🚨 BIGGEST BTC OPTIONS EXPIRY NEXT WEEK 🚨

Listen Pandas 🐼

When a massive options expiry hits, $BTC starts moving “weird” on purpose.

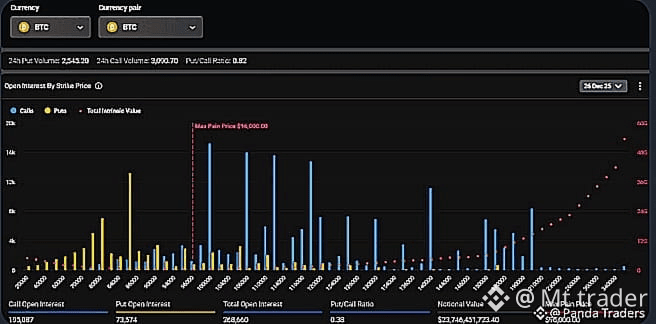

📅 Dec 26

About $23.7B worth of BTC options expire — the largest expiry of 2025.

Around 268,000 contracts roll off at once. Even with zero news, this alone can move price.

Here’s what most traders miss 👇

• Open interest is heavily skewed toward CALLS

• Put/Call ratio is low → market still leaning bullish

But options don’t sit idle.

Big players hedge these positions using spot & futures, and those hedges create real buy/sell pressure.

That’s why price action feels strange near big expiries:

sharp wicks

fake breakouts

choppy ranges trapping both longs & shorts

🎯 Key Level to Watch

96,000

This is the max pain zone — where option buyers lose the most at settlement.

BTC doesn’t have to go there, but when $23B+ expires in one day, price often reacts around these levels.

⏳ Typical Expiry Behavior

Before expiry:

• sideways & messy price

• stop hunts on both sides

• breakouts with no follow-through

After expiry:

• hedging pressure fades

• liquidity clears

• price action becomes cleaner

🧠 Dec 26 = Reset Point

Until then: manage risk, expect traps, and stay unemotional.

🐼 Trade smart