Dusk Network’s low-key goal: helping institutions settle privately without exposing user data:-

i started paying attention to Dusk again the moment i realized most “privacy” talk in crypto misses what institutions actually want. They do not need secrecy for its own sake. They need settlement that is private by default, because finance is full of sensitive information, but still provable when it matters, because regulation and risk teams do not accept “trust me” as an audit trail. If you have ever watched a serious firm avoid a promising product because it leaks counterparties, balances, or customer behavior the second it hits a public ledger, you know the problem is not ideology. It is operational survival.

Here is the quiet thesis behind Dusk. It is trying to let institutions move value and reconcile positions without broadcasting user level data to the entire internet, while still enabling controlled disclosure when an auditor, regulator, or counterparty needs evidence. That sounds abstract until you map it to normal workflows. Think about a fund that wants to issue tokenized shares, settle trades, and distribute dividends. On a fully transparent chain, every distribution can become a data leak: who holds what, who sold, who accumulated, who is connected to whom. In the real world, that kind of exposure creates front running risk, reputational risk, and sometimes legal risk. In practice, the safest move becomes not to touch the chain at all.

The retention problem shows up right there. Early adopters will tolerate friction and exposure once, just to try something new. Institutions and serious users will not repeat a workflow that turns every action into a permanent public broadcast. They churn quietly. They do fewer transactions, keep less value on chain, and eventually stop building internal support for the experiment. Retention is not a marketing issue in this category. It is a privacy plus compliance issue, because repeat usage depends on users believing the system will not create new liabilities over time.

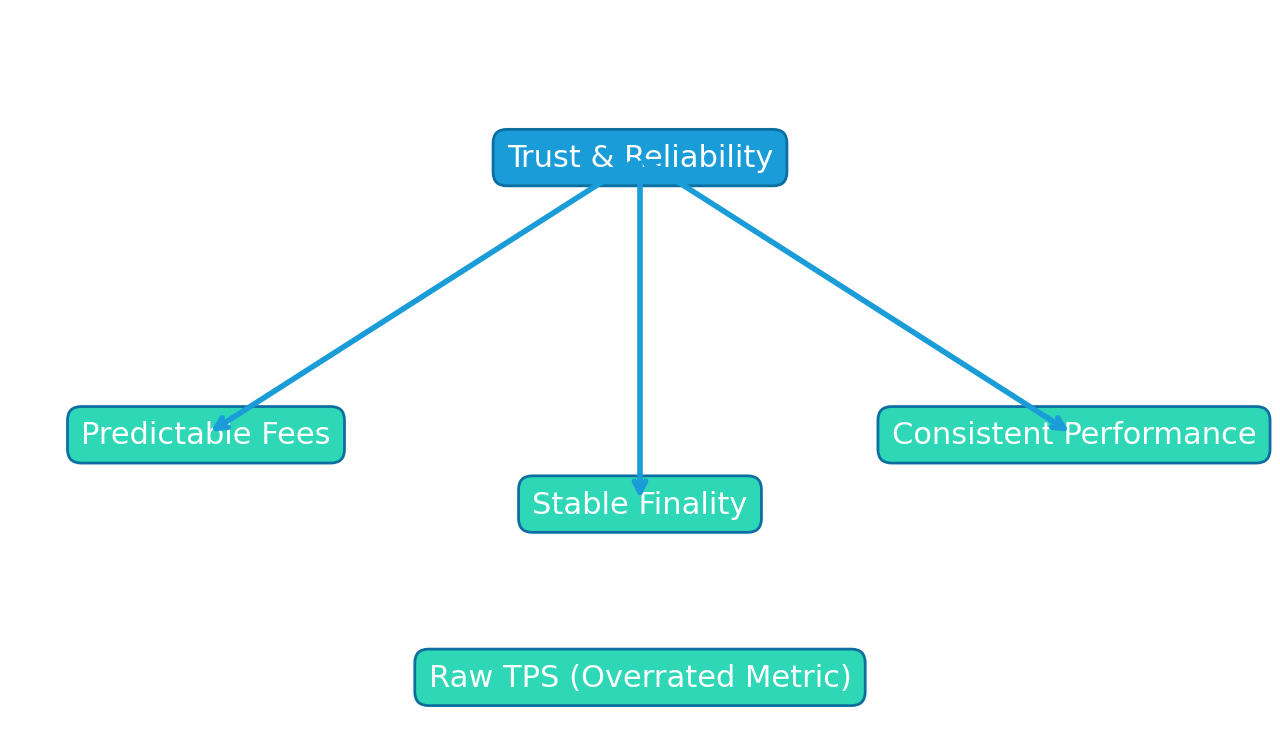

Dusk’s design goal is to make that repeat usage plausible. The network positions itself as a layer 1 for privacy preserving smart contracts that still satisfy business compliance needs. It also emphasizes settlement finality as a first class requirement, because institutions care about when something is actually done, not just “included in a block.” Under the hood, the core idea is selective disclosure: transactions can remain private to the public, while proofs can demonstrate validity to whoever is authorized to verify them. You can explain this without math. Instead of publishing your bank statement, you publish a receipt that proves a specific claim, like “this transfer was within limits” or “this trade matched an approved instrument,” and you can reveal more detail only to the parties that need it.

Now place the market data where it belongs, as context rather than the main character. As of 2026-02-07 13:19 UTC, Binance lists DUSK at about $0.0839, with roughly a $41.69M market cap and about $11.74M in 24 hour volume. The move is about -3.33% over 24 hours and about -25.12% over 7 days, which is a reminder that even “serious infrastructure” trades like a risk asset. On the supply side, CoinMarketCap shows roughly 497M circulating, with a 1B max supply and around 32.9K holders. Dusk’s own documentation describes a 500M initial supply with an additional 500M emitted over time to reward stakers, and it frames the maximum supply as 1B. For traders, that matters because emissions and staking incentives influence sell pressure and liquidity over long time horizons, not just the next candle.

What makes the institutional angle more than a slogan is the long arc of how Dusk has positioned itself around regulated rails. The partnership with NPEX has been public for years, including the detail that Dusk acquired a 10% stake in NPEX back in 2020, which is not the kind of move you make if you are only chasing narratives. Dusk and NPEX announced an official commercial partnership in March 2024 aimed at a regulated, blockchain powered securities exchange. NPEX later described work with Dusk and Cordial Systems in February 2025 around a blockchain based exchange and custody direction. Whether every milestone lands exactly on time is always a risk in infrastructure, but the pattern is consistent: build something that compliance teams can map to a familiar world.

If you are evaluating DUSK as an investor, the clean way to think about it is not “privacy coin versus transparent coins.” It is “can private settlement plus auditable disclosure become a retention engine for real financial workflows.” If the answer is yes, usage compounds because participants can transact repeatedly without turning their entire operation into public data. If the answer is no, you get the usual churn cycle: curiosity, pilot, internal pushback, and slow abandonment.