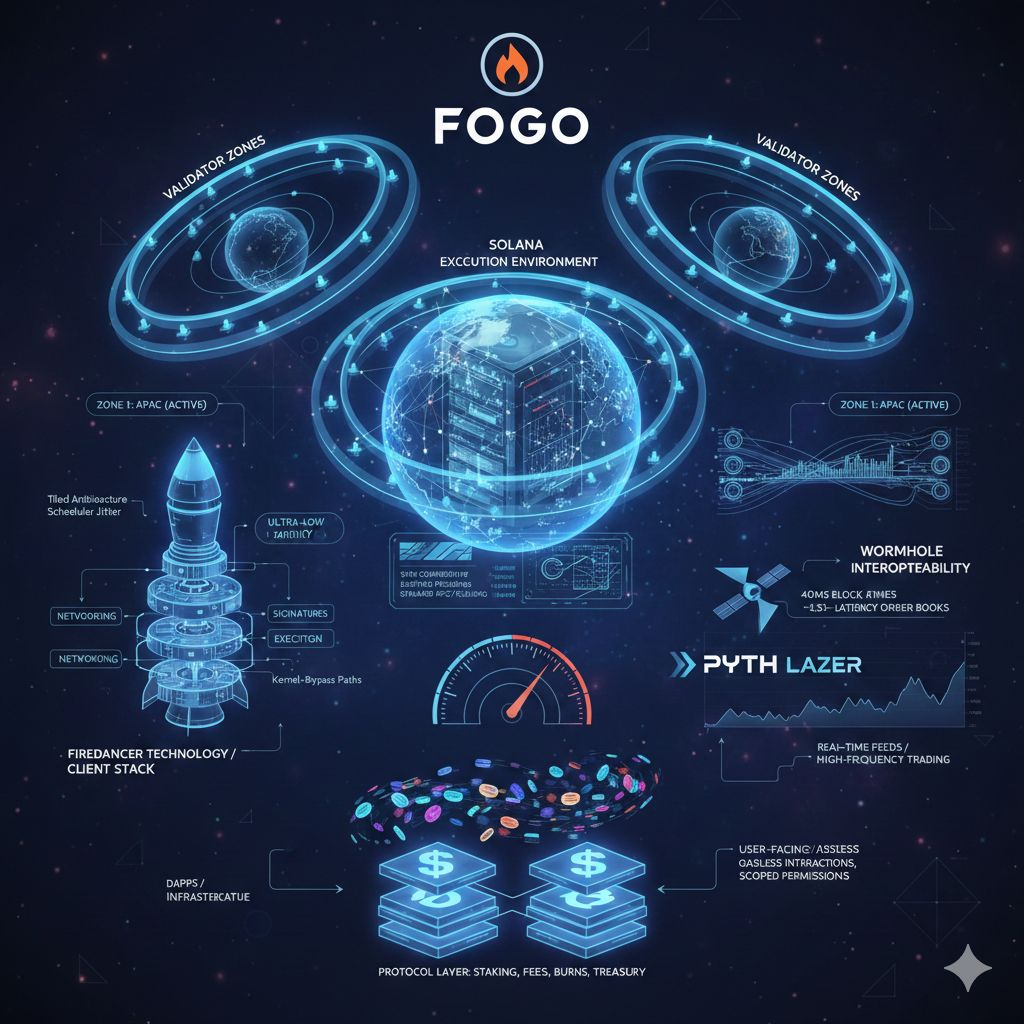

Fogo is building an SVM Layer-1 around a blunt constraint most chains try to abstract away: physics. The project keeps the Solana execution environment so existing Solana programs and the standard RPC/tooling can work with minimal friction, then redesigns the surrounding network and validator stack to reduce the real bottleneck for trading-grade applications—end-to-end latency and its ugly tail. Fogo’s own docs are explicit about this “Solana runtime + RPC compatibility” goal, positioning it as a chain you can reach with the Solana CLI and Solana-compatible keypairs.

At the core is a geographic “validator zone” model that treats distance as a protocol variable, not an accident. Validators are assigned to zones stored on-chain, and only one zone is active for consensus during an epoch; validators outside the active zone still follow the chain and stay synced, but they do not propose blocks, vote, or earn consensus rewards while inactive. The active set is enforced through stake filtering at epoch boundaries, and Fogo describes multiple selection strategies, including epoch-based rotation and a “follow-the-sun” schedule that can switch activity based on UTC windows rather than waiting for epoch boundaries. This is a very specific performance thesis: if you can shrink the quorum’s physical diameter, you can shrink the time it takes for leaders, votes, and propagation to converge without pretending bandwidth and propagation are free.

The second pillar is validator determinism. Fogo isn’t merely “SVM-compatible”; it is also trying to be validator-performance predictable by standardizing the client stack around Firedancer technology engineered by Jump Crypto, starting from a hybrid implementation it calls “Frankendancer.” In the litepaper, that implementation is described as a tiled architecture—separate sandboxed processes pinned to dedicated CPU cores for networking, signature verification, packing, execution, PoH, shredding, and more—designed to reduce scheduler jitter, maximize cache locality, and push packet I/O down toward kernel-bypass paths like AF_XDP for lower overhead. The philosophy is straightforward: if latency is your product, you cannot accept a long tail of “some validators are slower today” and still claim predictable execution.

