I. Market Talk: In the "Boring" Digestion Phase, Who’s Scared and Who’s Digging Trenches?

Waking up on January 9, the air in the Crypto market remains thick with the anxiety of a "sideways" trend. Bitcoin has been oscillating in the $85,000–$90,000 range for several weeks. For those used to the explosive "marubozu" candles of early 2025, the current market feels like "garbage time."

But I suggest you look at the bigger picture. If you think the industry is failing just because Bitcoin hasn't moved for a few weeks, you haven't grasped the market's "meridians."

According to Jim Ferraioli, Director of Crypto Research at Schwab, the market is currently "digesting" previous massive gains. From the November 2022 low to last October’s intraday peak of $126,000, Bitcoin returned 8x in three years. In the context of such growth, a 30% correction is a healthy, "expected" detox.

The current market signals are clear: ETF inflows dominate price action, while on-chain activity slows down. What does this mean? "Old money" is entering through regulated channels, while early "natives" and retail investors are either profit-taking or being shaken out by volatility. Ferraioli notes that "true institutional capital" hasn't even entered the space in full force yet. This sideways action is essentially a massive "change of hands." When long-term holders are exhausted and institutional giants fully arrive, that’s when the next real wave begins.

II. The Ultimate Vision: VanEck’s 2050 Forecast—Is $2.9 Million Just the Baseline?

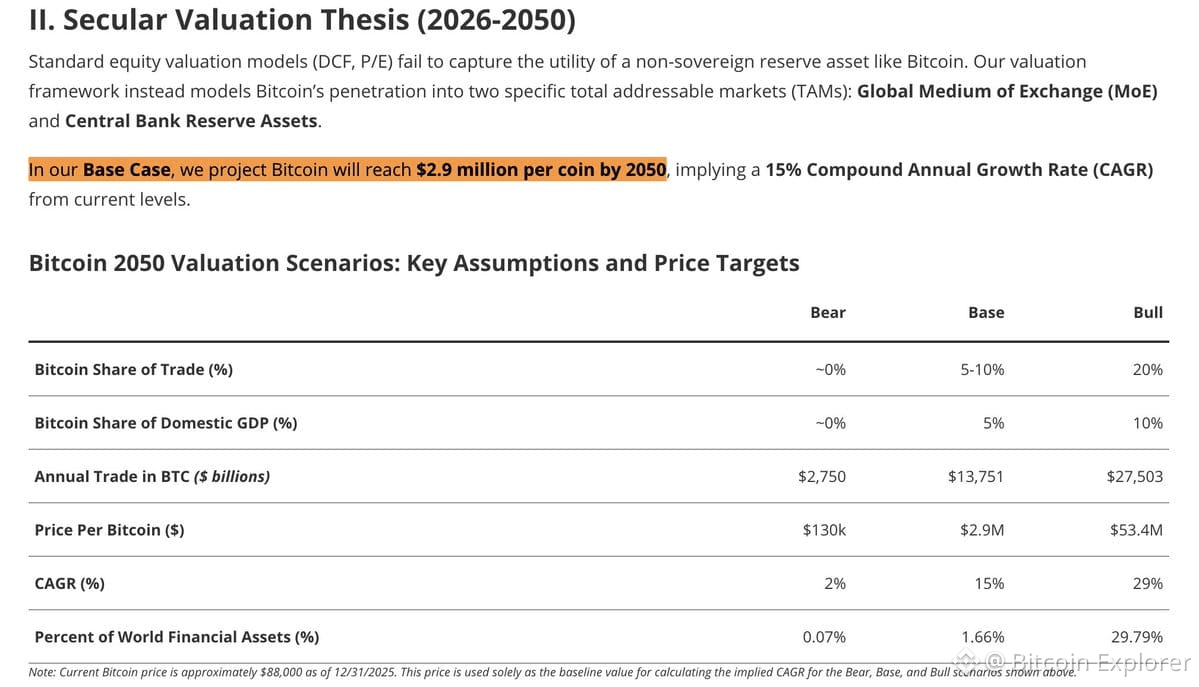

The most explosive news today is VanEck’s long-term valuation report. Their base-case price target for Bitcoin by 2050 is $2.9 million per coin.

