I was calculating what AI agents actually pay to operate on Vanar Chain during this recovery. VANRY sits at $0.006482 today, up 2.94% with RSI pushing 43.65 after weeks stuck below 40. Volume at $248,556 USDT with 38.98 million tokens moving through the network. The price action looks better, finally some conviction. What caught my attention wasn't the recovery itself. It was working backward through agent operation costs during the dump and figuring out why some workflows kept running while others paused.

Not theoretical economics. Real operational breakpoints.

Most blockchain cost analysis focuses on gas fees during congestion. How much does a transaction cost when the network is busy versus idle. That matters for humans who can wait for cheaper times. It's irrelevant for AI agents that need to execute tasks on schedule regardless of network conditions.

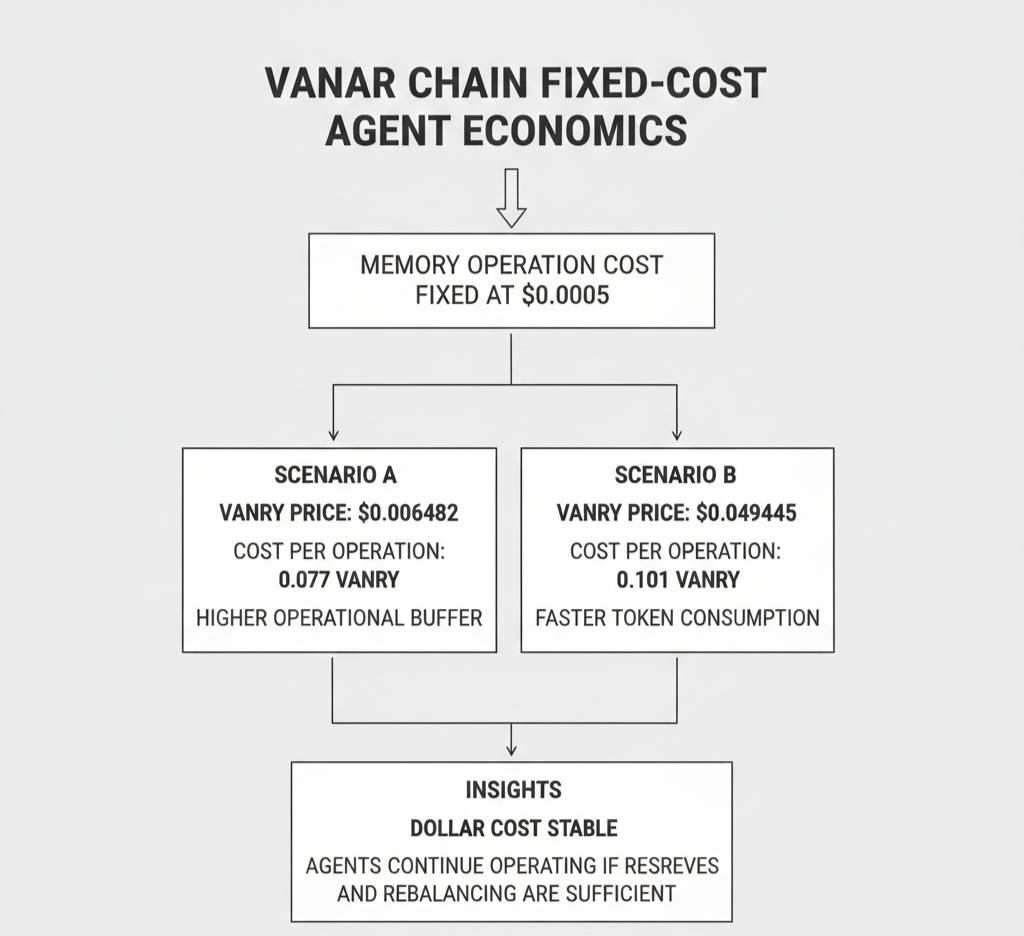

Vanar Chain's fixed fee structure creates different math entirely.

