There is a certain kind of silence that happens when money is late.

It’s the silence in a kitchen when rent is due tomorrow. The silence of a mother refreshing her phone, waiting for a remittance notification that hasn’t arrived. The silence of a small business owner staring at a pending transaction, unsure whether to hand over the goods. Money, in those moments, isn’t abstract. It’s breath. It’s sleep. It’s dignity.

For years, blockchain promised to fix this. Faster. Cheaper. Borderless. And yet, for many people, using it felt like learning a new religion. You didn’t just send money — you had to buy a different token to move your own. You didn’t just receive payment — you had to understand gas fees, confirmations, congestion. The rails were powerful, but they were not gentle.

Plasma feels like it was born from that tension.

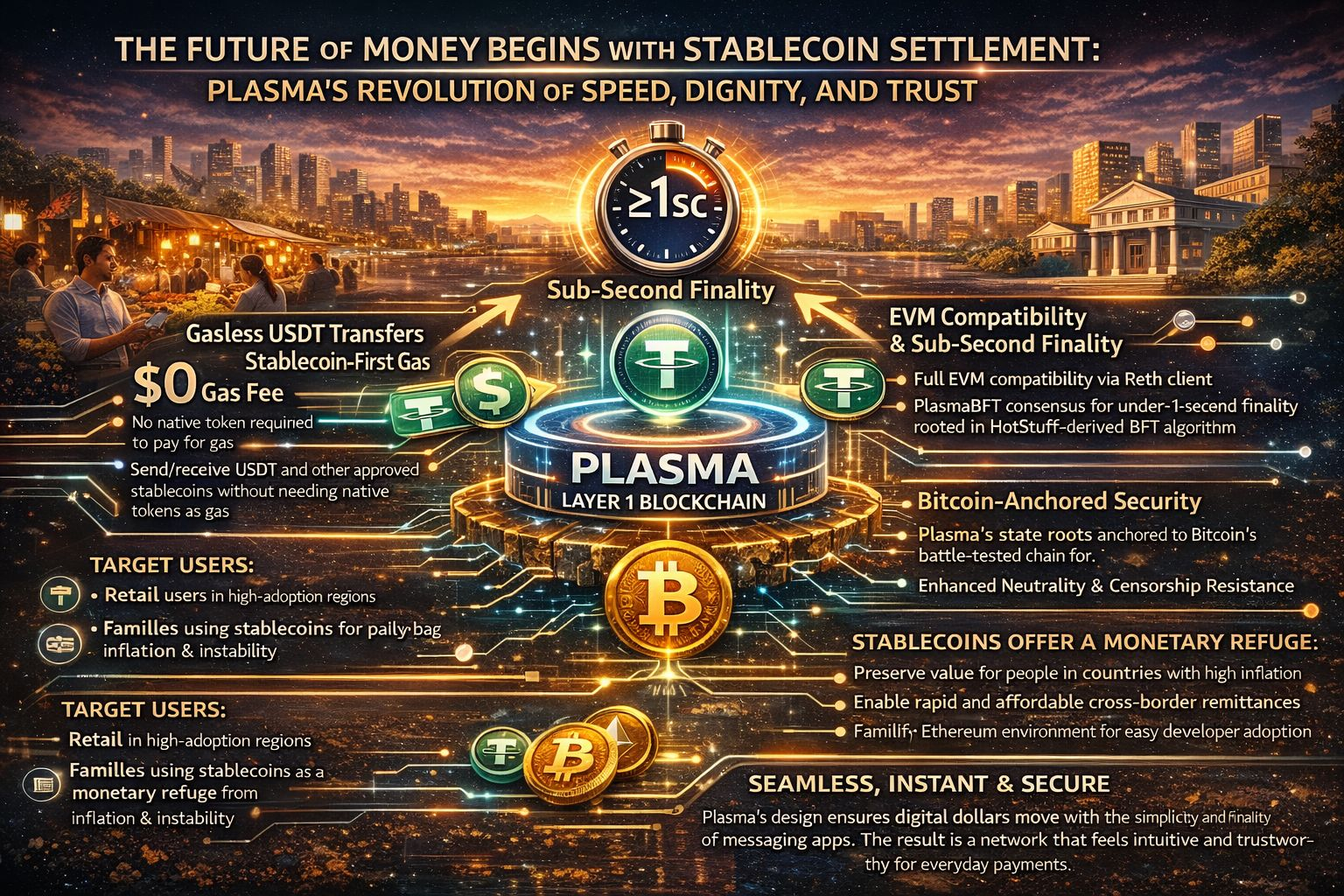

At its core, Plasma is a Layer 1 blockchain designed around stablecoins — not as an accessory, not as a side experiment, but as the main character. That distinction matters more than it sounds. Stablecoins like USDT are not speculative instruments for most people who use them daily. They are digital dollars. They are the thing that holds steady when local currencies don’t. In many high-adoption markets, stablecoins are already the quiet backbone of survival.

