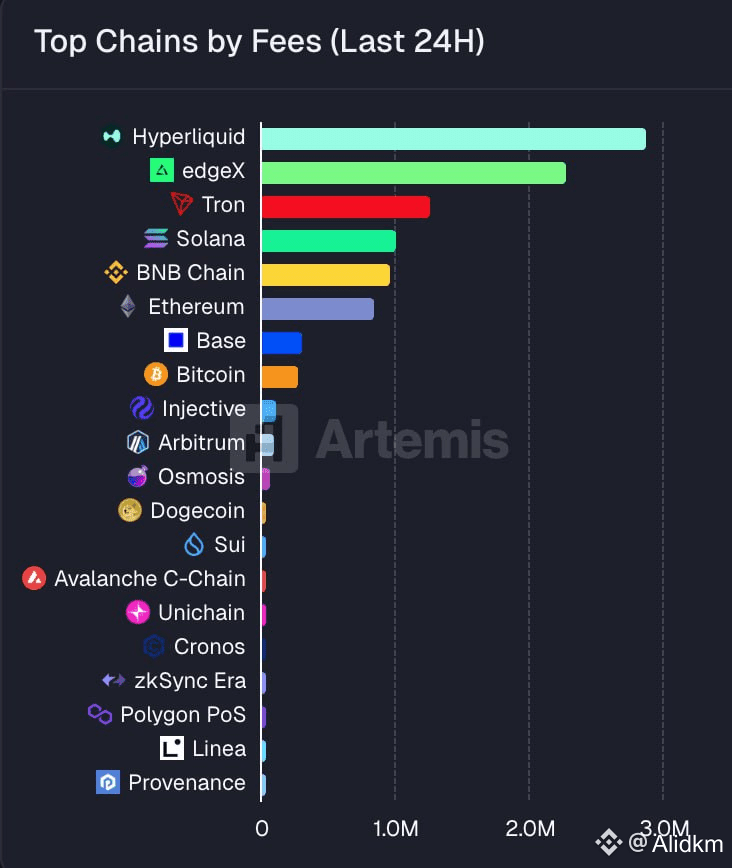

The latest 24-hour fee rankings paint a fascinating picture of the current crypto ecosystem, revealing clear trends that go beyond mere transaction volume. Topping the chart is not Ethereum or Bitcoin, but Hyperliquid, a decentralized exchange (DEX) and perpetual futures protocol on its own dedicated L1.

Let's break down the key takeaways:

1. The Rise of Hyperliquid & edgeX: The Derivatives Boom

Hyperliquid's leadership,followed closely by edgeX, is a powerful statement. It underscores a massive and growing demand for decentralized perpetual trading. Users are voting with their wallets, preferring the capital efficiency and permissionless nature of these new-age protocols. Their high fees indicate intense trading activity, suggesting they are capturing significant market share from centralized exchanges and established DeFi giants.

2. Tron's Enduring Dominance in a Specific Niche

Tron securing the third spot is no fluke.Its model, built on extremely low-cost transactions, has made it the de-facto chain for USDT transfers and stablecoin settlements, especially in emerging markets. High total fees mean high volume, proving its massive, utility-driven adoption for specific use cases.

3. The "Established Giants" Narrative

SeeingSolana and BNB Chain ahead of Ethereum in fees is significant. It highlights the intense competition in the smart contract platform space, where lower transaction costs and high throughput are attracting users and developers. However, Ethereum's high fee model persists, secured by its unparalleled value settlement and high-stakes DeFi activity.

Bottom Line for Traders:

This fee ranking is more than a leaderboard;it's a real-time heatmap of capital flow and user activity.

· For DeFi Degens: The action is hot in decentralized perps. Protocols like Hyperliquid are where the alpha and the fees are concentrated.

· For Ecosystem Investors: The data validates the theses around specialized L1s (Hyperliquid), the demand for decentralized derivatives (edgeX), and the utility of cost-effective chains for payments (Tron).

· For the Market: We are witnessing a maturation where different chains are dominating specific verticals—derivatives, payments, NFTs, high-value DeFi—rather than a one-chain-fits-all environment.

Keep a close watch on these fee rankings; they often provide the earliest signals of shifting market sentiment and capital rotation