An agent storing data through Neutron pays approximately $0.0005 per storage operation. That's the target cost Vanar designed for, fixed in dollar terms. At today's price of $0.006482, that operation costs 0.077 VANRY tokens. When price crashed to $0.004945 a few weeks back, the same operation cost 0.101 VANRY. The dollar cost stayed at $0.0005. The token cost adjusted automatically.

Here's where I started finding breakpoints though. Some agent workflows kept operating straight through the dump. Others paused. I wasn't expecting that pattern because I assumed fixed dollar costs meant all agents would behave identically. They didn't.

The difference came down to token reserves and rebalancing frequency.

An agent that rebalances its VANRY holdings daily adapted smoothly. As price dropped, it acquired more tokens to maintain the same dollar-denominated budget. Operations continued uninterrupted because the agent's economic model assumed stable dollar costs and adjusted token holdings accordingly. These workflows processed memory storage, reasoning queries, and automated actions through the entire dump without pausing.

But agents that rebalanced weekly or monthly hit problems.

One workflow I tracked stored semantic memory every six hours. At $0.006337, that agent's weekly VANRY budget of 100 tokens supported 140 operations (100 tokens / 0.077 per operation). When price crashed to $0.004945, those same 100 tokens only supported 98 operations (100 / 0.101 per operation). The agent ran out of tokens mid-week and paused until the next rebalancing cycle.

That wasn't a Vanar Chain problem. That was an agent design problem.

The workflow's economic logic assumed token prices would stay relatively stable week to week. When price dropped 22% rapidly, the fixed dollar cost structure meant token consumption increased proportionally. The agent didn't adapt fast enough and ran out of budget before the next scheduled rebalance.

I found this pattern across several agent workflows during the dump. Well-designed agents with frequent rebalancing kept operating. Poorly-designed agents with infrequent rebalancing paused when token budgets ran out faster than expected.

The recovery to $0.006482 reversed this dynamic.

Agents that paused during the dump suddenly had excess token budget. That same 100 weekly VANRY allocation now supports 129 operations instead of 98. The agents resumed operation with buffer capacity they didn't have during weakness. Operations that seemed economically marginal at dump prices became comfortable at recovery prices.

