Money is supposed to feel simple.

You hand it over. It arrives. It means something. It carries effort, time, sacrifice. It feeds families. It pays rent. It keeps lights on. Yet somewhere along the way, when money became digital and programmable and borderless, it also became complicated. Buttons replaced handshakes. Wallet addresses replaced names. Gas fees replaced common sense.

And in that complexity, something very human was lost.

Plasma begins from a place that feels almost tender: the recognition that people are tired of friction. Tired of waiting. Tired of explaining to their parents why they need one token to send another token. Tired of fees that spike without warning. Tired of the quiet anxiety that comes with seeing the word “pending.”

Stablecoins were meant to bring stability into crypto. Digital dollars that do not swing wildly with the market. They are the closest thing the blockchain world has to familiarity — something you can measure groceries with, tuition with, payroll with. And yet, the rails beneath them were not built for their everydayness. They were built for experimentation, for speculation, for infinite possibility. Stablecoins were passengers in someone else’s design.

Plasma feels like someone finally asking, “What if we built the road for the passenger?”

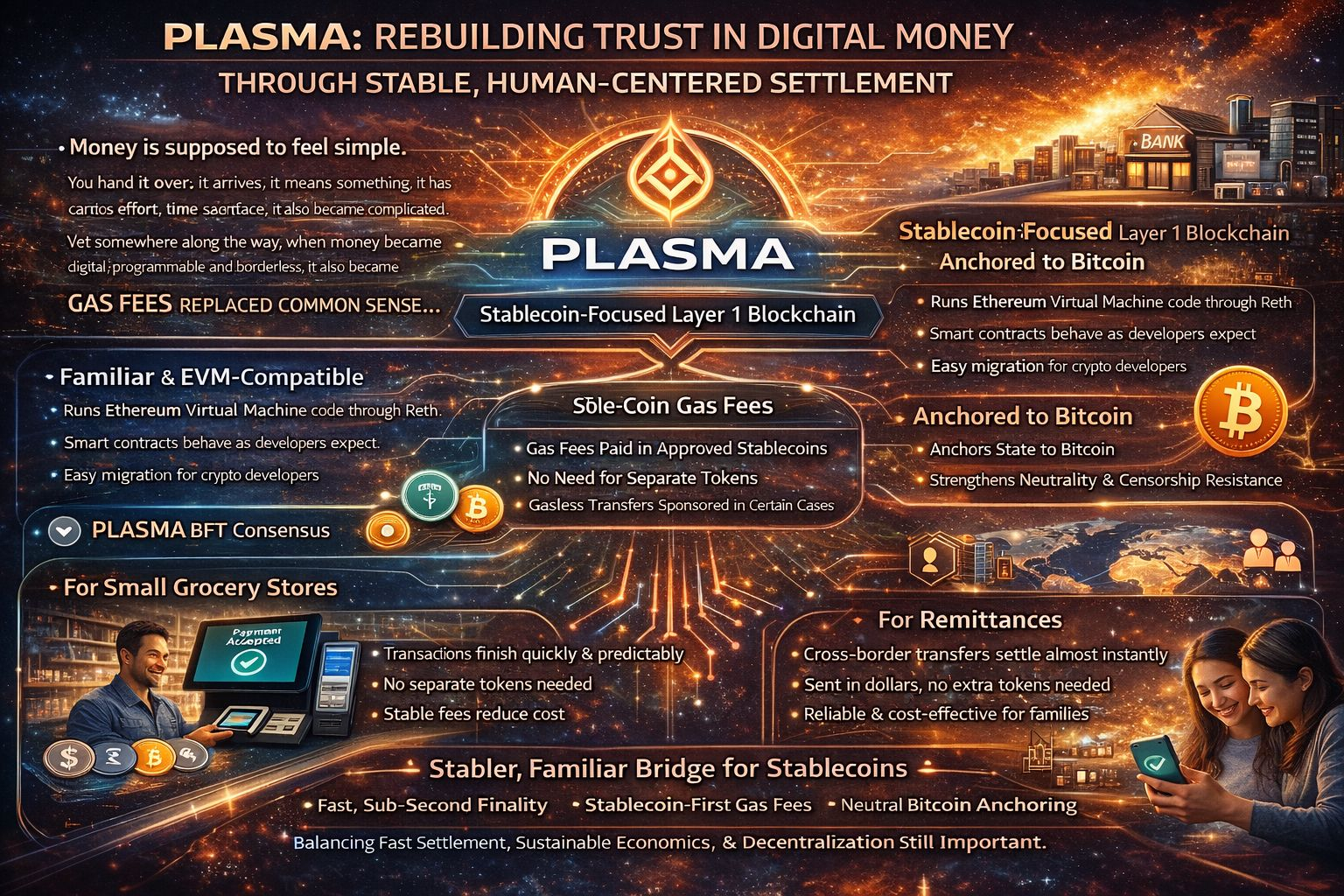

Underneath the emotion is serious engineering. Plasma is a Layer 1 blockchain, but unlike many before it, it narrows its gaze. It chooses focus over sprawl. It is tailored specifically for stablecoin settlement. Not as a feature. As a foundation.

