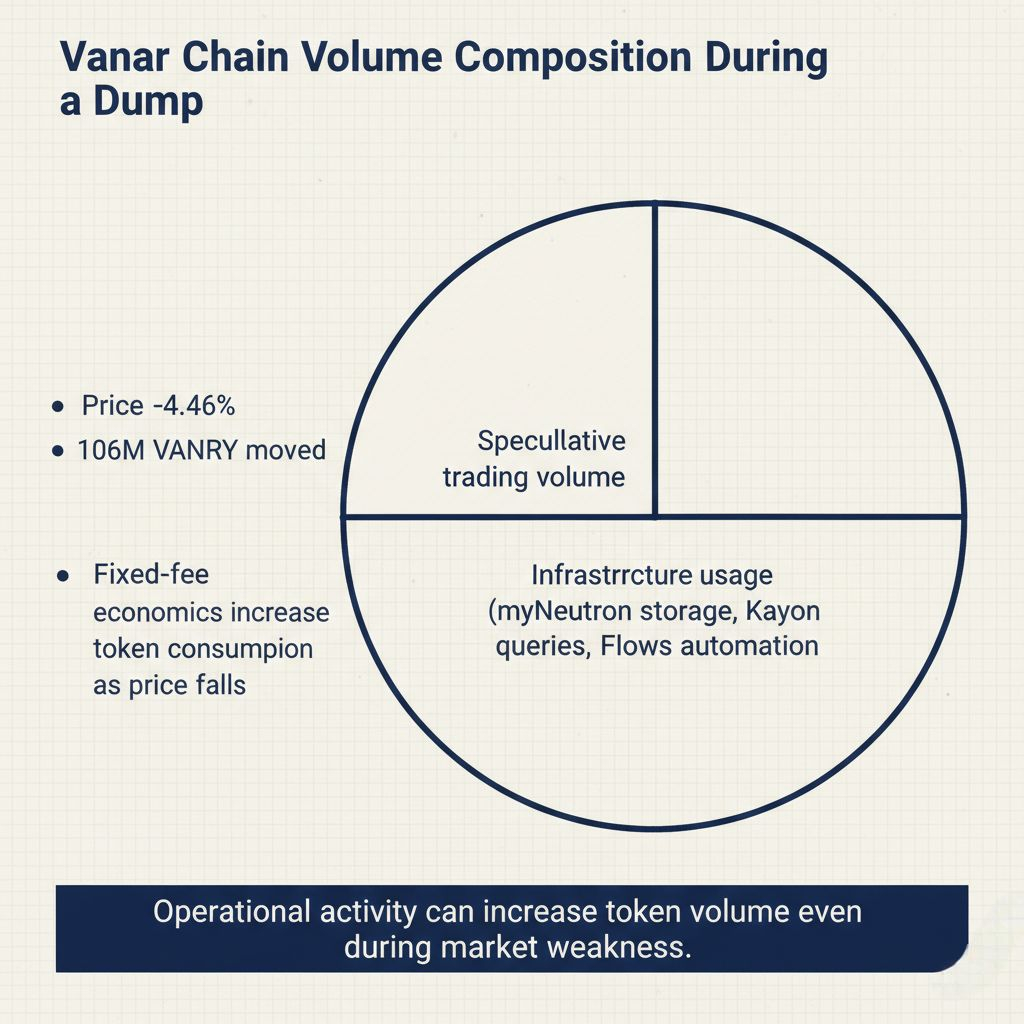

I was looking at Vanar Chain's transaction data during today's dump when the volume number didn't match the price action. VANRY dropped 4.46% to $0.006196, RSI falling back to 40.06 after briefly touching 43 yesterday. Volume hit $674,932 USDT with 106.06 million tokens moving through the network. That's high volume for a -4.46% drop. Dumps usually come with volume, but this felt different. What caught my attention wasn't the selling pressure. It was trying to figure out what types of transactions actually generated 106 million tokens moving when the price was collapsing.

