Why Settlement Isn’t an Add-On, It’s the Core Primitive

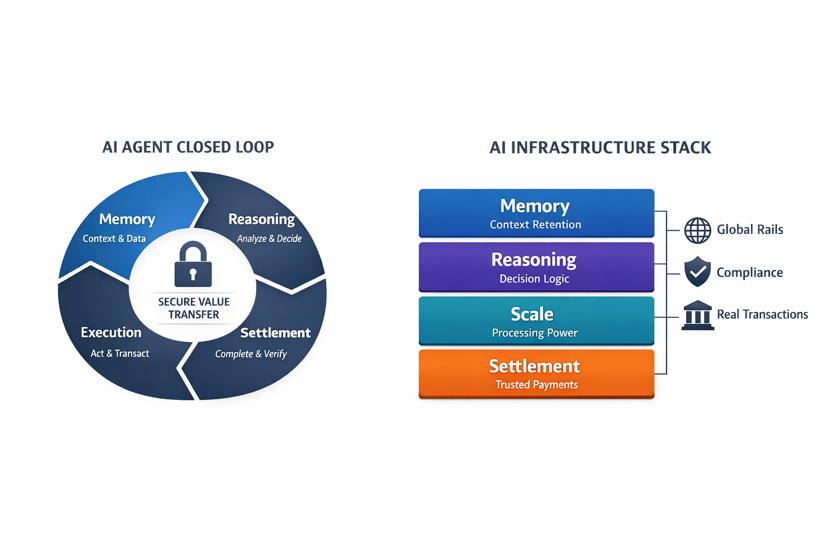

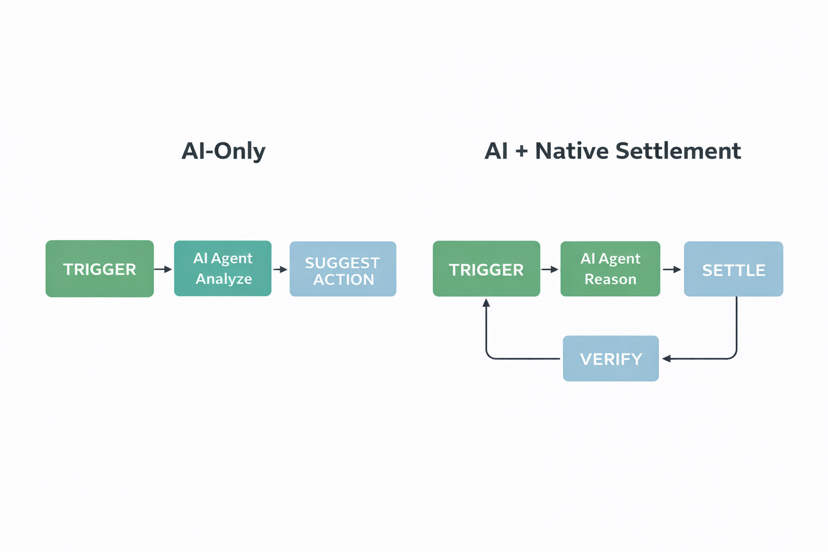

One of the most misunderstood aspects of AI agents in Web3 is assuming they can thrive without seamless settlement. People picture agents as smart coordinators — reasoning over data, automating decisions — but forget that real utility demands closing the loop with value transfer. Traditional wallet UX doesn’t cut it for agents; it’s built for humans clicking approvals, not autonomous systems executing in the background. Agents face real-world constraints like compliance hurdles, global rail incompatibilities, or the simple fact that without trusted settlement, they stay in simulation mode — suggesting actions but never completing them. In environments where speed and reliability matter, like finance or commerce, this gap turns promising tech into isolated experiments.

Payments are essential because settlement is a core AI primitive, not an afterthought. Without real settlement, agents stay stuck in “think but don’t act” mode. They can analyze, suggest, even plan — but they can’t actually move money or close the loop. That’s why compliance and global payment rails are so important. Agents need to navigate regulations, handle cross-border transfers, and prove every step without depending on centralized gatekeepers.

Vanar gets it by treating payments as core infra, not a side demo. Coming off their December 2025 Worldpay partnership (kicked off at Abu Dhabi Finance Week), they’re pushing agentic payments — AI handling dynamic on-chain settlements. Worldpay processes trillions a year and even runs validators on Vanar, mixing their global rails with Vanar’s AI-native stack for flows that are compliant and smart right out of the gate. The December 2025 hire of Saiprasad Raut as Head of Payments Infrastructure (ex-Worldpay and Stripe) further cements this — bridging TradFi, crypto, and AI to make settlement a seamless primitive. I felt this shift in my own tests from Kozyn last week setting up a mock PayFi agent on testnet: it monitored tokenized invoices over days (Neutron Seeds preserving history), used Kayon to reason risks, and auto-settled a small transfer if conditions cleared. No wallet prompts, no external rails — fees low, compliance baked in via verifiable checks. On setups without this, I’d hit approval walls or reset loops; here, it flowed like a complete system.

This aligns $VANRY with real economic activity. Gas from agent settlements, coordinations, and queries embeds the token in operational flows — not speculation. In a low-cap setup, it positions $VANRY for demand from sustained use, like compliant PayFi or tokenized payouts.

Most chains add payments later. Vanar builds them as the closing primitive for AI. In 2026, the platforms where agents can settle autonomously will quietly dominate. From my tinkering, this isn’t abstract — it’s turning experiments into tools that handle value end-to-end. If Vanar keeps integrating rails like this, it could make agentic finance the default.

Tried agentic payments on Vanar? What’s your take on settlement as an AI must-have?