Every bull run creates new traders.

Every correction teaches painful lessons.

If you're new in crypto, read this before the market teaches you the hard way.

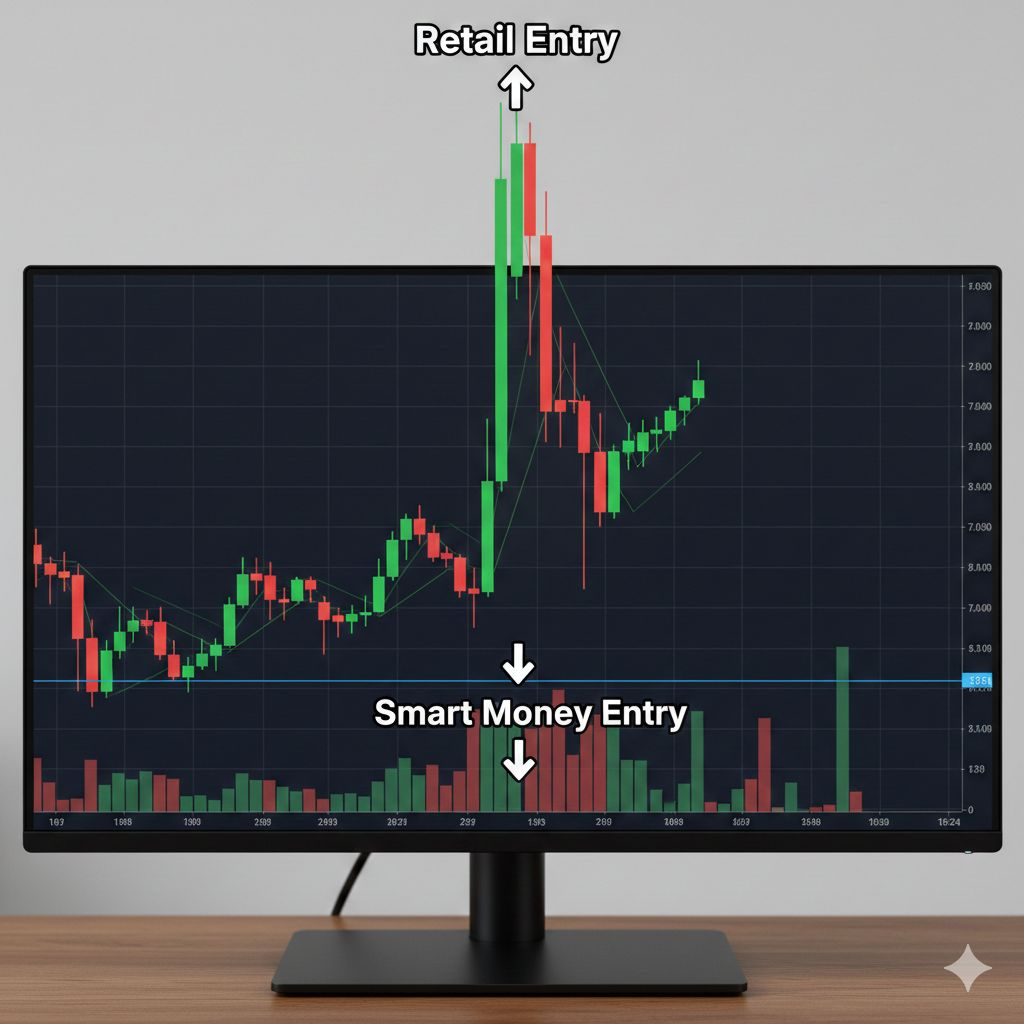

❌ 1. FOMO Buying Green Candles

You see a coin pumping +20%…

Twitter screaming “TO THE MOON!” 🚀

You enter at the top.

Reality: Smart money buys fear. Retail buys hype.

✅ How to Avoid It:

Wait for pullbacks.

Use support/resistance.

Never chase parabolic candles.

❌ 2. No Stop Loss (Future Traders Especially 😅)

“I’ll close manually.”

“It will come back.”

Liquidation email arrives.

Leverage without risk management = gambling.

✅ How to Avoid It:

Always set stop loss.

Risk only 1–3% per trade.

Never over-leverage your account.

❌ 3. Trading Without a Plan

Entering randomly.

Exiting emotionally.

Changing strategy every day.

That’s not trading — that’s reacting.

✅ How to Avoid It:

Define entry, exit, invalidation.

Follow one strategy consistently.

Journal your trades.

❌ 4. Following Influencers Blindly

“Whale insider signal.”

“100x gem.”

“Guaranteed pump.”

If it was guaranteed, they wouldn’t sell it to you.

✅ How to Avoid It:

Do your own research (DYOR).

Check tokenomics.

Analyze the chart yourself.

❌ 5. All-In On One Trade

New traders go: “Full margin. Full confidence.”

One wrong trade → account wiped.

✅ How to Avoid It:

Diversify positions.

Keep stablecoins ready.

Protect capital first. Profit second.

🧠 Final Advice

In crypto:

Survival > Quick profit

Discipline > Emotion

Risk management > Prediction

The goal isn’t one lucky trade.

The goal is staying in the game long enough to win.

If you're new, remember:

Even professional traders focus more on protecting capital than chasing gains.

💬 Which mistake did you make when you started?

#BinanceSquare #cryptotrading #RiskManagemen #Newtradersguide #cryptoeducation