What Is an NFT?

An NFT (Non-Fungible Token) is a unique digital asset recorded on a blockchain that proves ownership and authenticity of a specific item. Unlike cryptocurrencies, which are interchangeable, each NFT is distinct and cannot be exchanged on a like-for-like basis.

NFTs were introduced to solve three core problems in the digital world:

Digital ownership: Proving who owns an original digital file.

Creator monetization: Allowing artists to sell directly and earn royalties on resales.

Verifiable scarcity: Creating limited digital assets with transparent supply.

The Rise: 2021-2022 Boom

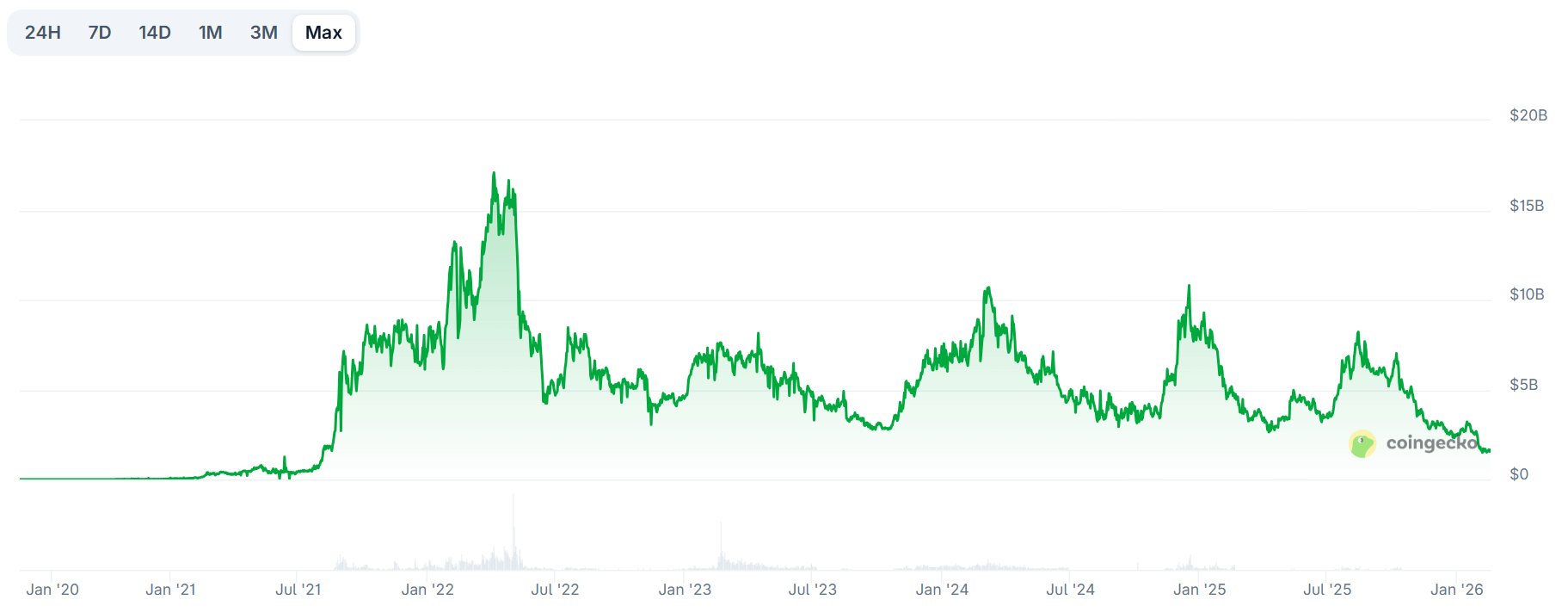

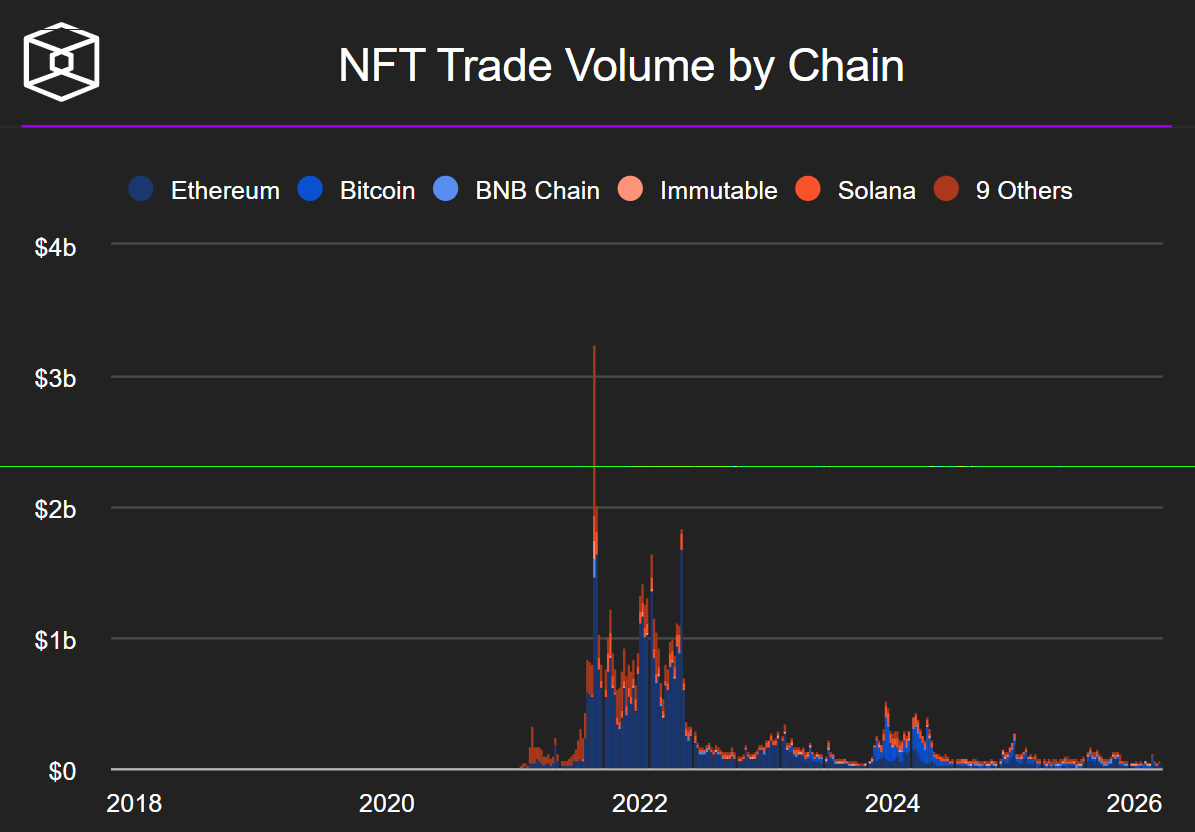

The NFT market surged into global attention in 2021. Digital artworks sold for millions of dollars. Profile picture collections became online status symbols. Celebrities, influencers, and brands launched NFT collections. Trading volumes on major marketplaces reached billions per month.

The narrative was powerful: digital ownership had finally arrived.

Speculation fueled rapid price appreciation. Early buyers enjoyed exponential gains. Media coverage fueled demand. For a moment, NFTs embodied the forefront of Web3 culture.

The Collapse: 2022-2024 Downturn

As broader crypto markets declined, NFT trading volume plummeted. Floor prices in major collections dropped substantially from peak levels. Liquidity evaporated. Many projects went dark or abandoned.

Retail investors who entered for short-term gains left the market. Headlines started declaring that NFTs were dead.

But market shrinkage doesn’t necessarily mean technological obsolescence.

Why Many Believe NFTs Are Dead

Several inherent flaws were revealed during the downturn:

Speculation without utility

Thousands of low-quality copycat projects

Misunderstanding of risk among new investors

Celebrity projects that failed to deliver

Lack of sustainable long-term demand

For many in the market, NFTs were considered trading vehicles rather than ownership technology. Once price momentum disappeared, so did interest.

