Here is a detailed, cross-checked technical briefing on the Russian economy in 2025, based entirely on the most recent and reliable data available (including IMF projections, national statistics, customs data, and macroeconomic forecasts). Wherever possible, I’ve provided explicit sources for verification.

🧾 2025 Russian Economic Overview – Key Technical Data

1) GDP & Growth

Nominal GDP (2025 forecast)

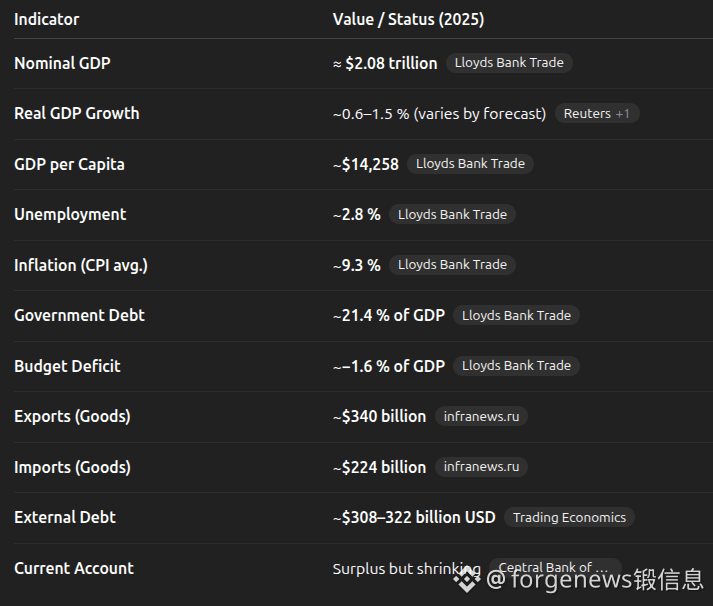

Russia’s nominal GDP is projected to be approx. $2.08 trillion USD in 2025. (Lloyds Bank Trade)

GDP Growth (Real)

IMF forecasts ~0.6 % growth in 2025, reflecting a sharp slowdown from earlier robust rates. (Reuters)

Other international forecasts vary widely:

• European Commission: 0.8 % growth projected for 2025. (Interfax.ru)

• Russian Ministry of Economic Development (optimistic “fragmented” scenario): ~2.5 %. (РБК)Independent sources note slow or near-stagnant real growth with weakening industrial output and lower oil revenue contributions. (Business Insider)

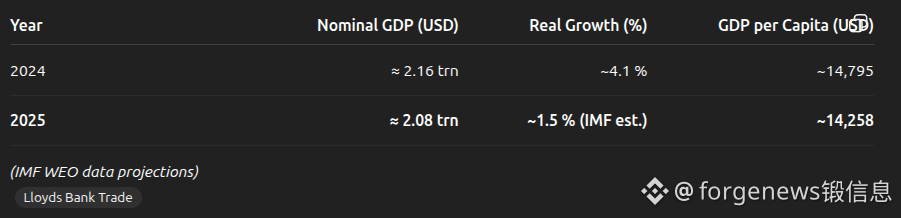

Annual GDP Trend (IMF projections)

YearNominal GDP (USD)Real Growth (%)GDP per Capita (USD)2024≈ 2.16 trn~4.1 %~14,7952025≈ 2.08 trn~1.5 % (IMF est.)~14,258(IMF WEO data projections) (Lloyds Bank Trade)

2) Inflation & Monetary Policy

Consumer inflation is projected at around ~9.3 % average for 2025 (followed by expected moderation in later years). (Lloyds Bank Trade)

The Central Bank maintained elevated interest rates (~17–21 %) during much of 2025 to curb inflation. (Reuters)

This combination of modest growth plus high inflation constitutes a stagflation-like dynamic.

3) Government Finance: Debt & Deficit

Government Debt (2025 Forecast)

Gross government debt: approx. 21.4 % of GDP. (Lloyds Bank Trade)

The IMF projection indicates a gradual increase trend in public debt levels. (GOV.UK)

Budget Balance

The government budget is expected in mild deficit (~−1.6 % of GDP). (Lloyds Bank Trade)

Budget pressures arise primarily from lower oil prices and high defense spending requirements.

❗ Note: Russian statistics do not publish a consolidated “foreign government debt” equivalent to external sovereign bonds in the same way Western statistical agencies do; external debt figures are less standardized and often wrapped in broader financial sector flows.

4) External Sector: Trade, Exports & Imports

External Trade (Goods & Services)

Official statistics for January–October 2025 show:

Total foreign trade volume: ~ $564.2 billion USD (down ~3.5 % y/y). (infranews.ru)

Exports: ~ $340 billion (~4–5 % decline). (infranews.ru)

Imports: ~ $224 billion (down ~2–3 %). (infranews.ru)

Major trends:

Trade flows remain heavily weighted toward Asian partners, especially China, though overall export values are down due to falling energy prices and weaker global demand. (infranews.ru)

Trade with “friendly states” (non-Western markets) accounted for ~80 % of total trade by late 2025—a sharp increase from earlier years. (tadviser.ru)

Trade Balance & Current Account

The goods trade surplus persists, but the current account surplus shrinks, reflecting a relative rise in service and investment income deficits. (Central Bank of Russia)

5) Labor Market

Unemployment (2025 forecast)

Unemployment is projected to be ~2.8 % in 2025. (Lloyds Bank Trade)

IMF and other sources report continued tight labor markets and low official unemployment rates. (Le Monde.fr)

Note: Russian unemployment figures are typically measured in a narrower sense than in many Western economies and may understate labor slack.

6) Income & Wealth Indicators

GDP per Capita (Nominal)

Russian GDP per capita is forecast at approx. $14,258 in 2025. (Lloyds Bank Trade)

Wealth Distribution & Inequality

Russia’s wealth inequality data (e.g., GINI) are not consistently updated in international databases for 2025; regional analyses indicate substantial spatial disparities and income inequality exacerbated by sanctions and differential industry growth. (Wikipedia)

7) External Debt & Reserves

Foreign/External Debt Position

According to trading data, Russia’s external debt stands at roughly $308–$322 billion USD (central bank and external liabilities). (Trading Economics)

Foreign Reserves

Russian reserve assets (excluding IMF SDR allocations) have been under pressure due to sanctions and balance of payments adjustments, but remain significant in size (no precise consolidated figure publicly available for 2025). (Central Bank of Russia)

8) Structural & Sectoral Notes

Energy Sector

Oil & Gas export revenues for 2025 are estimated to decline by ~15 % compared to 2024 forecasts, reflecting lower prices and sanctions effects. (Reuters)

Energy remains the dominant export category, though diversification is limited. (Wikipedia)

Defense & Industrial Base

High defense spending continues, absorbing fiscal space and contributing to GDP statistics. (Institute of New Europe)

Foreign Trade Patterns

Export orientation is increasingly toward Asia, Middle East, Africa, while trade with EU and Western markets has stagnated or declined due to sanctions. (tadviser.ru)

Key Technical Summary (2025)

Methodology & Reliability Notes

GDP and macro forecasts are drawn from IMF World Economic Outlook and international projections. (Lloyds Bank Trade)

Trade figures are based on Russian Federal Customs Service published data (through Oct 2025). (infranews.ru)

Unemployment and debt ratios use IMF aggregate projections and national statistics harmonized with WEO. (Lloyds Bank Trade)

Russian official data may understate challenges due to methodological differences and sanctions-related reporting gaps.