond enthusiasts.

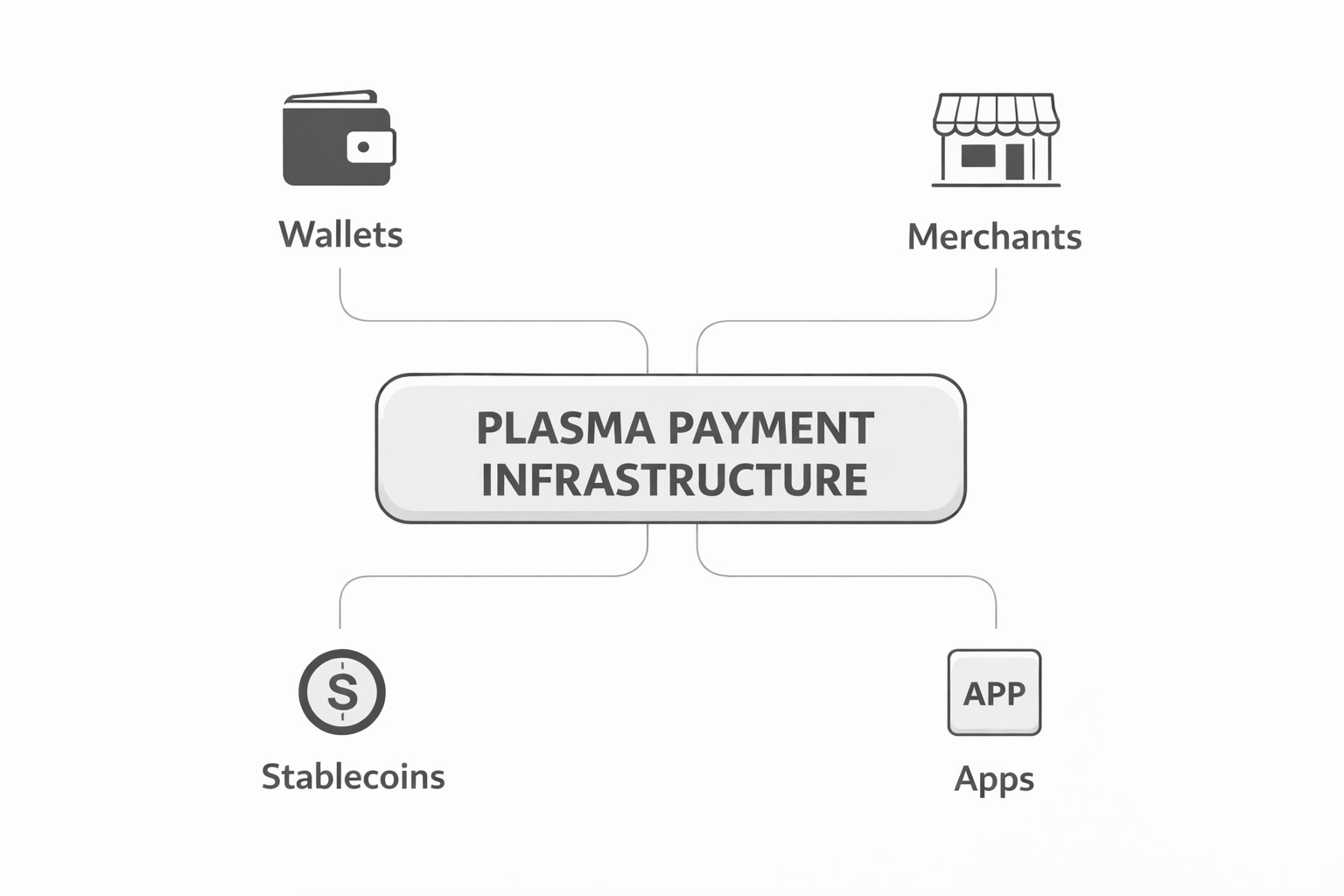

There is also a deeper strategic reason Plasma insists on this framing. When payments are treated as a feature, they compete with other features for attention and resources. When payments are infrastructure, everything else is built on top of them. Stablecoins, merchant tools, wallets, compliance layers, and financial products all assume that the underlying rail will not surprise them. This inversion attracts a different class of builders. Instead of designing clever workarounds for broken payment mechanics, developers can assume a dependable base layer and focus on distribution, UX, and real-world integration.

Historically, the most successful financial platforms did not win because they were flashy. They won because they made coordination cheap. Bank transfers enabled national economies. Card networks enabled global commerce. Mobile money systems transformed entire regions by prioritizing reliability over experimentation. Plasma’s bet is that blockchain payments will follow the same pattern. The winning chain will not be the one with the most features, but the one that becomes too dependable to replace.

Seen through this lens, Plasma’s choices look less like innovation for innovation’s sake and more like a return to first principles. If crypto wants to move beyond demos and narratives into actual economic infrastructure, payments cannot remain a side quest. They must be treated as plumbing: engineered carefully, stress-tested relentlessly, and improved quietly. Plasma is not trying to make payments exciting. It is trying to make them inevitable.

That is what it means to treat payments as infrastructure, not a feature. It is a refusal to optimize for applause and a commitment to optimize for trust. In a space obsessed with novelty, Plasma’s most radical idea may be its willingness to be boring in exactly the right ways.