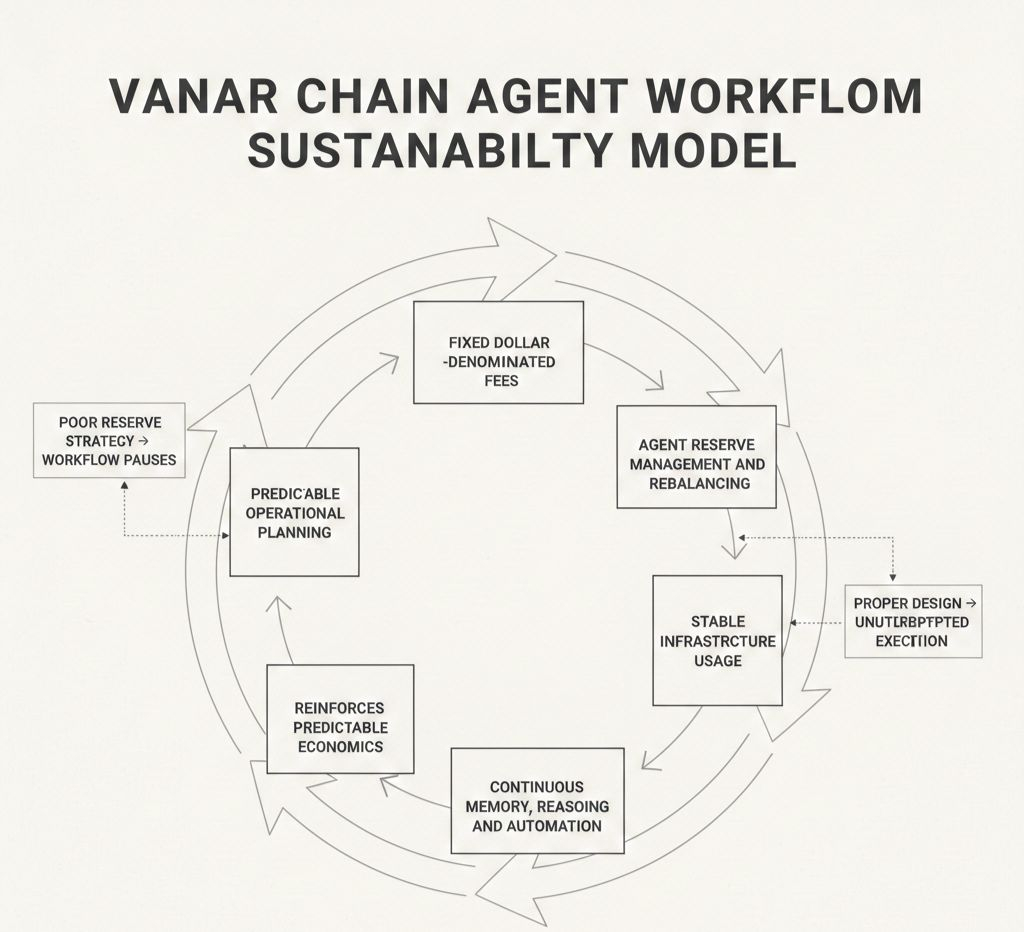

This creates interesting implications for how agents should be designed for Vanar Chain infrastructure.

If you're building an agent that needs operational continuity through market volatility, you either implement dynamic rebalancing that adjusts to price changes daily, or you maintain significant token reserves that absorb price swings without running out mid-cycle.

Kayon reasoning queries show the same pattern. Each query costs approximately $0.0008. At $0.004945, that was 0.162 VANRY per query. At today's $0.006482, it's 0.123 VANRY per query. An agent running 500 queries weekly needed 81 VANRY tokens during the dump but only needs 61.5 tokens now. That's a 24% reduction in token consumption for identical operational load.

Maybe I'm reading too much into agent design patterns. Could just be specific implementation choices without broader implications. But when you calculate the operational economics, the fixed dollar cost structure creates predictability in fiat terms while introducing variability in token consumption that agents need to manage actively.

Flows automation adds another cost layer. Executing an automated action costs approximately $0.0006 per execution. During the dump at $0.004945, that was 0.121 VANRY per execution. Today at $0.006482, it's 0.093 VANRY per execution. An agent executing 100 automated actions daily needed 12.1 VANRY tokens during weakness but only needs 9.3 tokens during recovery.

That 23% reduction in token requirements for the same operational load matters when agents operate on fixed budgets with infrequent rebalancing cycles.

I don't have comprehensive data on how many agent workflows paused during the dump versus continued operating. But the transaction patterns suggest baseline infrastructure usage that persisted through price weakness at reduced efficiency, then resumed full capacity during recovery as token budgets stretched further.

Centralized infrastructure doesn't have this dynamic. AWS charges the same dollar amount regardless of whether your company's stock price moves. Vanar Chain's token-based fee structure introduces exchange rate variability that agent designers need to account for, even though the underlying dollar costs stay constant.

The bet Vanar is making is that predictable dollar costs with floating token costs is manageable for well-designed agents, and that this model works better than variable gas fees that spike unpredictably regardless of how well you design your agent.

My gut says this creates selection pressure for better agent design. Workflows that can't handle token price volatility will fail or pause. Workflows that implement proper rebalancing and reserve management will operate continuously. Over time, the agents running on Vanar Chain will be the ones designed to handle this specific economic model.

Whether that's a feature or a bug depends on whether you believe good agent design should include managing operational token volatility. Centralized services remove that complexity. Decentralized token-based infrastructure introduces it. The tradeoff is verifiable, censorship-resistant operations versus simpler economic predictability.

Time will tell if agents find that tradeoff worthwhile. For now, the operational costs stay predictable in dollar terms, token consumption fluctuates with price, and agent workflows either adapt or pause based on how well they were designed for this specific economic reality.