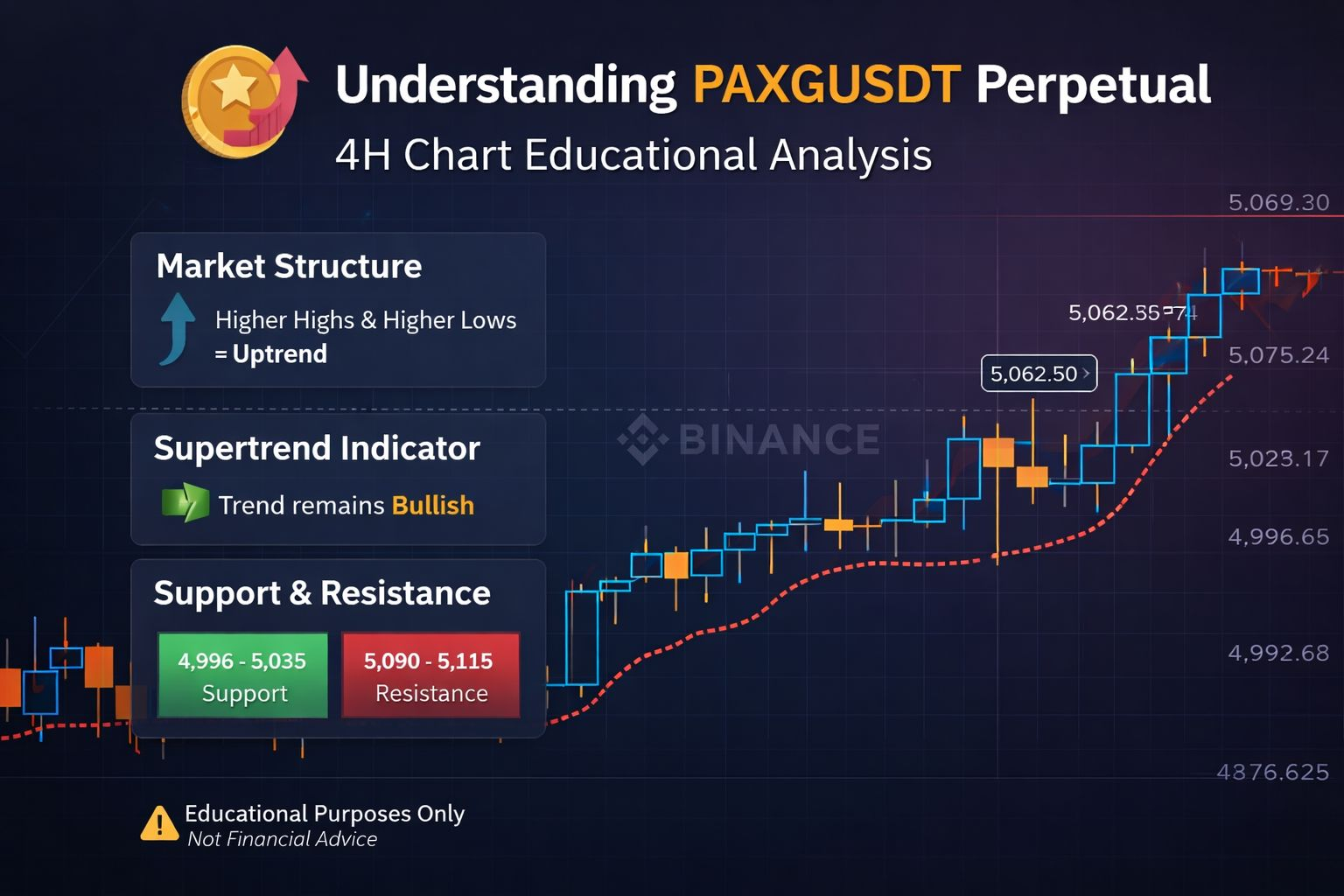

PAXG is a gold-backed crypto asset, meaning its price often reflects both crypto market behavior and gold market sentiment. On the 4-hour timeframe, PAXGUSDT Perpetual is currently trading near 5,062 USDT, providing a good case study for learning technical analysis.

🔹 Market Structure Explained

The price is forming higher highs and higher lows, which is a textbook definition of an uptrend. This tells traders that buyers are consistently willing to enter at higher prices, indicating strength in the market.

🔹 Role of the Supertrend Indicator

The Supertrend indicator remains bullish, acting as a dynamic support. As long as price stays above the Supertrend level, the broader trend bias remains upward. Beginners often use this indicator to understand trend direction and possible trend changes.

🔹 Support and Resistance Zones

Support: 4,996 – 5,035

This zone shows where buyers previously defended price.

Resistance: 5,090 – 5,115

This area may attract profit-taking or short-term selling pressure.

🔹 Educational Takeaway

In trending markets, pullbacks are normal and healthy. A pullback toward support does not mean the trend is broken unless key levels fail. A strong close above resistance may indicate trend continuation, while rejection suggests consolidation.

📌 This article is for educational purposes only, not financial advice.

Understanding structure, indicators, and key levels helps traders make informed decisions.

#PAXG #PAXGUSDT #cryptoeducation #GoldBackedCrypt #TradingEducation #BinanceSquare