So Plasma asks a deeply human question: if people are already living in digital dollars, why make them hold something else just to move those dollars?

On most blockchains, you need a native token to pay for gas. It’s like needing to buy a subway card just to unlock your own wallet. Plasma turns that ritual on its head with gasless USDT transfers and stablecoin-first gas. It allows transactions to be sponsored, relayed, or paid in stablecoins directly. Behind the scenes, relayers and protocol mechanisms handle the complexity. On the surface, it feels simple. You send dollars. They arrive.

There is something profoundly relieving about that simplicity.

Imagine a father working abroad, sending money home every month. He doesn’t want to manage token balances. He doesn’t want to worry about whether he has enough gas. He wants to press send and know it’s done. Plasma’s architecture — through mechanisms like relayers and stablecoin-first fee models — is designed to make that experience feel natural. Invisible. Human.

And then there is speed.

Plasma integrates a Byzantine Fault Tolerant consensus model, PlasmaBFT, engineered for sub-second finality. That phrase sounds technical, but emotionally it translates to this: when you send money, it settles almost instantly. No waiting for multiple confirmations. No hovering over a spinning circle. No anxiety creeping into your chest as you wonder whether the transaction will reverse.

In under a second, it’s final.

Finality is more than speed. It’s certainty. It’s the moment when doubt disappears. For a merchant accepting payment, that certainty means confidence. For an institution processing payroll, it means reduced risk. For an everyday user, it means peace.

Underneath it all runs familiar machinery. Plasma uses full EVM compatibility through Reth, a high-performance Ethereum execution client written in Rust. This isn’t flashy marketing — it’s reassurance. Developers can deploy smart contracts without rewriting their entire mental model. Wallet providers can integrate more easily. Infrastructure teams don’t have to start from zero.

Compatibility is a quiet act of respect. It says: we won’t make you abandon what already works.

But perhaps the most emotionally charged layer of Plasma’s design is its relationship with Bitcoin. By anchoring security to Bitcoin’s network — the most battle-tested and censorship-resistant chain in existence — Plasma gestures toward neutrality. In a world where financial systems can freeze accounts or close doors, neutrality becomes sacred.

For someone living under capital controls or political uncertainty, censorship resistance isn’t philosophical. It’s protective. Anchoring to Bitcoin signals a desire for durability — for roots deep enough that the rails won’t simply vanish under pressure.

Plasma sits at an intersection of worlds. On one side are retail users in high-adoption regions — people already using stablecoins for groceries, tuition, savings. On the other side are institutions — payment processors, fintech startups, remittance corridors — who need deterministic settlement, predictable finality, and infrastructure they can trust.

Sub-second confirmation reduces operational risk. Stablecoin-first gas simplifies treasury management. EVM compatibility lowers integration costs. Bitcoin anchoring strengthens security narratives. Each piece speaks a different language, but together they form a single promise: stability without friction.

And yet, nothing about this is naive. Gasless systems require relayers that must be incentivized. Anchoring introduces complexity. Bridges must be audited carefully. The economics must sustain themselves. Payments infrastructure carries human weight; failure is not theoretical.

But there is something refreshing about a blockchain that centers its design on what people are actually using today. Not what might exist in ten years. Not what speculators debate on social media. Stablecoins are already embedded in everyday life across parts of Latin America, Africa, Southeast Asia. They are already being used to protect savings, settle invoices, and send love across borders.

Plasma does not try to convince people to change behavior. It tries to support behavior that already exists.

Picture a market vendor accepting USDT for fresh fruit, the transaction final before the customer finishes putting away their phone. Picture a payroll administrator sending hundreds of salaries without juggling separate gas tokens. Picture a family receiving remittance funds with no hidden step required to “unlock” their own money.

These are not grand, cinematic moments. They are ordinary. And that is precisely the point.

When technology works, it fades into the background. You don’t think about the card network when you buy coffee. You don’t think about TCP/IP when you send a message. Plasma’s ambition is similar — to make stablecoin settlement so seamless that users forget they are interacting with a blockchain at all.

What remains is simply money that moves.

There is something deeply emotional about that idea. Because for many people, money is not an investment thesis. It is a lifeline. It is rent paid on time. It is medicine purchased without delay. It is a small sense of control in economies that often feel uncontrollable.

If Plasma succeeds, it won’t be because of buzzwords. It will be because someone pressed send and felt relief instead of anxiety. Because a merchant trusted the confirmation without hesitation. Because a developer built a payment app without reinventing the wheel. Because a family somewhere slept easier knowing the transfer was final.

Technology rarely announces its most important victories. They happen quietly, in kitchens and corner shops and payroll spreadsheets. They happen in under a second.

And sometimes, that single second is everything.