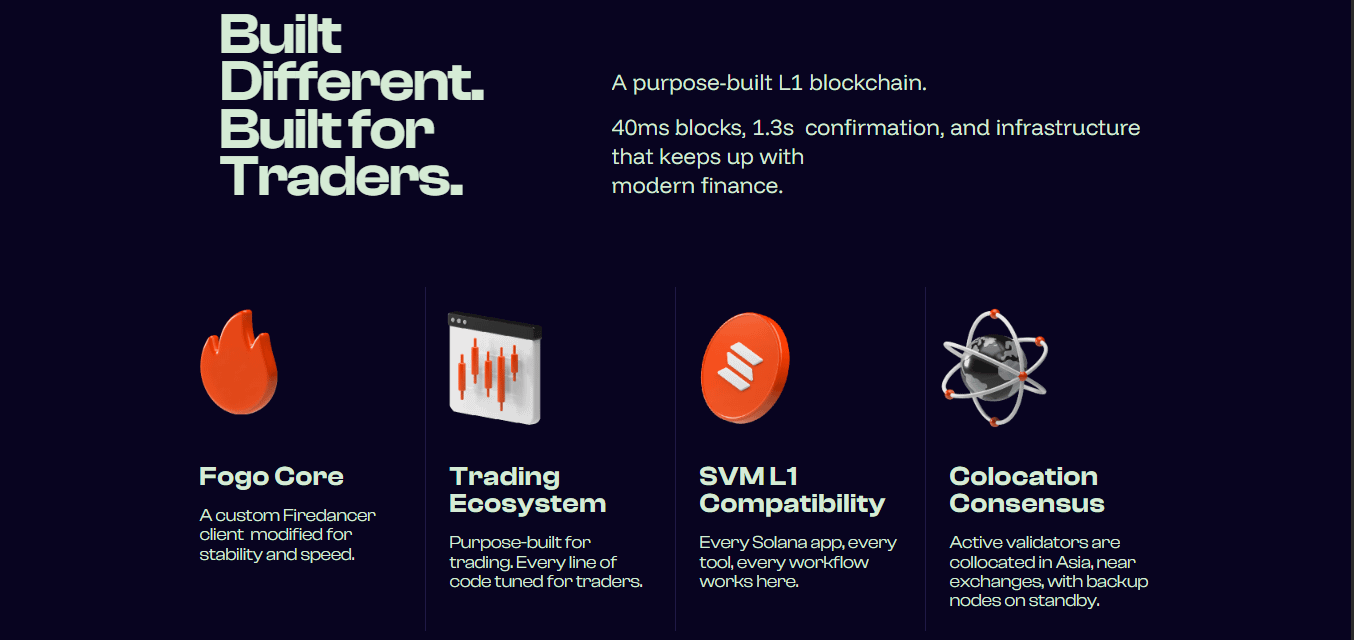

The crypto space has seen countless projects promise revolutionary performance, but Fogo enters the arena with 40 millisecond block times and sub-second finality that actually exist in testnet form. Built as a Solana Virtual Machine compatible Layer 1 blockchain, Fogo represents an ambitious attempt to bring traditional finance execution speeds to decentralized infrastructure. The question is not whether the technology works in controlled environments, but whether it can deliver on its promises when facing real-world pressures.

The Fogo protocol was conceived by Robert Sagurton and Douglas Colkitt, bringing together expertise from Jump Crypto, JPMorgan, and Citadel. This is not a team of blockchain dreamers but rather trading professionals who understand what institutional users actually need. The technical development comes from Douro Labs, the same group behind the Pyth oracle network. On paper, this combination of traditional finance experience and blockchain engineering talent creates a strong foundation.

The architecture makes some bold choices that separate Fogo from typical blockchain designs. Instead of running multiple validator clients for diversity, Fogo will run with a single canonical client based on Firedancer. This is a deliberate tradeoff that prioritizes raw speed over the theoretical security benefits of client diversity. The team argues that when pushing blockchain performance to physical limits, different client implementations would share core architectural decisions anyway, making diversity largely theoretical.

More controversial is the validator colocation model. All initial active validators operate within a single high-performance data center in Asia, strategically positioned near major crypto exchange infrastructure. This is borrowed directly from high-frequency trading practices where milliseconds matter. For traders accustomed to centralized exchanges, this makes perfect sense. For blockchain purists concerned about geographic decentralization, it raises immediate red flags. Fogo does maintain backup nodes in alternate data centers for contingency rotation, but the active consensus happens in one location.

The multi-local consensus mechanism offers an interesting middle ground. Validators dynamically co-locate to reduce network latency while maintaining fallback to global consensus . If local consensus cannot be reached, the network intelligently falls back to a slower but more distributed global consensus. This design acknowledges that perfect decentralization and maximum speed are competing objectives, then creates a system that can toggle between them based on conditions.

Performance metrics from the testnet environment show impressive numbers. The devnet recorded 54,000 transactions per second, significantly outperforming Ethereum and competitive with Solana under ideal conditions. Block times have been measured averaging closer to 40ms in testnet Messari, which is imperceptibly fast for human users. These are not theoretical projections but actual measurements from working code.

The ecosystem is being built with a vertical integration strategy that differs from most blockchain projects. Core elements include Pyth Network providing native price feeds and Ambient Finance supplying the enshrined DEX. This is not an empty blockchain waiting for applications to emerge organically. The team has pre-integrated critical infrastructure for trading, creating a cohesive stack from execution to price feeds to settlement.