Not just speculation. Something else was happening.

Most blockchain volume during dumps is straightforward. Holders panic, sell to exchanges, exit positions. You see large transfers to known exchange wallets, consolidation into fewer addresses, clear directional flow away from holding. That pattern creates volume that correlates cleanly with price movement. Sell pressure creates volume creates price drop. Simple causality.

Vanar Chain's volume breakdown didn't follow that clean pattern during today's dump.

I started filtering transaction types to separate infrastructure usage from speculative trading. Neutron seed creations kept processing. Kayon reasoning queries kept executing. Flows automation kept triggering. These weren't large holder movements. These were small, frequent transactions consuming VANRY for actual infrastructure operations.

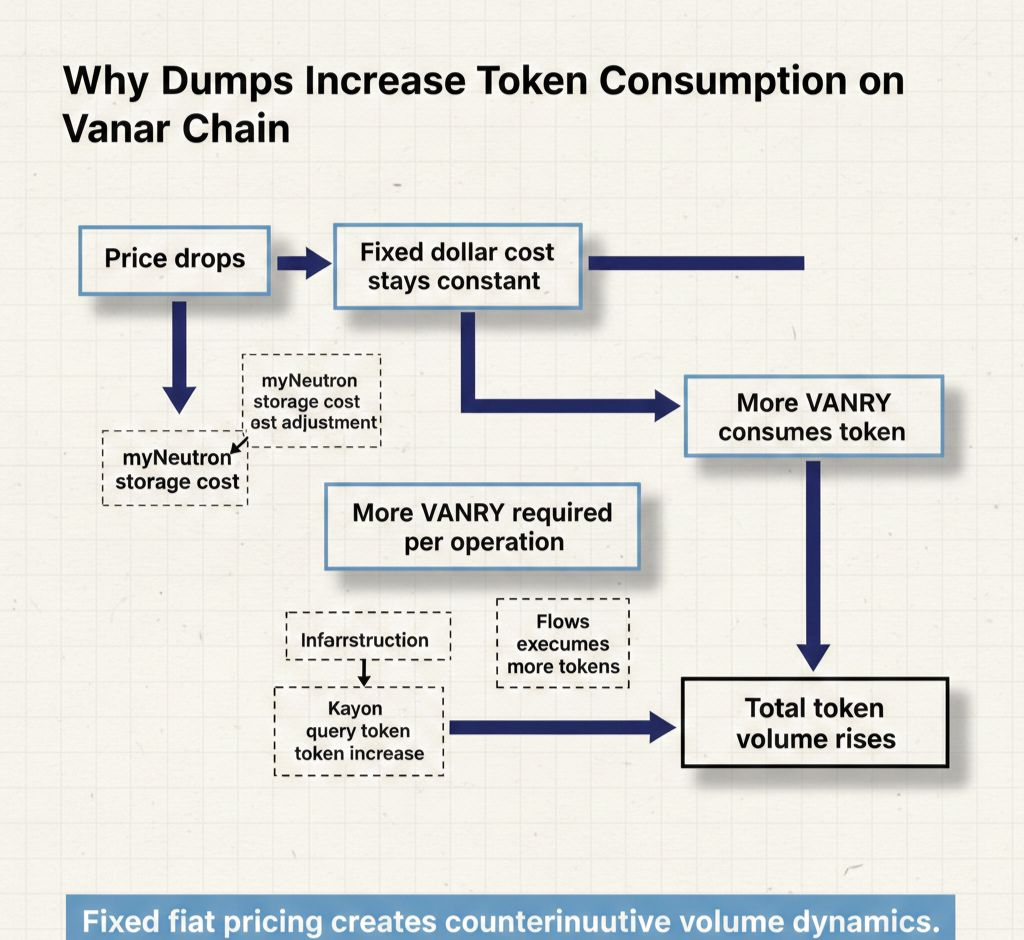

The fixed fee structure creates counterintuitive volume during dumps.