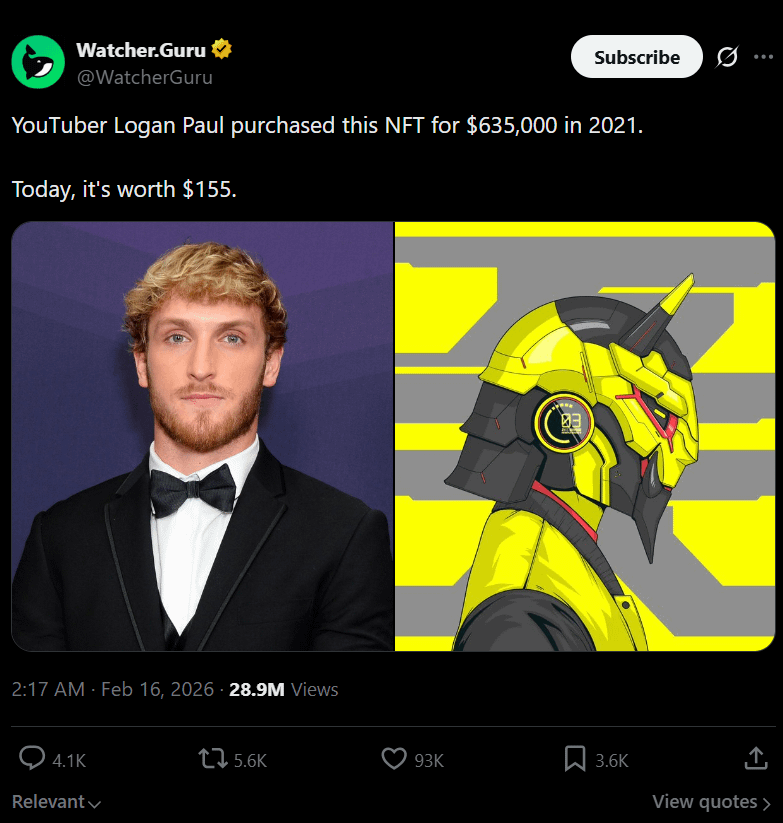

The Logan Paul Case: A Symbol of the Cycle

Celebrity involvement was a major factor in the acceleration of NFT mania. One such celebrity was Logan Paul and his involvement in NFT projects, such as CryptoZoo.

During the 2021 NFT market peak, Logan Paul bought an NFT from the 0N1 Force collection for around $635,000. At the peak of the bull market, such purchases were considered digital status symbols and long-term cultural assets.

Recent market information indicates that the same NFT is now worth around $155. This is a fall of over 99.9% from its original purchase price.

This extreme price drop highlights several inherent realities of the NFT market:

Peak prices were driven by hype and social momentum.

Liquidity within the NFT market is highly cyclical and demand-driven.

Many profile picture collections lacked sustainable revenue streams or utility models.

CryptoZoo also received criticism and legal challenges for failing to deliver on expectations, further fueling public disillusionment with celebrity NFT projects.

Recently, Logan Paul made news again by selling a rare physical Pokémon card for around $16.5 million. Although this sale was record-breaking, it was not a revival of the digital NFT. Rather, it brought attention to the difference between traditional markets for collectibles, which have deep liquidity and demand, and the volatile NFT market.

The case does not represent the failure of NFT technology. It shows how a speculative price structure, unconnected to long-term utility, can rapidly unwind once market sentiment changes.

What Actually Died

What has largely died is:

Rapid flipping for guaranteed profits

Hype-driven influencer cycles

Low-effort JPEG collections with no utility

Irrational valuations unconnected from real demand

The speculative bubble popped. The infrastructure is still there.

What Is Still Developing

Although trading volumes are down, NFT technology is still developing in terms of use cases:

Gaming: Ownership of in-game items and digital economies

Ticketing: Fraud-proof digital tickets

Membership systems: Token-gated communities and loyalty programs

Digital identity: Verifiable credentials and online authentication

Real-world asset tokenization: Representation of physical assets on blockchain networks

These applications are less about speculation and more about utility.

