Trade with $ETH

📉 Where Things Stand for ETH Shorts

According to one recent update, over US$ 3 billion in ETH short positions sit near the $3,500 price level — a breakout above that could trigger significant forced liquidations (a "short squeeze").

On the other hand, multiple days of short-liquidations and renewed accumulation by large investors (“whales”) have been observed, which may signal that many bearish leveraged positions have already been cleared out.

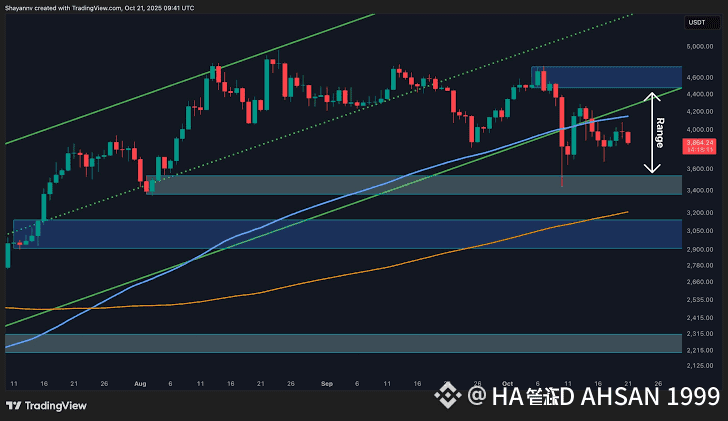

From a technical perspective, some recent analysis shows ETH is trading between signal lines, with the short-term trend still leaning bearish — meaning a rebound is possible, but downward risk remains if resistance zones hold.

🧠 What to Watch Right Now

Breakout level ~ $3,500 — this is the key level to watch. A convincing break above could trigger a rush of short-covering.

Short-liquidation data & on-chain inflows — more liquidations or large buys by whales/spot investors tend to flip sentiment bullish.

Technical indicators & macro context — watch moving averages, RSI, global interest-rate news, and general crypto sentiment to gauge whether ETH’s recent bounce will hold.

🧮 My Take (Based on Current Data)

At the moment, ETH is in a critical transitional phase: there's enough short interest that a breakout toward $3,500+ could trigger a sharp rally. But the technicals and broader market conditions caution against assuming a smooth upward ride. If you’re considering a short — or holding one — it feels like a high-risk / high-reward setup: possible fast gains if price drops, but also a strong squeeze risk if bullish m

omentum returns.