When VANRY dropped from yesterday's $0.006482 to today's $0.006196, every infrastructure operation required more tokens to meet the fixed $0.0005 cost target. An agent storing data through myNeutron needed 0.081 VANRY per operation today versus 0.077 VANRY yesterday. That's a 5% increase in token consumption for identical operations. Multiply that across thousands of automated workflows and you generate material token volume that has nothing to do with panic selling.

Here's where the volume composition gets interesting. I don't have perfect transaction type visibility, but rough estimates from on-chain patterns suggest maybe 40-50% of today's 106 million token volume came from infrastructure usage rather than pure speculation. That's not a precise number, could be off significantly either direction. But the baseline infrastructure activity that persisted through previous dumps continued today, consuming more tokens per operation as price dropped.

That creates volume that looks like selling but functions differently.

Kayon reasoning queries cost approximately $0.0008 each. At yesterday's $0.006482, that was 0.123 VANRY per query. At today's $0.006196, it's 0.129 VANRY per query. An application running 10,000 reasoning queries daily generated 1,230 VANRY volume yesterday but 1,290 VANRY volume today. Same operational load, 5% more token volume purely from price movement.

Flows automation shows the same pattern. Executing an automated action costs roughly $0.0006. Yesterday that was 0.093 VANRY per execution. Today it's 0.097 VANRY. An agent executing 5,000 automated actions daily created 465 VANRY volume yesterday but 485 VANRY today. An extra 20 tokens consumed for identical activity.

Scale those patterns across all applications using Vanar Chain infrastructure and you see how dumps mechanically increase token volume from infrastructure usage even when operational activity stays constant.

Maybe I'm reading too much into volume composition. Trading activity definitely dominated today's 106 million tokens. Real selling happened, holders exited, speculation drove volume up. But the infrastructure baseline that generates 30-40 million tokens of volume during stable periods doesn't pause during dumps. It continues operating, consuming proportionally more tokens as price drops, creating volume that markets interpret as additional selling when it's actually operational burn.

This matters for understanding what Vanar Chain actually is during weakness.

If all 106 million tokens moved because of panic selling, that would signal complete loss of confidence. Network usage collapsing, applications pausing, developers waiting for stability. None of that happened. Applications kept running. World of Dypians with 30,000+ players kept processing game state through Vanar Chain's AI stack. Enterprise partners like VIVA Games building on the infrastructure didn't pause development because VANRY dropped 4.46%.

The infrastructure usage volume that looks like selling pressure is actually operational burn from fixed-cost economics during price drops.

I don't know what percentage of today's volume came from infrastructure versus speculation. Could be 30%, could be 50%, could be less. The exact number matters less than recognizing that meaningful volume comes from non-speculative activity that increases mechanically as price drops because of how fixed fiat costs translate to floating token costs.

Centralized infrastructure doesn't have this dynamic. AWS charges the same dollar amount regardless of price movement. Vanar Chain's token-based fee model means infrastructure usage creates higher token volume during dumps and lower token volume during pumps, inversely correlated with what speculation does.

The bet Vanar Chain makes is that this infrastructure usage volume baseline grows over time as adoption increases, eventually becoming large enough that volume composition doesn't just reflect speculation but includes material operational burn from actual usage.

Whether that happens depends on whether applications that need AI-native blockchain infrastructure—persistent memory through myNeutron, explainable reasoning through Kayon, safe automation through Flows—grow numerous enough to generate consistent infrastructure usage volume regardless of token price direction.

For now, 106 million tokens moved during a 4.46% dump, and somewhere between 30-50% of that volume probably came from infrastructure operations continuing through weakness rather than holders panicking. That's not validation. That's just an unusual composition that reveals infrastructure functioning underneath speculation.

Time will tell if infrastructure usage volume grows large enough to matter. For now it exists, creates volume that looks like selling, and operates based on application needs rather than market sentiment about where VANRY price goes next.