VanEck isn't some random Twitter shiller; they are a top-tier global asset manager. Their framework abandons outdated DCF or P/E models, which fail to capture the utility of a non-sovereign reserve asset. Instead, they use a TAM (Total Addressable Market) penetration model:

Global Medium of Exchange (MOE): Assuming Bitcoin captures 5-10% of global trade.

Central Bank Reserve Asset: Assuming Bitcoin makes up 2.5% of central bank balance sheets.

Under this logic, the $2.9M target implies a 15% Compound Annual Growth Rate (CAGR). If that’s not wild enough, their "Bull" scenario (Hyper-bitcoinization) projects a price of $53.4 million if BTC captures 20% of global trade and 10% of domestic GDP.

Many will see these numbers as fantasy, but VanEck points to a core pain point: Developed markets face high sovereign debt, and the risk of "zero exposure" to a non-sovereign reserve asset now exceeds the volatility risk of the position itself. This is what I often call Bitcoin’s transition to the "ultimate form of a safe-haven asset."

Interestingly, VanEck's simulations show that replacing just 1-3% of a traditional 60/40 portfolio with Bitcoin significantly improves the Sharpe Ratio. It captures "convex returns" without adding proportional risk.

III. The TradFi Blitzkrieg: Don’t Wait for Bills; the Giants Are Already Moving

Four major headlines dropped on Wednesday that, five years ago, would have individually sent the market up 20%. Today, they happened all at once, signaling that mainstream adoption has moved from "future tense" to "present continuous".

JPMorgan: Announced JPM Coin will launch on the Canton Network, expanding its settlement system into a broader interoperable network.

Barclays: Invested in Ubyx to enable banks to settle transactions using stablecoins over existing rails.

Morgan Stanley: Filed with the SEC for an Ethereum Trust (ETH ETF), adding to its Bitcoin and Solana filings.

Wyoming State: Confirmed the launch of its state-backed stablecoin, FRNT, on Solana—a concrete example of a U.S. government entity deploying crypto infrastructure.

Combined, these events send a clear message: TradFi players aren't looking to replace crypto; they are looking to upgrade their own systems with it. We've moved past "banks are bullish on blockchain" to "banks are running on blockchain". The focus has shifted to stablecoins and tokenized dollar settlements. Ethereum and Solana are becoming institutional infrastructure, not just retail playgrounds. This is the foundation of the "Tokenize Everything" craze.

IV. The Privacy Coin "Civil War": Zcash’s Darkest Hour or a New Beginning?

While the giants celebrate, Zcash (ZEC) experienced a governance earthquake. Due to a dispute with the non-profit Bootstrap, the ECC development team departed to form a new company.

This caused ZEC to slump 19%. The conflict centered on the control of the Zashi wallet and potential privatization to seek external investment. The departing team felt Bootstrap’s governance was overly cautious and misaligned with Zcash’s mission of freedom.

Although the price hit is painful, as Helius CEO Mert Mumtaz said, Zcash "did not lose anything". The same team is working on the same tech, just without the burden of a bureaucratic board. However, this turmoil directly benefited Monero (XMR), which saw a 6.5% gain, extending its market cap lead over ZEC. This "VC-backed vs. Organic Demand" debate in the privacy sector will continue, but as long as privacy remains a necessity, the tech will persist.

V. The Final "Easter Egg": Trump and Venezuela’s Oil Play

Lastly, a fascinating note: Trump’s team has ordered Big Oil into Venezuela under the banner "Do it for our country".

It looks like energy politics, but as a Crypto investor, you should smell the money. Geopolitical shifts are often catalysts for monetary regime changes. If the U.S. aggressively intervenes in global energy pricing to reshape the "Petrodollar" landscape, the demand for a "non-sovereign reserve asset" like Bitcoin only grows stronger. The logic of "hedging against monetary debasement" mentioned in the VanEck report is anchored in these very geopolitical maneuvers.

Summary:

Bitcoin today is like a maturing asset class—less hysterical, more calculated. Don't let a 1% daily move shake you. The risk of being "out of the market" is now far greater than the risk of holding through a correction.