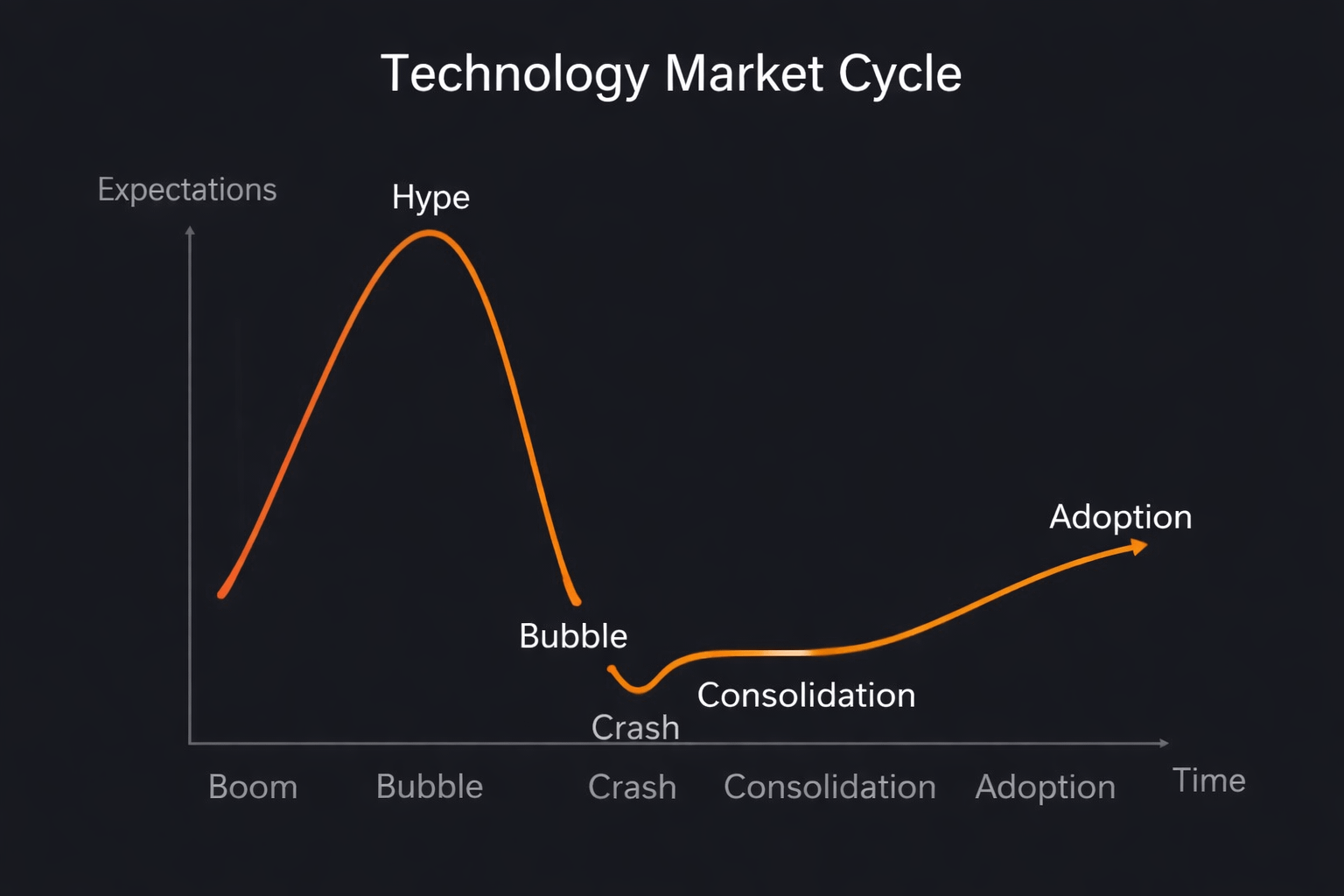

Market Cycles and Innovation

It is a pattern of history that new technologies go through speculative market cycles before reaching maturity. Interest accelerates, capital pours in, and a bubble forms. Eventually, a correction occurs.

After the correction, serious builders are left. Infrastructure develops in the background. Regulation becomes more defined. The technology moves past the hype cycle.

The NFT market seems to be at this point in time.

The Structural Shift

The initial NFT market was all about digital collectibles and profile picture projects.

The next wave could be characterized by:

Smooth integration into apps and games

Utility that users interact with but are unaware of

Institutional testing

More defined regulatory frameworks

In this scenario, NFTs could become invisible infrastructure rather than a hype asset.

Final Verdict

NFTs are not dead.

The hype cycle is over. The speculative bubble has burst. Many initial projects have failed.