Those design choices show up in what’s actually live. Fogo’s mainnet documentation states that mainnet is running with a single active zone today (Zone 1, APAC) and provides the public RPC endpoint, entrypoints, and genesis hash used for configuration. On the ecosystem side, interoperability was a launch priority: Wormhole announced mainnet interoperability support and frames Fogo as built for low-latency applications, including on-chain order books and liquidation engines, with published performance claims such as 40ms block times and ~1.3s confirmations. Fogo’s own ecosystem docs say transfers are already live via Portal Bridge and enumerate Wormhole products available on the network. For market data, the docs also highlight Pyth Lazer as a low-latency oracle built on Pyth Network infrastructure, intended for real-time feeds in high-frequency trading and time-sensitive DeFi.

Token utility on Fogo is deliberately split into two layers: what secures the chain, and what users feel. At the protocol layer, the litepaper describes a Solana-like fee model where a basic one-signature transaction costs 5,000 lamports, optional priority fees can be added during congestion, and value is split so that half of the base fee is burned and half is paid to the processing validator (with priority fees paid to the block producer). It also outlines a rent mechanism (with a stated 3,480 lamports per byte-year rate, rent-exemption via minimum balances, and burn/distribution mechanics) designed to discourage uncontrolled state growth while keeping the default user experience rent-exempt. For security incentives, Fogo states mainnet operates with a fixed 2% annual inflation rate, with newly minted tokens distributed to validators and delegated stakers via an epoch-based points system tied to stake and vote credits.

The user-facing layer is where Fogo gets distinctive: Sessions are positioned as a chain-level primitive for “gasless, session-based” interactions using paymasters and scoped permissions, but with a sharp constraint—Sessions only allow interacting with SPL tokens and explicitly do not allow interacting with native FOGO. The docs spell out the intended outcome: everyday activity should happen in SPL assets, while native FOGO is reserved for paymasters and low-level protocol primitives. This matters because it’s not just a UX feature; it’s an economic design choice. If dApps and infrastructure providers are the ones reliably touching native FOGO (to sponsor fees, run validators, and secure consensus), then FOGO’s “daily demand” can skew toward sophisticated actors rather than every end user—closer to an infrastructure commodity than a retail gas token.

On distribution and value accrual, the most canonical source is Fogo’s own tokenomics post (dated January 12, 2026), which frames $FOGO as the native gas and staking asset while also introducing a third mechanism it calls a “flywheel”: the foundation supports high-impact projects via grants/investments and partners commit to revenue-sharing agreements designed to route value back to the network, with the post stating that several agreements are already in place. The same post details genesis distribution categories and percentages—including Community Ownership (16.68%, combining Echo raises, a Binance Prime Sale, and an airdrop), Institutional Investors (12.06%), Core Contributors (34%), Foundation (21.76%), Advisors (7%), Launch Liquidity (6.5%), and a Burned allocation (2%)—and states that 63.74% of genesis supply is locked at launch with gradual unlocks over four years for several categories. (Secondary explainers, such as one from Backpack Exchange, broadly align with the same structure—community, contributors, investors, advisors, foundation, liquidity—though the exact category percentages can differ depending on how allocations are grouped, which is why the project’s own tokenomics post should be treated as primary. )

Recent updates point in the same direction: less marketing polish, more low-level throughput work. Fogo’s release notes for v20.0.0 mention moving gossip and repair service traffic to XDP, adding support for native token wrapping/transferring with Sessions, and reducing consecutive leader slots, alongside bug fixes. These are not cosmetic changes; they’re the kind of knobs you turn when you’re trying to make “fast in a benchmark” become “fast in production,” especially in networks where propagation and leader dynamics can quietly dominate latency.

If you zoom out, Fogo’s ecosystem role becomes clearer: it’s aiming to be the SVM chain where execution speed is not a nice-to-have but the organizing principle—especially for markets that care about microstructure, predictable finality windows, and minimizing latency advantage gained purely through geography. That’s why the early stack emphasizes interoperability for liquidity routing, low-latency oracle feeds, and UX primitives that let applications pay the complexity cost on behalf of users.

The most interesting thing about Fogo’s future direction isn’t “will it be fast”—it’s whether it can keep speed from becoming a centralization trap. Zoned consensus and standardized high-performance clients can absolutely compress confirmation times, but they also create a new kind of governance responsibility: deciding how zones rotate, how stake thresholds are set, how many zones can be supported without reintroducing tail latency, and how the network preserves credible neutrality when the protocol intentionally makes geography matter. The long-term bet is that $FOGO becomes the coordination asset for that balancing act—securing the chain through staking and emissions while also underwriting a product strategy where users rarely need to hold it, yet the network can still capture value through fees, burns, and partner revenue-sharing. If Fogo succeeds, it won’t be because it made the SVM faster in isolation; it will be because it made performance predictable enough that markets can treat the chain like infrastructure, not a variable.