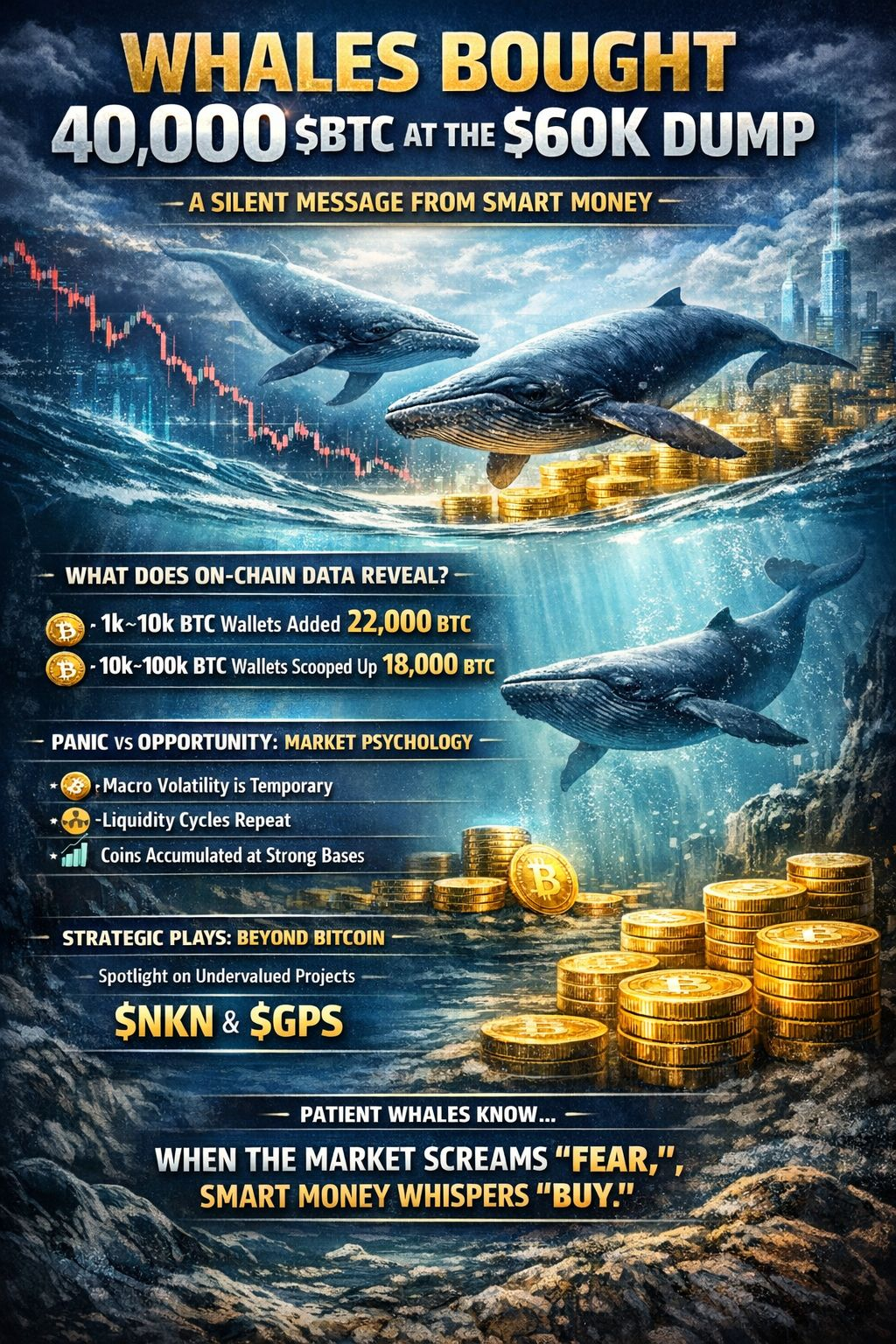

When panic spreads across the crypto market, that’s often when the biggest players become most active. The recent dip below $60K was a perfect example. As Bitcoin slipped under this key psychological level, two powerful whale groups stepped in aggressively, accumulating nearly 40,000 BTC in total. This wasn’t just a random move—it was a clear reflection of smart money conviction.

🔍 What Does On-Chain Data Reveal?

According to on-chain analysis:

Wallets holding 1k–10k BTC added around 22,000 BTC

Wallets holding 10k–100k BTC scooped up another 18,000 BTC

This kind of accumulation is rarely short-term speculation. Instead, it signals a medium- to long-term conviction trade. History shows that whales tend to buy where risk-to-reward is most favorable.

📉 Panic vs Opportunity: Market Psychology

While retail investors react emotionally to liquidation cascades, bearish headlines, and red candles, large capital often moves in the opposite direction. Why? Because whales understand that:

Macro volatility is temporary

Liquidity cycles repeat

Coins accumulated at strong bases often fuel the next major move

This dump didn’t weaken the market—it facilitated a transfer of supply from weak hands to strong hands.

🧠 Strategic Perspective: Beyond Bitcoin$BTC

Whale accumulation in the leading asset usually sends a broader signal across the ecosystem. When big players show confidence in Bitcoin, smart investors begin scanning for structurally undervalued projects with solid fundamentals.

In this context, projects with real utility, network growth, and long-term development potential quietly enter accumulation zones. During such phases, names like $NKN and $GPS naturally come into focus as part of a strategic, forward-looking positioning approach.

🚀 What Does This Accumulation Signal Going Forward?

Large players are treating current levels as a value zone

Supply is gradually moving into stronger hands

Major breakouts often follow periods of silent accumulation

Markets reward patience. Those who react to headlines often miss opportunities, while those who read the data position themselves ahead of the trend.

✨ Final Thoughts

This 40,000 BTC whale accumulation is not a coincidence—it’s a signal. And the signal is clear: the seeds of the next move are planted during moments of fear. For investors who rely on data-driven analysis, long-term vision, and smart positioning, these phases often present the most asymmetric opportunities.

When the market screams “fear,” smart money quietly whispers—“buy.”