However, the underlying technology is still in place.

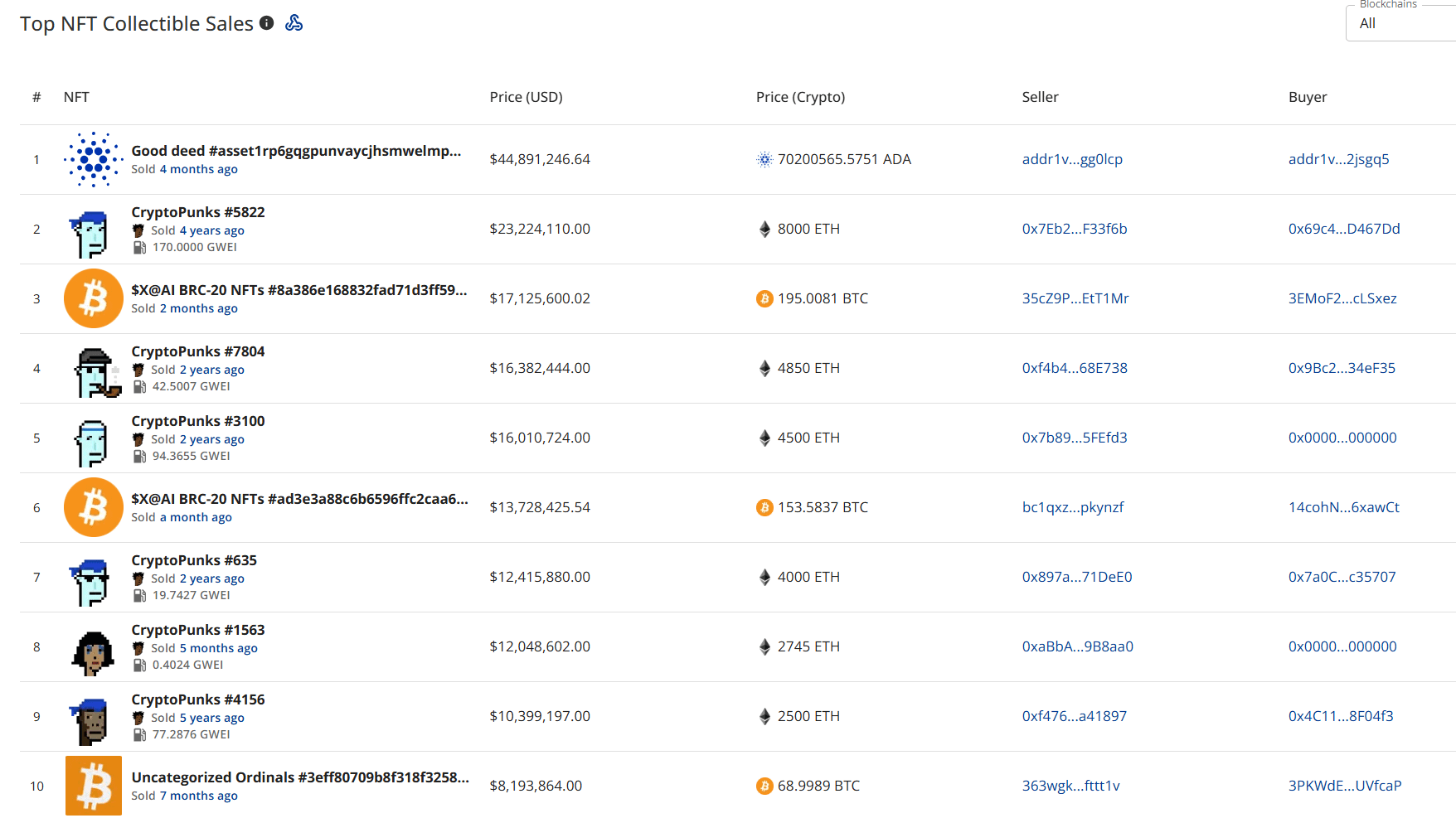

High-Value Sales Still Occur

Utility-focused NFTs are quietly developing outside the spotlight.

The future of NFTs will probably be more subdued, more utility-focused, and less about the headlines.

#NFT #NFTComeback