Ambient Finance represents a particularly interesting component. Unlike most conventional onchain perps DEXs, Ambient will move away from the traditional CLOB model to a Dual Flow Batch Auction model. This design removes speed-based advantages by settling trades in batches linked to an oracle, making traders compete purely on price rather than latency. In theory, this creates fairer execution. In practice, it remains to be tested whether users will prefer this model over the familiar central limit order book.

The curated validator set is where Fogo makes its most explicit tradeoff. The initial set includes 20 to 50 high-performance validators in a proof of authority style, with governance later transitioning to validator supermajority voting. This prevents underperforming nodes from degrading network speed and deters predatory MEV behavior. It also creates a permissioned system that looks more like a consortium blockchain than a fully open network. The team argues this is necessary for enterprise-grade reliability. Critics will argue it sacrifices the permissionless ideals that make blockchains valuable.

Funding has been substantial and comes from serious players. The project has raised 20.5 million dollars across three rounds , including participation from Distributed Global and CMS Holdings. The token launched in January 2026 and has experienced typical volatility. Early investors who bought at the sale price have seen their positions decline, while those who entered after launch have mixed results depending on timing.

The SVM compatibility is genuinely valuable for ecosystem bootstrapping. Developers can migrate existing Solana programs with minimal changes, instantly giving Fogo access to battle-tested DeFi protocols and tooling. This is not starting from zero the way entirely novel blockchain architectures must. Projects like Valiant DEX, Pyron lending, and various infrastructure providers are already committed to launching on Fogo.

But serious questions remain about whether this can scale beyond controlled testnet conditions. Achieving 54,000 TPS with a handful of validators in one data center is impressive engineering. Maintaining that performance as the network grows, as transaction types become more complex, as adversarial actors probe for weaknesses, is an entirely different challenge. Solana itself has demonstrated that testnet performance and mainnet reality can diverge significantly.

The concentrated validator model creates obvious centralization concerns, but it also creates concentration risk. If that single Asian data center experiences connectivity issues, power problems, or regulatory intervention, the entire active consensus layer goes down simultaneously. The backup validators can take over, but this switches the network to slower global consensus mode, negating the primary value proposition of ultra-low latency.

The enshrined DEX model is both a strength and a limitation. Having Ambient Finance deeply integrated means trading infrastructure works seamlessly from day one. It also means the network is tightly coupled to one particular DEX architecture. If Ambient's batch auction model does not gain traction with users, or if a superior trading mechanism emerges, Fogo has locked itself into specific design choices that may be difficult to change.

Market adoption is the ultimate test that Fogo has not yet faced. Professional traders will not migrate from centralized exchanges just because blockchain latency improved. They need deep liquidity, tight spreads, reliable uptime, regulatory clarity, and institutional custody solutions. Fogo addresses the latency problem effectively, but latency is only one variable in a complex equation. Retail users might not notice the difference between 40 millisecond blocks and 400 millisecond blocks in their actual trading experience.

The tokenomics and incentive structure will matter enormously. Projects with strong technology but poor token economics have repeatedly failed to gain sustainable traction. Early distribution, inflation schedule, validator rewards, and governance rights all impact whether stakeholders remain aligned over multi-year timeframes. These details are still emerging and will significantly influence long-term viability.

Regulatory risk looms larger for a project explicitly targeting institutional users and traditional finance use cases. Regulators pay more attention to platforms that court Wall Street than those serving only crypto natives. The curated validator model might actually help by providing clear entities for compliance, but it also creates centralized points where regulatory pressure can be applied effectively.

Competition is intensifying in the high-performance blockchain space. Solana continues to optimize and has the advantage of established liquidity and ecosystem. Sui and Aptos bring novel architectures with strong backing. Monad promises EVM compatibility at extreme speeds. Fogo needs to not just be fast, but be meaningfully faster and better than alternatives that are also improving rapidly. The performance gap that exists today may shrink as competitors iterate.

The technical team has credibility and the architecture shows sophisticated understanding of the tradeoffs involved in high-performance distributed systems. They are not making unrealistic promises about having solved the blockchain trilemma. Instead, they explicitly acknowledge sacrificing certain decentralization properties to achieve specific performance targets. This honesty is refreshing, but it also means the project will appeal to a narrower audience than platforms claiming to offer everything simultaneously.

Infrastructure partnerships are developing but remain early stage. Wormhole integration provides cross-chain liquidity pathways. Various indexing services, wallets, and analytics tools are committing to Fogo support. Whether these partnerships translate into actual user activity depends on factors beyond technology, including marketing, business development, and the broader market environment.

The Fogo Flames points program represents a standard playbook for bootstrapping early activity. Users earn rewards for staking, trading, providing liquidity, and social engagement. These programs effectively generate testnet usage and community enthusiasm. They also attract mercenary capital that disappears immediately when rewards end. Converting points farmers into genuine long-term users is a challenge every new blockchain faces and most fail to fully solve.

Mainnet launch timing matters considerably. Launching during a bear market means less attention and liquidity regardless of technical merit. Launching during peak bull market mania creates unsustainable expectations and attracts users who will leave at the first downturn. The team appears to be taking a measured approach rather than rushing to market, which shows maturity but also means they compete with projects that are already live and iterating.

Fogo represents a serious attempt to build blockchain infrastructure that matches traditional finance performance standards. The technology works in testnet environments. The team has relevant expertise. The backing is substantial. The architecture makes deliberate tradeoffs that prioritize speed over maximum decentralization. Whether these choices prove correct depends entirely on market demand for ultra-low latency decentralized trading and whether institutional users actually migrate to blockchain rails when performance barriers are removed. The vision is compelling. The execution so far is solid. The ultimate success remains genuinely uncertain.

#fogo $FOGO @Fogo Official