🟠 Bitcoin & Tether Back Dreamcash – RWA Expansion Accelerates

Bitcoin

Tether

Dreamcash

Tether’s strategic investment in Dreamcash signals a strong push toward mobile-first, self-custodial on-chain trading. The launch of 10 RWA perpetual markets tied to traditional assets such as:

S&P 500

Gold & Silver

Tesla

Nvidia

marks a serious step toward merging TradFi (Traditional Finance) with DeFi (Decentralized Finance).

🔥 The Big Catalyst: $200,000 Weekly Incentives

Dreamcash is launching a $200K weekly rewards program for CASH markets.

👉 Rewards are distributed based on traders’ share of total USDT volume.

👉 This creates immediate liquidity injection.

👉 Incentivizes aggressive participation.

👉 Boosts ecosystem growth.

This is how ecosystems scale — liquidity → incentives → volume → attention → adoption.

If RWA perp markets gain traction, this could trigger the next major narrative rotation in crypto.

📊 Altcoin Technical Analysis & Trade Outlook

🔵 Chainlink ($LINK) – Liquidity Leader Preparing Expansion

Chainlink

Market Structure:

Strong liquidity coin

Buyers defending key support zone

Momentum gradually increasing

Structure supportive for upside breakout

Technical View:

If LINK holds above its demand zone, probability favors an expansion leg upward. Strong liquidity coins tend to move aggressively once structure reclaims resistance.

📈 Outlook: Bullish continuation bias as long as structure remains intact.

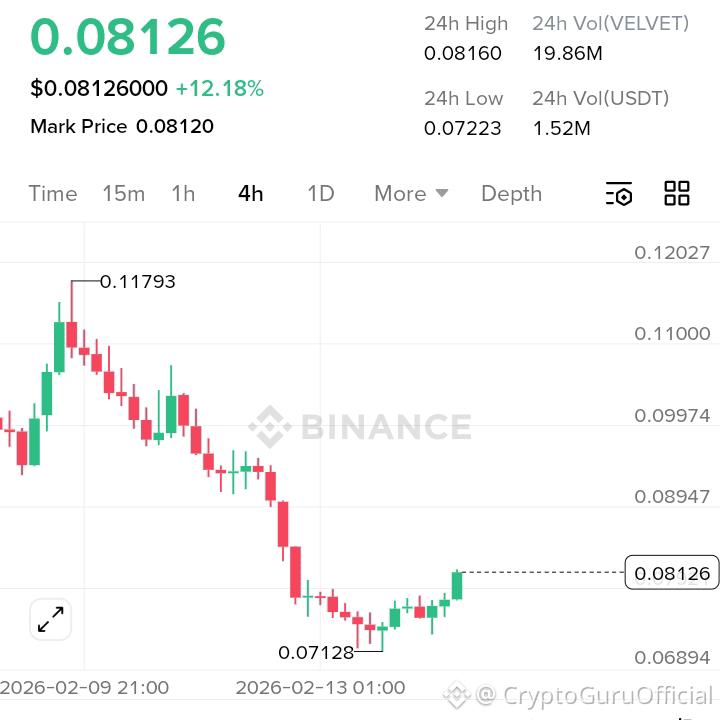

🟣 VELVET/USDT – Reversal Structure Forming

Velvet Capital

Trade Setup:

Entry Zone: 0.0780 – 0.0820

Targets:

0.0900

0.1000

0.1120

0.1250

Stop Loss: 0.0710

Technical Analysis:

Reversal forming from strong support

Early bullish momentum shift

Higher-low structure developing

Volume expansion beginning

If price holds above 0.078, continuation toward resistance ladder is technically valid.

🚀 Momentum Phase: Early breakout preparation stage.

🟢 Solana ($SOL) – Structure Reclaim with Momentum Build

Solana

Trade Setup:

Entry: 85 – 88

Stop Loss: 79

Targets:

95

108

125

Market Signals:

Higher-low bounce from demand

Structure reclaimed

Buyers stepping back in

Momentum rebuilding

SOL historically moves aggressively once reclaim patterns confirm. Holding above 79 keeps bullish structure valid.

⚡ If momentum expands, continuation toward 108–125 becomes realistic.

📌 Macro Perspective: Why This Matters

The combination of:

RWA tokenization

Self-custodial mobile trading

Incentivized liquidity programs

Strong altcoin structure setups

… suggests early signs of capital rotation back into high-beta assets.

If Bitcoin remains stable and liquidity expands through Tether-backed initiatives, altcoins could see significant upside volatility.

⚠️ Risk Note

Leverage trading (especially 20x) increases liquidation risk significantly. Always:

Manage position size

Respect stop losses

Avoid emotional entries

🔥 Final Take

$BTC BTC ecosystem liquidity expansion is bullish long-term

$LINK shows strong liquidity foundation

$VELVET forming early reversal structure

#SOL reclaim setup looks technically clean

If RWA markets gain momentum, we may be witnessing the early stage of the next trading cycle narrative.

Stay sharp. Manage risk. Follow momentum.