🔎 What is RSI?

The Relative Strength Index (RSI) is a momentum oscillator developed by J. Welles Wilder Jr. in 1978.

It measures:

Speed of price movement

Strength of momentum

Overbought & oversold conditions

RSI moves between 0 and 100.

⚙️ How RSI Works

RSI compares:

Average Gain (bullish candles)

Average Loss (bearish candles)

📌 Basic Formula:

RSI = 100 − [100 / (1 + RS)]

(RS = Average Gain / Average Loss)

👉 You don’t need to calculate manually — your chart does it automatically.

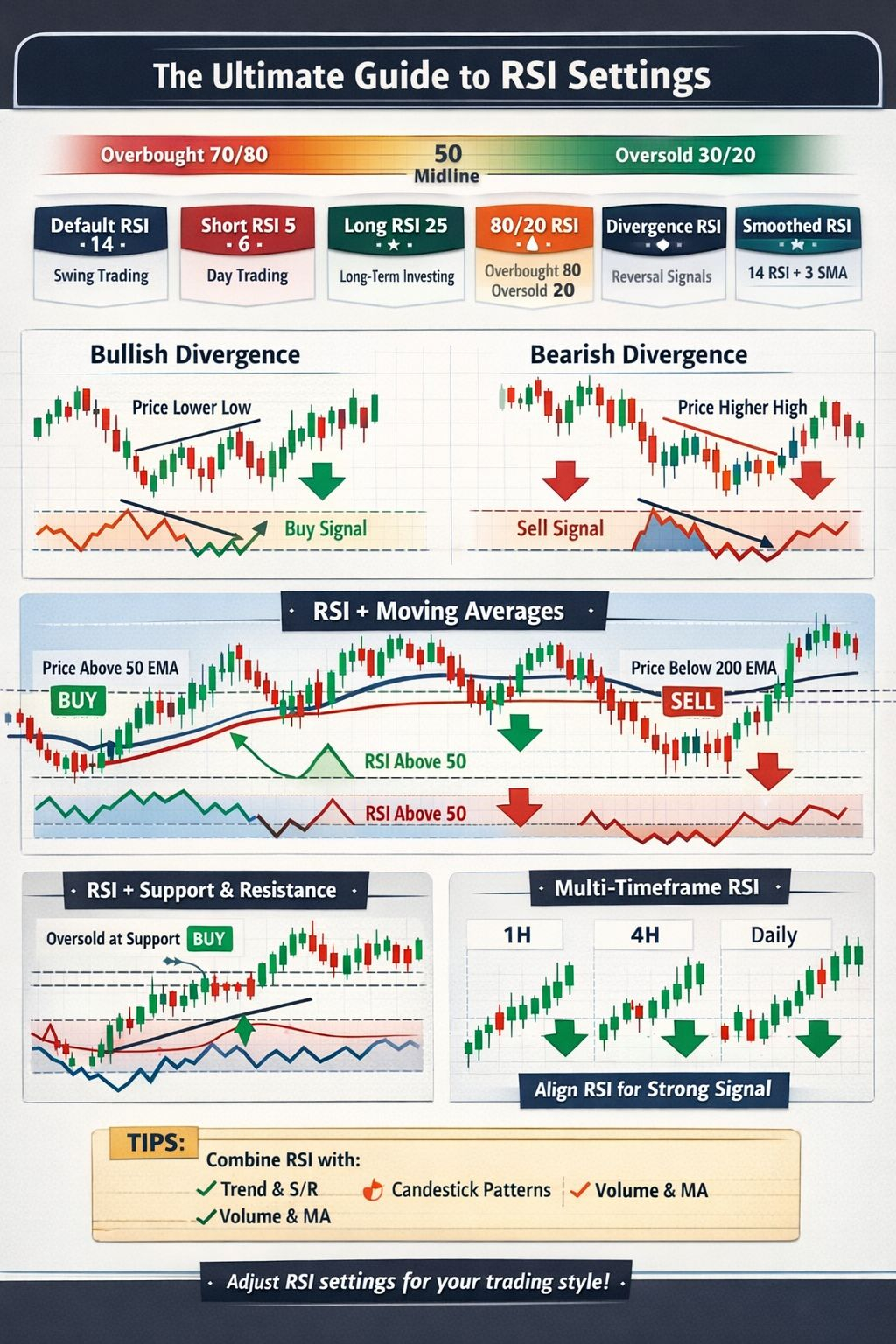

📈 Standard RSI Settings

Setting

Value

Length

14 (Default)

Overbought Level

70

Oversold Level

30

Default settings were recommended by J. Welles Wilder Jr..

🎯 RSI Levels Explained

🔴 Above 70 → Overbought

Market may be overextended

Possible pullback or correction

🟢 Below 30 → Oversold

Market may be undervalued

Possible bounce

⚖️ 50 Level → Trend Strength

Above 50 = Bullish momentum

Below 50 = Bearish momentum

🛠 Advanced RSI Settings (For Traders)

🔹 Scalping (Lower Timeframes)

RSI Length: 7 or 9

Faster signals

More fake signals

🔹 Swing Trading

RSI Length: 14 (standard)

Balanced signals

🔹 Long-Term Trading

RSI Length: 21

Smoother & stronger confirmation

🚀 RSI Trading Strategies

1️⃣ Overbought & Oversold Strategy

Buy → When RSI goes below 30 and crosses back above

Sell → When RSI goes above 70 and drops below

⚠ Works best in sideways markets.

2️⃣ RSI Divergence (Powerful Strategy)

🔥 Bullish Divergence

Price → Lower low

RSI → Higher low

Possible reversal upward.

❄ Bearish Divergence

Price → Higher high

RSI → Lower high

Possible reversal downward.

3️⃣ RSI 50 Level Strategy

In strong trends:

Buy when RSI pulls back near 40–50 in uptrend

Sell when RSI rises near 50–60 in downtrend

Very effective in trending markets.

4️⃣ RSI + Moving Average Combo

Use RSI with:

Exponential Moving Average (EMA)

Simple Moving Average (SMA)

Example: If price above 200 EMA + RSI above 50 → Strong bullish confirmation.

⚠ Common Mistakes Traders Make

❌ Selling immediately at 70

❌ Buying immediately at 30

❌ Ignoring trend direction

❌ Using RSI alone without confirmation

Remember: RSI can stay overbought in strong bull trends!

💡 Pro Tips

✔ Combine RSI with Support & Resistance

✔ Use higher timeframe for confirmation

✔ Look for confluence (trendline + RSI + volume)

✔ Avoid trading only based on one signal

📊 RSI in Crypto Market

RSI works very well in:

BTC

ETH

Altcoins

But crypto is volatile ⚡

So always use proper risk management.

🧠 When RSI Works Best

✅ Sideways markets

✅ Pullbacks in trends

✅ Reversal zones

❌ Not reliable alone during strong breakout moves

📌 Final Summary

RSI is:

Simple

Powerful

Beginner friendly

Professional level tool

If used correctly with trend + volume + key levels, it becomes very powerful.

⚠️ Disclaimer

This content is for educational purposes only. Cryptocurrency trading involves risk. Always do your own research before investing.

#CryptoEduFaisal #RSI #Binance #CryptoEarnings #BinanceSquare