It runs fully compatible with the Ethereum Virtual Machine through Reth, which means developers do not have to relearn their craft. Smart contracts behave the way they expect. Tools feel familiar. Builders can migrate without tearing down everything they’ve built. There is something profoundly respectful in that — respect for time, for effort, for continuity.

Then there is PlasmaBFT, the consensus mechanism designed for sub-second finality. That phrase can sound technical, almost sterile. But sub-second finality is not about milliseconds. It is about breath. It is about sending value and not holding your breath while you wait. It is about a merchant looking at their screen and knowing — knowing — that the payment is done. It is about a mother sending money across a border and seeing confirmation before doubt has time to creep in.

Finality is a form of reassurance.

One of Plasma’s most radical decisions is also one of its simplest: stablecoin-first gas. On most blockchains, even if you want to send dollars, you must first own the chain’s native token just to pay the transaction fee. It is like being told you cannot mail a letter unless you first buy a different kind of currency just to purchase the stamp. For seasoned crypto users, it’s routine. For newcomers, it’s alienating.

Plasma softens that edge. Gas can be paid in approved stablecoins. Certain USDT transfers can be gasless to the recipient through sponsorship mechanisms built into the protocol. The result is quiet but powerful: people can stay in dollars. They can live in the currency they understand. The experience feels less like navigating a system and more like using money.

Imagine a small grocery store owner in a high-adoption market. Margins are thin. Every percentage point matters. They accept stablecoins because customers demand it. But unpredictable fees hurt. Delays hurt. Confusion hurts. On a network optimized for stablecoin settlement, transactions complete quickly and predictably. Fees are stable. There is no separate token barrier. The owner can focus on inventory, on customers, on survival.

Or imagine a remittance corridor — workers abroad sending earnings home. In many parts of the world, stablecoins are not speculation. They are insulation against inflation. They are a hedge against unstable local currencies. When those transfers settle almost instantly, when recipients do not need to navigate additional tokens to receive funds, something changes. The system fades into the background. The human connection comes forward.

Plasma also anchors aspects of its state to Bitcoin. This is not for aesthetics. It is a design choice rooted in credibility. Bitcoin has earned a reputation as one of the most censorship-resistant and battle-tested blockchains in existence. By anchoring to it, Plasma seeks to strengthen neutrality and resilience. It signals that settlement history should not bend easily to pressure.

Neutrality is not a buzzword. It is protection.

For institutions — payment processors, fintech platforms, custodians — neutrality and predictability are oxygen. They need rails that do not surprise them. They need settlement that is auditable, deterministic, fast. Plasma’s combination of EVM compatibility, rapid finality, and stablecoin-centric economics speaks directly to that need. It says: you can build here, and you can know what you are building on.

But no system is without tension. Fast finality often implies structured validator sets. Subsidized or gasless transfers must be economically sustainable. Regulatory realities surround any chain deeply tied to dollar-denominated assets. These are not footnotes; they are living questions. Plasma’s long-term strength will depend on governance, validator diversity, economic incentives, and the balance between usability and decentralization.

Still, what feels different is the intention.

In a space that often celebrates volatility and endless experimentation, Plasma chooses steadiness. It does not try to be everything. It tries to be good at one thing: moving stable value well.

There is something deeply human about that restraint.

We do not need every road to lead everywhere. We need some roads to reliably get us home.

Stablecoins already move billions of dollars daily across exchanges and applications. They are bridges between traditional finance and crypto-native systems. But bridges need solid foundations. If stablecoins are becoming the bloodstream of digital finance, then the arteries that carry them matter. Plasma positions itself as one of those arteries — not flashy, not dramatic, but essential.

When you strip away the acronyms and architectural diagrams, what remains is a quiet aspiration: that digital money can feel less intimidating, less fragile, less foreign. That sending value across a border can feel as natural as sending a message. That a merchant can accept payment without worrying about token mechanics. That institutions can trust settlement not because of marketing, but because of design.

Technology at its best disappears. It serves. It supports. It lets human intention flow through it without distortion.

If Plasma succeeds, most users will never think about Plasma. They will think about groceries purchased, tuition paid, wages delivered, families supported. They will think about the absence of friction — the relief of not having to understand the machinery beneath the surface.

And perhaps that is the most radical idea of all: a blockchain that does not ask to be admired, only relied upon.